MS DoR 89-140 2011 free printable template

Show details

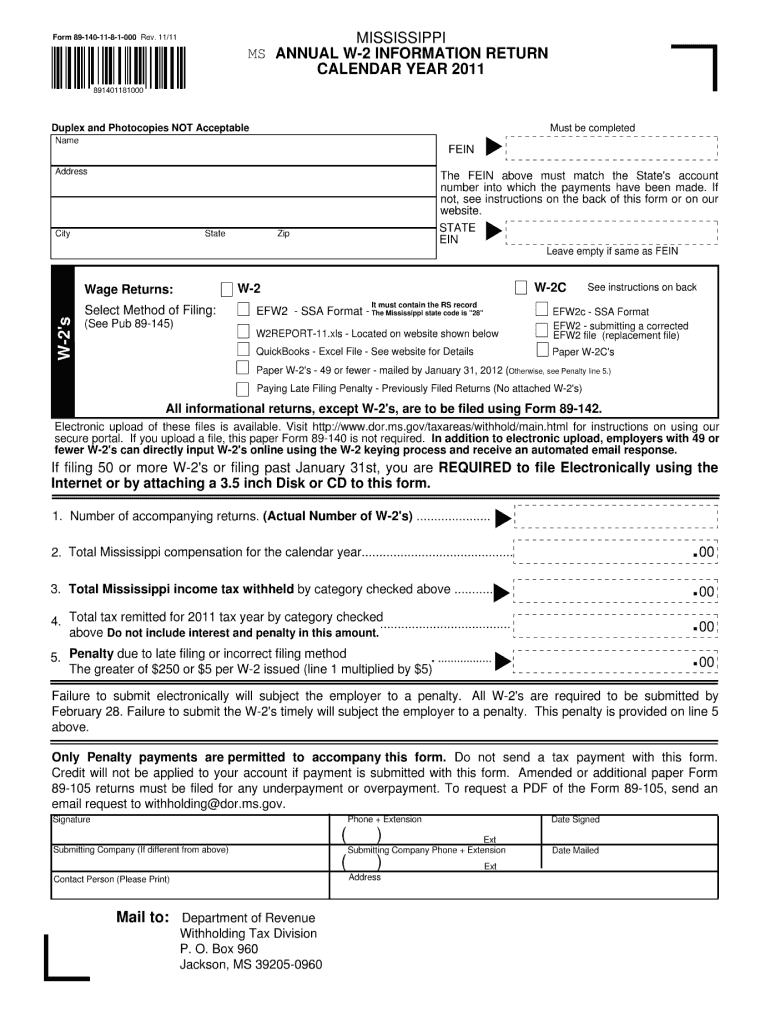

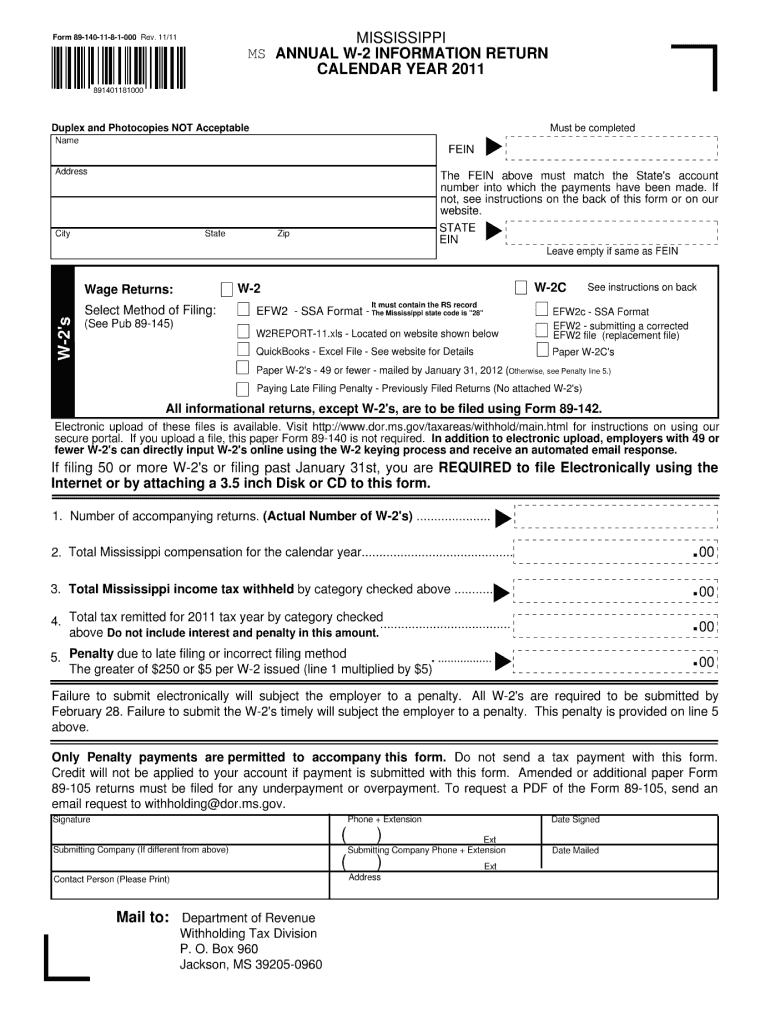

Form 89-140-11-8-1-000 Rev. 11/11 MISSISSIPPI MS ANNUAL W-2 INFORMATION RETURN CALENDAR YEAR 2011 891401181000 Duplex and Photocopies NOT Acceptable Name Address VEIN Must be completed City State

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 89 140 14

Edit your form 89 140 14 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 89 140 14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 89 140 14 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 89 140 14. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 89-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 89 140 14

How to fill out MS DoR 89-140

01

Obtain the MS DoR 89-140 form from the official website or your relevant authority.

02

Fill in the personal identification information at the top section, including your name, address, and contact details.

03

Provide details related to the project or purpose for which the form is being submitted.

04

Carefully review the guidelines for any specific information required in each section of the form.

05

Include supplementary documents if required, such as identification proof or project-related documentation.

06

Double-check all filled information for accuracy before submission.

07

Submit the completed form to the designated authority through the specified method (online or by mail).

Who needs MS DoR 89-140?

01

Individuals or organizations applying for permits or approvals related to specific projects.

02

Contractors or service providers seeking to initiate a project regulated by the authority.

03

Anyone needing to document compliance with regulations set forth by local or regional agencies.

Fill

form

: Try Risk Free

People Also Ask about

What is the phone number for Mississippi withholding?

The appropriate forms may be downloaded from Mississippi Department of Revenue, or if you have additional questions or need assistance you can call (601) 923-7000 .

What is Mississippi tax withholding for employers?

Mississippi has a flat income tax rate of 5 percent. The employer must withhold an amount equal to that percentage from each paycheck after subtracting the employee's pretax deductions, such as health insurance or retirement plans. The employer must also match what it withholds from employee paychecks.

What is MS 89 140?

Form 89-140 is a transmittal form for the State's copies of W-2 statements. Federal forms may not be substituted for State forms. If you are required to submit copies of withholding statements using electronic media, this form should be completed and sent with that media.

What is the number for Mississippi employer withholding?

Mississippi Withholding Account Number and Filing Frequency You can also retrieve your account number and filing frequency by contacting the agency at 601-923-7088.

What does Mississippi withholding mean?

Employers must withhold Mississippi income tax from all wages earned by non-resident employees for services performed in Mississippi unless their Mississippi earnings for the year will be less than their standard deduction amount for their filing status.

What form is used to withhold MS state tax?

Form 89-350 - Withholding Exemption Certificate Completed by employee; retained by employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 89 140 14?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 89 140 14. Open it immediately and start altering it with sophisticated capabilities.

How do I complete form 89 140 14 online?

Completing and signing form 89 140 14 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out form 89 140 14 on an Android device?

On Android, use the pdfFiller mobile app to finish your form 89 140 14. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is MS DoR 89-140?

MS DoR 89-140 is a form used for reporting specific financial information to the state authorities, often required for compliance with state regulations.

Who is required to file MS DoR 89-140?

Entities that operate within the jurisdiction and meet certain financial thresholds or criteria established by state regulations are required to file MS DoR 89-140.

How to fill out MS DoR 89-140?

To fill out MS DoR 89-140, gather the required financial data, ensure accuracy, and complete each section of the form according to the provided instructions, then submit it to the appropriate state department.

What is the purpose of MS DoR 89-140?

The purpose of MS DoR 89-140 is to ensure that entities provide accurate financial information, which enables state authorities to monitor compliance with financial regulations and tax obligations.

What information must be reported on MS DoR 89-140?

The information that must be reported on MS DoR 89-140 typically includes income, expenses, assets, liabilities, and any other financial data as specified by the form's guidelines.

Fill out your form 89 140 14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 89 140 14 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.