Get the free Chase Home Equity Line of Credit EquilineSM Visa Card Request Form

Show details

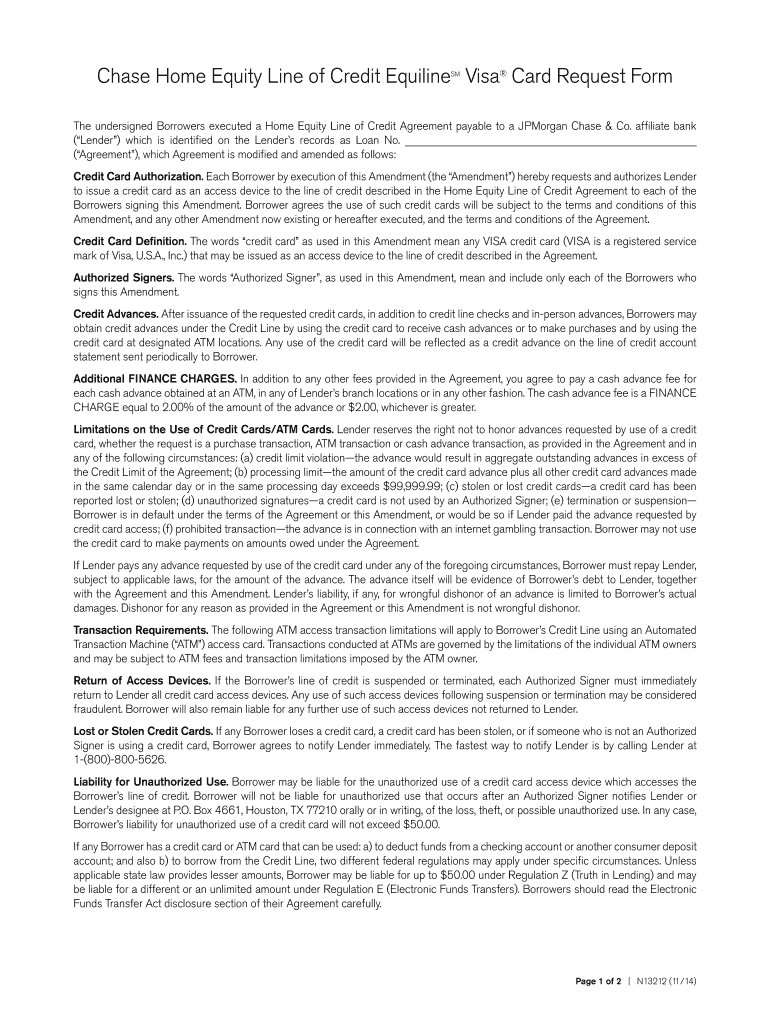

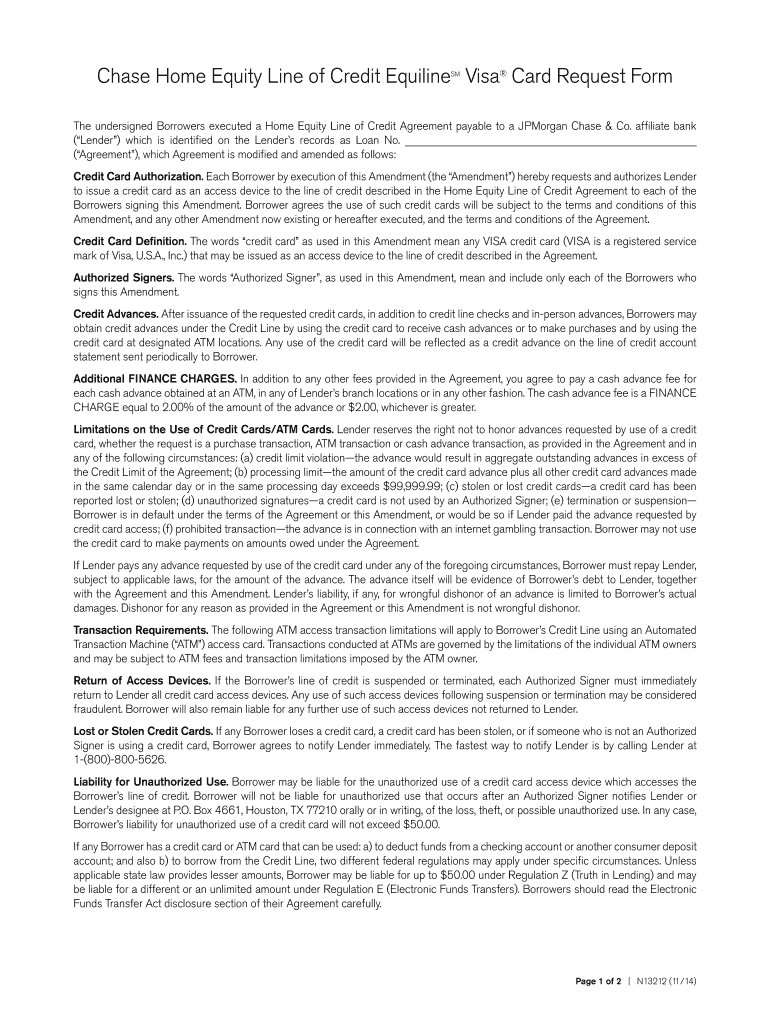

Chase Home Equity Line of Credit Aquiline Visa Card Request Form SM The undersigned Borrowers executed a Home Equity Line of Credit Agreement payable to a JPMorgan Chase & Co. affiliate bank (Lender)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chase home equity line

Edit your chase home equity line form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chase home equity line form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chase home equity line online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chase home equity line. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chase home equity line

How to fill out a Chase home equity line:

01

Gather necessary documentation: Before filling out the Chase home equity line application, make sure you have all the required documentation handy. This typically includes proof of income, recent tax returns, bank statements, and details about the property you plan to use as collateral.

02

Start the application process: Visit the Chase website or contact a Chase representative to begin the application process. They will guide you through the necessary steps and provide assistance if needed.

03

Provide personal and financial information: As part of the application, you will need to provide personal details such as your name, address, and social security number. You will also need to disclose relevant financial information, such as your income, debts, and assets.

04

Submit supporting documents: Along with the application, you will need to submit the required supporting documents. Ensure that all documents are accurate, up-to-date, and complete to avoid delays in the application process.

05

Await approval and appraisal: Once your application is submitted, Chase will review your information and conduct an appraisal of the property you plan to use as collateral for the home equity line. This appraisal helps determine the maximum loan amount you may qualify for.

06

Review and sign the loan terms: If your application is approved, Chase will provide you with the loan terms, including the interest rate, repayment period, and other details. Carefully review these terms and ensure you understand them before signing any documents.

07

Close the loan: After reviewing and accepting the loan terms, you will be scheduled for a closing appointment. During this appointment, you will sign the final loan documents and complete any remaining paperwork. It is crucial to review everything carefully and ask any questions you may have before signing.

Who needs a Chase home equity line?

01

Homeowners looking to access funds: A Chase home equity line can be beneficial for homeowners who need money for various purposes, such as home renovations, debt consolidation, or educational expenses. It allows them to tap into the equity built in their homes and use it as a source of financing.

02

Individuals with good credit and stable income: Chase typically requires applicants to have a good credit score and a stable income to qualify for a home equity line. Therefore, those who meet these criteria may find this financing option suitable for their needs.

03

Homeowners planning for the future: Some homeowners may choose to establish a home equity line of credit as a safety net or future financial resource. By having access to additional funds, they can be prepared for unexpected expenses or take advantage of investment opportunities.

It is important to note that individual circumstances may vary, and it is advisable to consult with a financial advisor or Chase representative to determine the suitability of a home equity line for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit chase home equity line from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your chase home equity line into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send chase home equity line to be eSigned by others?

When your chase home equity line is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete chase home equity line on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your chase home equity line by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is chase home equity line?

A chase home equity line is a type of loan in which the borrower uses the equity in their home as collateral.

Who is required to file chase home equity line?

Individuals or homeowners who are looking to borrow against the equity in their home may be required to file a chase home equity line.

How to fill out chase home equity line?

To fill out a chase home equity line, borrowers will need to provide information about their income, assets, debts, and the property being used as collateral.

What is the purpose of chase home equity line?

The purpose of a chase home equity line is to provide homeowners with access to funds that can be used for various purposes, such as home improvements, debt consolidation, or other expenses.

What information must be reported on chase home equity line?

Information that must be reported on a chase home equity line includes details about the borrower's income, assets, debts, and the property being used as collateral.

Fill out your chase home equity line online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chase Home Equity Line is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.