MS DoR 89-140 2012 free printable template

Show details

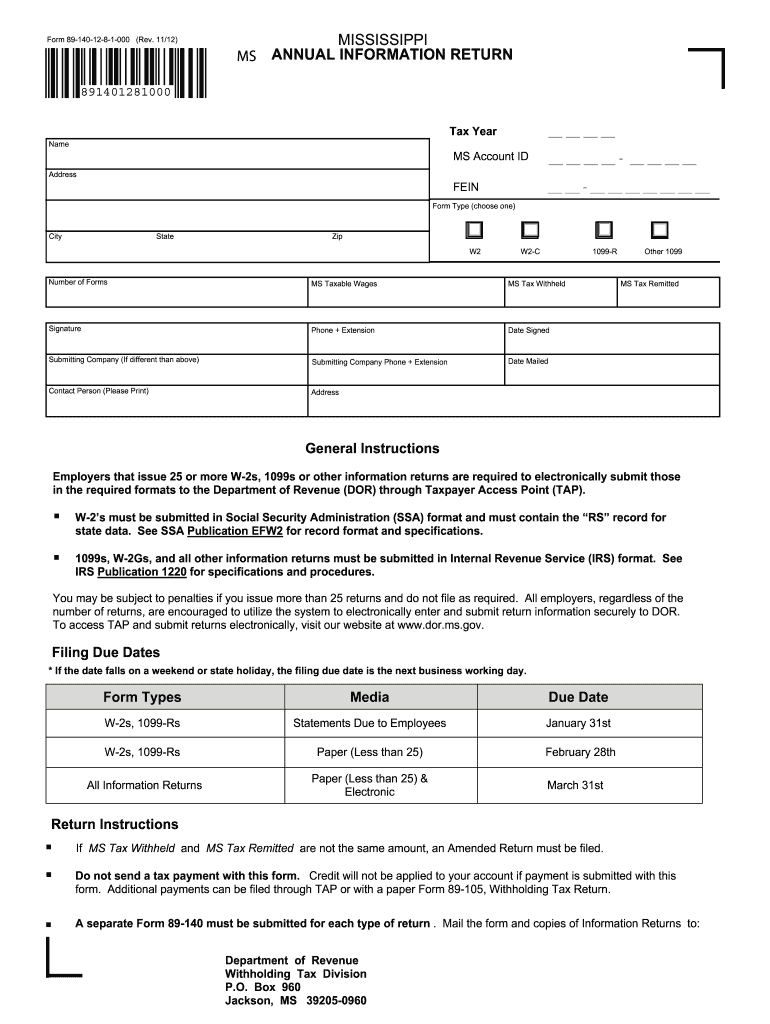

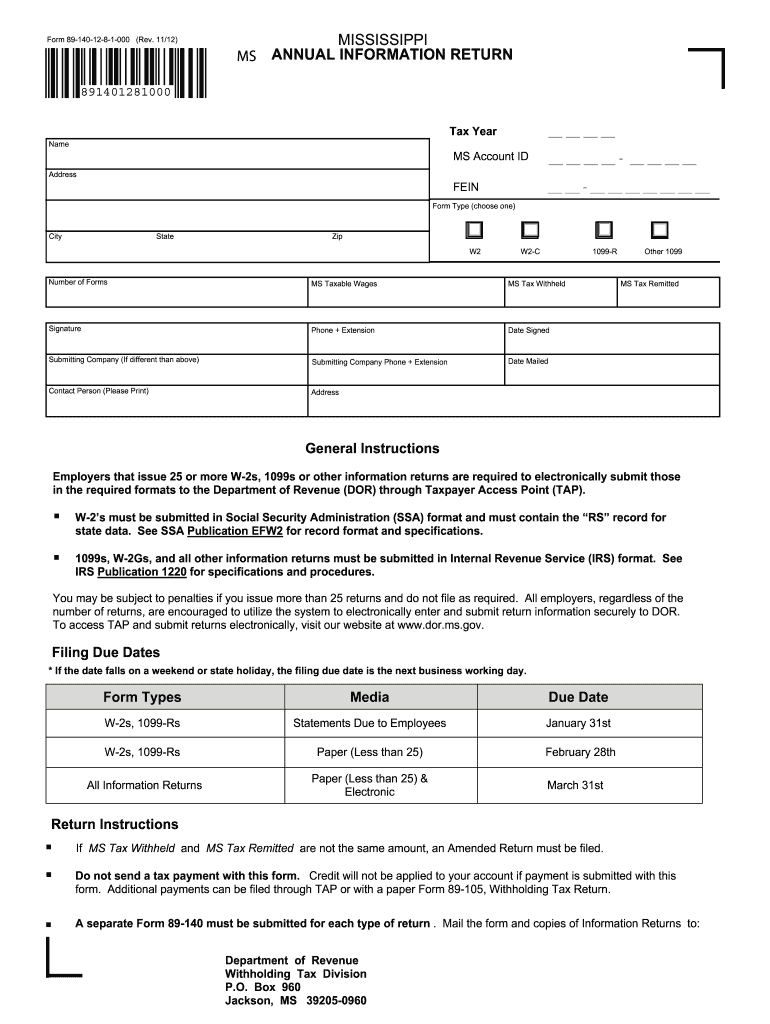

Form 89-140-12-8-1-000 Rev. 11/12 MS MISSISSIPPI ANNUAL INFORMATION RETURN 891401281000 Tax Year Name MS Account ID - FEIN - Address Form Type choose one City State Zip W2 W2-C 1099-R Number of Forms MS Taxable Wages MS Tax Withheld Signature Phone Extension Date Signed Submitting Company If different than above Date Mailed Contact Person Please Print Other 1099 MS Tax Remitted General Instructions Employers that issue 25 or more W-2s 1099s or other information returns are required to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS DoR 89-140

Edit your MS DoR 89-140 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS DoR 89-140 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MS DoR 89-140 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MS DoR 89-140. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 89-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS DoR 89-140

How to fill out MS DoR 89-140

01

Obtain a copy of the MS DoR 89-140 form from the appropriate agency or website.

02

Read the instructions carefully to understand the information required.

03

Fill in the applicant's personal information, including name, address, and contact details.

04

Provide details of the relevant incident or application that the form pertains to.

05

Attach any required documentation that supports your application or claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as instructed, either online or via mail.

Who needs MS DoR 89-140?

01

Individuals or entities seeking to document a specific incident or apply for a particular service or remedy as outlined by the agency requiring the form.

02

Anyone who is required by law or regulation to submit this form for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Mississippi tax return?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You are a Non-Resident or Part-Year Resident with income taxed by Mississippi.

What is MS 89 140?

Form 89-140 is a transmittal form for the State's copies of W-2 statements. Federal forms may not be substituted for State forms. If you are required to submit copies of withholding statements using electronic media, this form should be completed and sent with that media.

What is the minimum income to file taxes in Mississippi?

Who has to file Mississippi state taxes? If you lived in Mississippi or worked for a company based there, you must file a tax return if your income exceeds the deductions and exemptions. For single taxpayers, your gross income must be more than $8,300, plus $1,500 for each dependent.

Is MS doing away with state income tax?

Mississippi's Republican-controlled legislature passed legislation in 2022 that will eliminate the state's 4% income tax bracket starting in 2023. In the following three years, the 5% bracket will be reduced to 4%.

How do I file my state taxes in Mississippi?

Mississippi allows returns to be filed on-line using your home computer and an Electronic Transmitter Service/On-Line Service Provider. The following is a list of those companies intending to provide on-line electronic filing of Mississippi Individual Income Tax Returns for tax year 2022.

What is MS state tax 2021?

Mississippi residents have to pay a sales tax on goods and services. Mississippi's sales tax rate consists of a state tax (7 percent) and local tax (0.07 percent).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the MS DoR 89-140 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your MS DoR 89-140 in seconds.

Can I create an eSignature for the MS DoR 89-140 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your MS DoR 89-140 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out MS DoR 89-140 using my mobile device?

Use the pdfFiller mobile app to fill out and sign MS DoR 89-140. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is MS DoR 89-140?

MS DoR 89-140 is a form used for reporting certain types of income and expenditures in a specified jurisdiction, ensuring compliance with tax regulations.

Who is required to file MS DoR 89-140?

Individuals and entities that meet specific criteria regarding their income or business activities in the jurisdiction are required to file MS DoR 89-140.

How to fill out MS DoR 89-140?

To fill out MS DoR 89-140, gather the required financial documents, enter the relevant information as prompted on the form, and ensure all sections are completed accurately before submission.

What is the purpose of MS DoR 89-140?

The purpose of MS DoR 89-140 is to collect necessary financial information to ensure proper tax assessment and compliance with local financial regulations.

What information must be reported on MS DoR 89-140?

MS DoR 89-140 requires reporting of income earned, business expenditures, tax identification numbers, and other specific details pertinent to financial activities.

Fill out your MS DoR 89-140 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS DoR 89-140 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.