Canada FLR 13 2015 free printable template

Show details

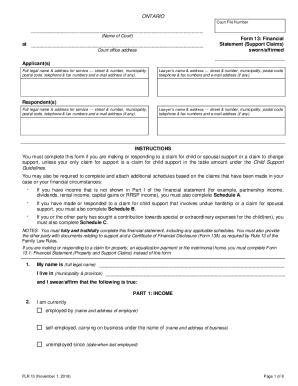

ONTARIO Court file number (Name of Court) at Form 13: Financial Statement (Support Claims) sworn/affirmed Court office address Applicant(s) Full legal name & address for service street & number, municipality,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada FLR 13

Edit your Canada FLR 13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FLR 13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada FLR 13 online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada FLR 13. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FLR 13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FLR 13

How to fill out Canada FLR 13

01

Begin by downloading the Canada FLR 13 form from the official website.

02

Read the instructions thoroughly to understand the requirements.

03

Fill in personal details including your full name, date of birth, and contact information.

04

Provide your immigration status and details of your application or request.

05

Include information related to your family members if required.

06

Fill out the declaration of your criminal history if applicable.

07

Review your answers to ensure all information is accurate.

08

Sign and date the form as required.

09

Submit the completed form along with any necessary documents and fees.

Who needs Canada FLR 13?

01

Individuals who are applying for a temporary stay in Canada.

02

Foreign nationals who need to verify their immigration status.

03

Applicants seeking a document for specific immigration purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is Rule 13 in Ontario Family Law?

Rule 13(1)(a) of the Family Law Rules provides that a party making a claim for support, property, or exclusive possession of a matrimonial home and its contents must serve and file a financial statement along with the documentation that contains the claim.

What is a sworn financial statement Ontario?

Financial statements must be sworn or affirmed. This means the person signing it is promising that the information in it is true. It is against the law to not tell the truth when swearing or affirming an affidavit.

What is a form 13 in Ontario?

Fill out Form 13: Financial Statement (Support Claims) if your case involves child support or spousal support, but not property issues. Do not use this form if you are making a claim regarding property or debts.

What is financial statement in business Canada?

Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company owns and owes and how much money it has made and spent.

What accounting does Canada use?

The Canadian Accounting Standards Board (AcSB) requires publicly accountable enterprises to use IFRS in the preparation of all interim and annual financial statements.

Are financial statements required in Canada?

All Canadian corporations must prepare financial statements. Financial statements shall be prepared in ance with the Generally Accepted Accounting Principles of Canada (GAAP of Canada). Financial statements must be presented to shareholders not less than 21 days before the annual meeting.

How do I show proof of income if I paid in cash Canada?

One of the key steps in how to prove cash income in Canada is to keep accurate records. This means tracking how much money you receive, how it was spent, and how much tax was paid. The best way to do this is by using a receipt book or an accounting software program, such as QuickBooks or Sage One Accounting.

How do you fill out a financial statement form?

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program. Step 2: Fill In Your Personal Information. Step 3: Write Down Your Assets. Step 4: Write Down Your Liabilities. Step 5: Fill Out the Notes Payable to Banks and Others Section. Step 6: Fill Out the Stocks and Bonds Section.

What accounting rules does Canada use?

The Canadian Accounting Standards Board (AcSB) requires publicly accountable enterprises to use IFRS in the preparation of all interim and annual financial statements. Most private companies also have the option to adopt IFRS for financial statement preparation.

What is financial statement in Canada?

They're a snapshot of your business performance—helping you run your company, plan its future, seek financing and much more. Financial statements are a key tool for running your business. They're a snapshot of your company's finances and give crucial information about your business performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada FLR 13 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your Canada FLR 13 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send Canada FLR 13 to be eSigned by others?

Canada FLR 13 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I fill out Canada FLR 13 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your Canada FLR 13 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is Canada FLR 13?

Canada FLR 13 is a form used by certain individuals and entities in Canada to report information related to foreign income or assets.

Who is required to file Canada FLR 13?

Individuals or entities that have foreign income or hold foreign assets exceeding a certain threshold are required to file Canada FLR 13.

How to fill out Canada FLR 13?

To fill out Canada FLR 13, taxpayers must provide personal information, details about foreign income or asset holdings, and any necessary supporting documentation as per the form's instructions.

What is the purpose of Canada FLR 13?

The purpose of Canada FLR 13 is to ensure transparency and compliance with taxation laws related to foreign assets and income in Canada.

What information must be reported on Canada FLR 13?

Individuals must report information such as their foreign income sources, amounts, foreign assets, and any specific transactions related to those assets on Canada FLR 13.

Fill out your Canada FLR 13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FLR 13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.