Get the free TILA-RESPA Integrated Mortgage Disclosure Rule Implementation bb

Show details

TULAREMIA Integrated Mortgage Disclosure Rule Implementation. Together Were Prepared! SEMINAR: Wednesday, April 15 9:00 a.m. to 12:00 p.m. Embassy Suites Charleston 300 Court Street Charleston, WV

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tila-respa integrated mortgage disclosure

Edit your tila-respa integrated mortgage disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tila-respa integrated mortgage disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tila-respa integrated mortgage disclosure online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tila-respa integrated mortgage disclosure. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tila-respa integrated mortgage disclosure

How to Fill Out TILA-RESPA Integrated Mortgage Disclosure:

01

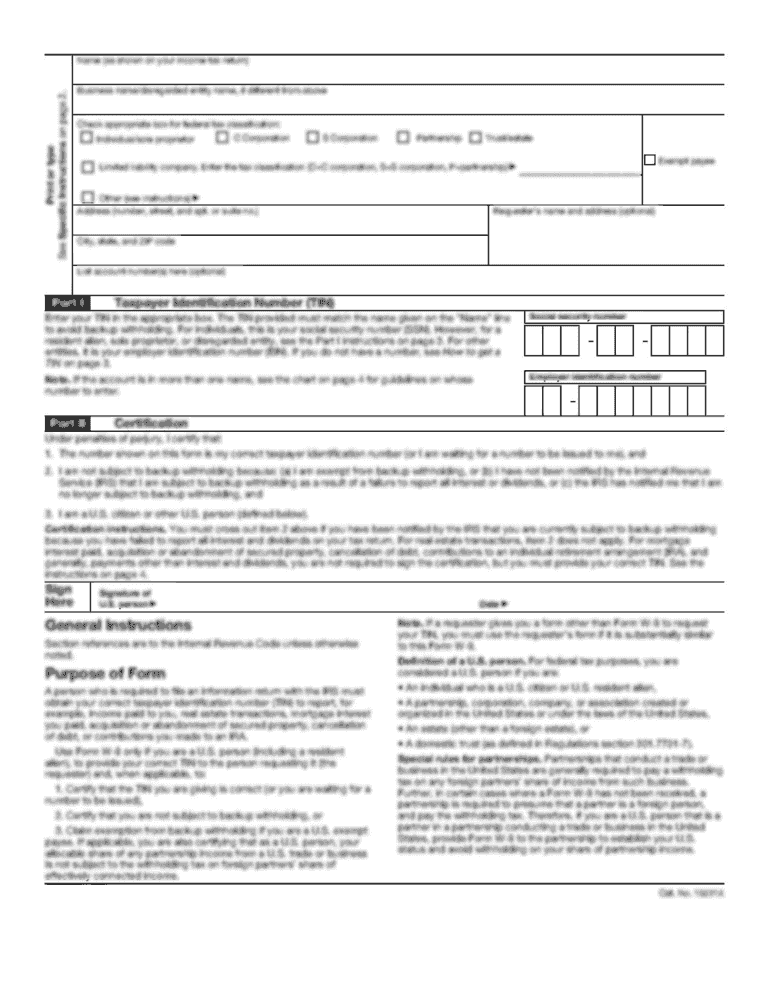

Begin by gathering all the necessary information and documents required to complete the TILA-RESPA Integrated Mortgage Disclosure form. This includes the loan application, the loan estimate, and any other relevant financial documents.

02

Review the form thoroughly to understand each section and the information that needs to be provided. The form consists of two main sections: the Loan Estimate section (Page 1) and the Closing Disclosure section (Page 2).

03

Start by filling out the Loan Estimate section on Page 1. This section requires you to enter details such as the loan terms, interest rate, monthly payment, and estimated closing costs. Make sure to carefully input all the accurate information based on the loan estimate you received.

04

After completing the Loan Estimate section, move on to the Closing Disclosure section on Page 2. This part of the form requires more detailed information about the loan terms, interest rate, and estimated closing costs. Additionally, it includes a breakdown of the loan amount, finance charges, and any prepayment penalties, among other details.

05

Ensure that you provide all the necessary information accurately, including any additional fees or charges associated with the loan. Take your time to double-check the figures and calculations to ensure accuracy.

06

Review the completed TILA-RESPA Integrated Mortgage Disclosure form thoroughly before submission. Check for any errors or inconsistencies and make the necessary corrections. It is crucial to ensure the form is complete and accurately reflects all the details of your mortgage.

Who Needs TILA-RESPA Integrated Mortgage Disclosure:

01

Borrowers applying for a mortgage loan in the United States need to fill out the TILA-RESPA Integrated Mortgage Disclosure. This form is required under the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA).

02

Both home buyers and homeowners refinancing their existing mortgage are required to complete this disclosure form. It aims to provide borrowers with valuable information about the terms and costs associated with their loan, enabling them to make informed decisions about their mortgage.

03

Lenders are also obligated to provide this disclosure form to borrowers within specific timeframes during the mortgage application process. It promotes transparency and helps borrowers understand and compare loan offers from different lenders.

In conclusion, completing the TILA-RESPA Integrated Mortgage Disclosure accurately is crucial for borrowers applying for a mortgage. It provides essential information about the loan terms and costs, aiding borrowers in making informed decisions about their mortgage. Lenders are required to provide this disclosure form to borrowers, ensuring transparency and fair lending practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tila-respa integrated mortgage disclosure to be eSigned by others?

To distribute your tila-respa integrated mortgage disclosure, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit tila-respa integrated mortgage disclosure online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tila-respa integrated mortgage disclosure to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in tila-respa integrated mortgage disclosure without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tila-respa integrated mortgage disclosure, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your tila-respa integrated mortgage disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tila-Respa Integrated Mortgage Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.