I.B.E.W. Local 25 401(K) Fund Loan Application 2011-2025 free printable template

Show details

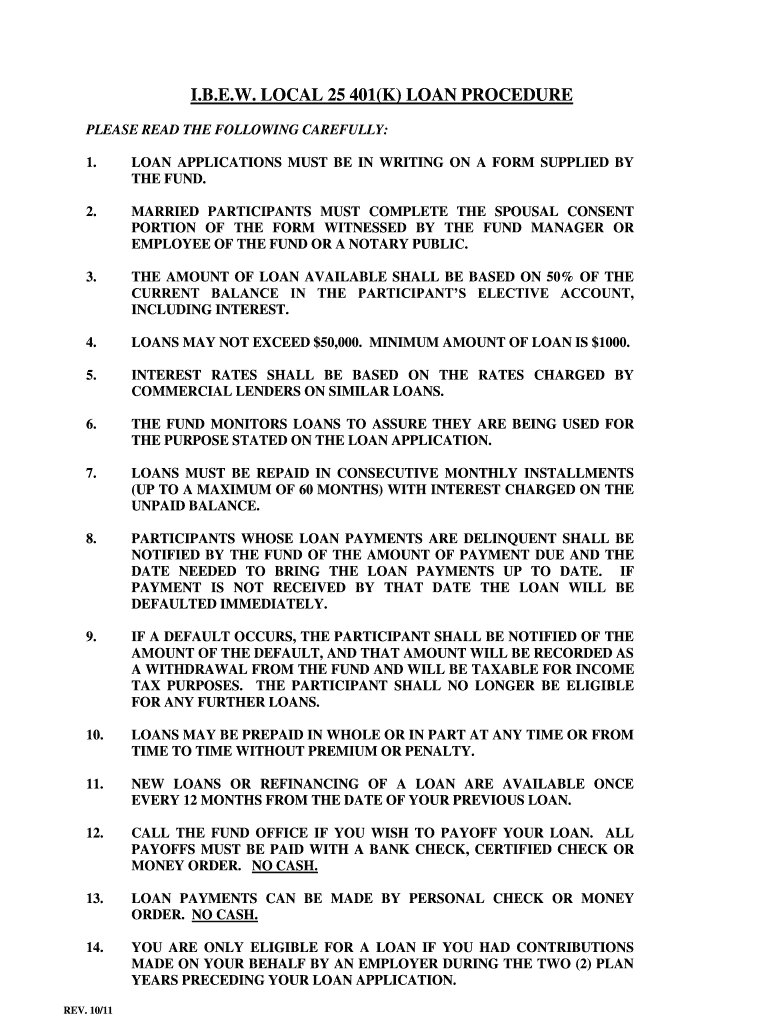

I.B.E.W. LOCAL 25 401(K) LOAN PROCEDURE PLEASE READ THE FOLLOWING CAREFULLY: 1. LOAN APPLICATIONS MUST BE IN WRITING ON A FORM SUPPLIED BY THE FUND. 2. MARRIED PARTICIPANTS MUST COMPLETE THE SPOUSAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ibew local 25 loan form

Edit your eib local 25 fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eib local form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IBEW Local 25 401K Fund Loan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IBEW Local 25 401K Fund Loan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IBEW Local 25 401K Fund Loan

How to fill out I.B.E.W. Local 25 401(K) Fund Loan Application

01

Obtain the I.B.E.W. Local 25 401(K) Fund Loan Application from the official website or the fund office.

02

Read through the instructions and requirements carefully before starting the application.

03

Fill in your personal information at the top of the application, including your name, address, and Social Security number.

04

Indicate the amount you wish to borrow, ensuring it complies with the fund's borrowing limits.

05

Select the loan type and purpose as specified by the application.

06

Provide information regarding your employment, including your current employer, job title, and employment length.

07

Review the repayment terms and indicate your preferred repayment schedule.

08

Sign and date the application, verifying that all information is accurate and complete.

09

Submit the application to the appropriate fund office, either in person or through the designated channels.

Who needs I.B.E.W. Local 25 401(K) Fund Loan Application?

01

Members of I.B.E.W. Local 25 who are seeking financial assistance through a loan from their 401(K) retirement fund.

02

Individuals planning to access funds for emergencies, major purchases, or other financial needs.

03

Employees who have been contributing to the I.B.E.W. Local 25 401(K) Fund and meet the eligibility criteria for a loan.

Fill

form

: Try Risk Free

People Also Ask about

When can I draw my IBEW pension?

NECA-IBEW Pension Trust Fund The normal retirement age is 65 years old. May I retire before age 65? Yes, you may retire anytime on or between the ages of 55 through 59 years old at an actuarially reduced pension, provided you are vested.

Can you borrow from IBEW pension?

APPLICATION FOR A LOAN Under the Plan, a participant may borrow up to half of his or her account balance in the plan, to a maximum of $50,000.00, for a purchase of a primary residence or general purpose.

Can I borrow against my union pension?

Key Takeaways. Pension loans are unregulated in the United States. Lump-sum loans as an advance on your pension may result in unfair payment plans. The Consumer Financial Protection Bureau (CFPB) warns customers of taking out loans against their pensions.

How much does IBEW Local 25 pay?

How much does IBEW Local 25 pay? The average IBEW Local 25 salary ranges from approximately $53,258 per year for an Electrician to $53,258 per year for an Electrician. The average IBEW Local 25 hourly pay ranges from approximately $25 per hour for an Electrician to $25 per hour for an Electrician.

Can I cash out my IBEW pension?

Q: I have been laid off; can I withdraw the money in my account? A: No, This is a Pension Plan; the funds may only be withdrawn if you going to retire and are no longer working in the Electrical or Sound and Communication industry, either Union or Non-Union.

Can I borrow money from my retirement pension?

More In Retirement Plans Your 401(k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your 401(k). If you don't repay the loan, including interest, ing to the loan's terms, any unpaid amounts become a plan distribution to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IBEW Local 25 401K Fund Loan for eSignature?

Once your IBEW Local 25 401K Fund Loan is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute IBEW Local 25 401K Fund Loan online?

Completing and signing IBEW Local 25 401K Fund Loan online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit IBEW Local 25 401K Fund Loan on an iOS device?

You certainly can. You can quickly edit, distribute, and sign IBEW Local 25 401K Fund Loan on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

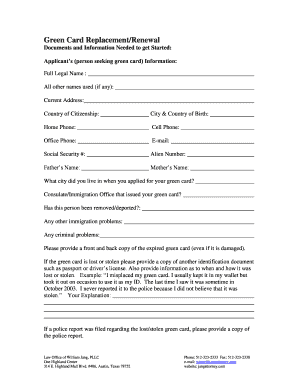

What is I.B.E.W. Local 25 401(K) Fund Loan Application?

The I.B.E.W. Local 25 401(K) Fund Loan Application is a form used by members of the International Brotherhood of Electrical Workers Local 25 to request a loan against their 401(K) retirement savings, allowing them to access funds for various personal financial needs.

Who is required to file I.B.E.W. Local 25 401(K) Fund Loan Application?

Members of I.B.E.W. Local 25 who wish to take a loan from their 401(K) retirement account are required to file the I.B.E.W. Local 25 401(K) Fund Loan Application.

How to fill out I.B.E.W. Local 25 401(K) Fund Loan Application?

To fill out the I.B.E.W. Local 25 401(K) Fund Loan Application, members should follow the instructions provided on the form, which typically includes providing personal information, specifying the loan amount requested, and signing to acknowledge the terms and conditions.

What is the purpose of I.B.E.W. Local 25 401(K) Fund Loan Application?

The purpose of the I.B.E.W. Local 25 401(K) Fund Loan Application is to allow members to borrow money from their 401(K) retirement savings in order to meet emergencies or fund personal projects, while providing a structured way to manage such loans.

What information must be reported on I.B.E.W. Local 25 401(K) Fund Loan Application?

The information that must be reported on the I.B.E.W. Local 25 401(K) Fund Loan Application includes the member's personal identification details, employment information, the loan amount requested, repayment terms, and acknowledgment of the loan's conditions.

Fill out your IBEW Local 25 401K Fund Loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IBEW Local 25 401k Fund Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.