MS DoR 89-140 2018 free printable template

Show details

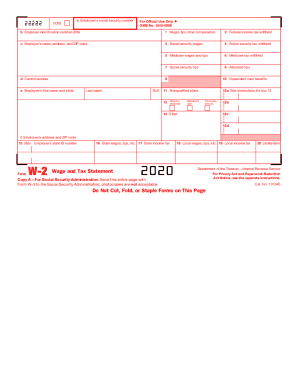

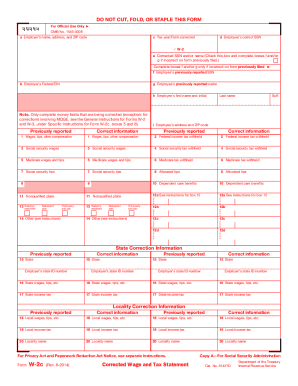

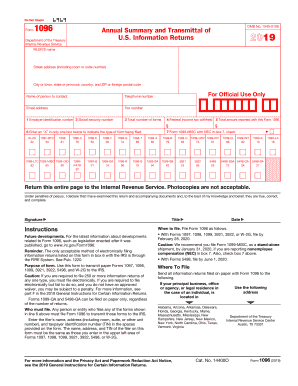

Form 89-140-18-8-1-000 Rev. 09/18 Reset Form Mississippi Print Form Annual Information Return 891401881000 Tax Year FEIN MS Account ID Name FORM TYPE CHECK ONE Address City State Zip W-2 1099-R Other 1099 Number of Forms MS Taxable Wages MS Tax Withheld Signature Phone Extension Date Signed Submitting Company If different than above Contact Person Please Print MS Tax Remitted Ext. Do not send a tax payment with this form. Credit will not be applied to your account if payment is submitted with...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mississippi annual information return

Edit your mississippi annual information return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mississippi annual information return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mississippi annual information return online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mississippi annual information return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 89-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mississippi annual information return

How to fill out MS DoR 89-140

01

Obtain the MS DoR 89-140 form from the appropriate source.

02

Enter your personal information, including your name, address, and contact details in the designated fields.

03

Provide details of the relevant incident or reason for filling out the form in the provided section.

04

Fill in any additional required information, ensuring accuracy and completeness.

05

Review the filled-out form for any errors or omissions.

06

Sign and date the form at the end.

07

Submit the form to the designated authority or agency as instructed.

Who needs MS DoR 89-140?

01

Individuals who are involved in specific incidents that require reporting.

02

Businesses that need to document certain regulatory compliance events.

03

Organizations needing to request specific actions or responses from authorities.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a Mississippi tax return?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Is it okay if I don't file state taxes?

Consequences of not filing Just like other crimes, the punishment can include time in jail. However, the majority of taxpayers who don't file their state returns are only subject to penalties, interest and other fees in addition to the amount of tax due.

Do I have to file a MS state tax return?

You must file a Mississippi Resident return and report total gross income, regardless of the source. You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent.

Is Mississippi accepting tax returns 2023?

The due date for filing 2022 Mississippi Individual Income Tax Returns is April 18, 2023.

What states do not require you to file a tax return?

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mississippi annual information return online?

pdfFiller has made it easy to fill out and sign mississippi annual information return. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in mississippi annual information return?

With pdfFiller, it's easy to make changes. Open your mississippi annual information return in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit mississippi annual information return in Chrome?

mississippi annual information return can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is MS DoR 89-140?

MS DoR 89-140 is a specific form used for reporting purposes related to state regulations.

Who is required to file MS DoR 89-140?

Entities or individuals that fall under the jurisdiction of the regulations it pertains to are required to file MS DoR 89-140.

How to fill out MS DoR 89-140?

To fill out MS DoR 89-140, you need to follow the guidelines provided in the accompanying instructions, including providing necessary details and ensuring accuracy.

What is the purpose of MS DoR 89-140?

The purpose of MS DoR 89-140 is to ensure compliance with state regulations and to facilitate the collection of relevant data.

What information must be reported on MS DoR 89-140?

Information required on MS DoR 89-140 typically includes identification details of the filing entity, data related to their operations, and any other pertinent information as stipulated by the form's instructions.

Fill out your mississippi annual information return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mississippi Annual Information Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.