Canada FLR 13 2010 free printable template

Show details

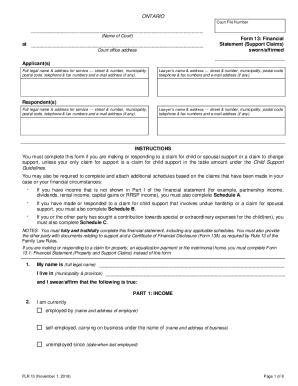

ONTARIO Court File Number (Name of Court) Form 13: Financial Statement (Support Claims) sworn/affirmed at Court office address Applicant(s) Full legal name & address for service street & number, municipality,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada FLR 13

Edit your Canada FLR 13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FLR 13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada FLR 13 online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada FLR 13. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FLR 13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FLR 13

How to fill out Canada FLR 13

01

Download the Canada FLR 13 form from the official government website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your full name, date of birth, and contact information.

04

Indicate your current immigration status in Canada.

05

Provide details about your family members, if applicable.

06

Answer all questions truthfully and accurately.

07

Review your completed form for any errors or missing information.

08

Sign and date the form where required.

09

Prepare any supporting documents you need to submit with the form.

10

Submit the completed form and documents to the appropriate Canadian immigration office.

Who needs Canada FLR 13?

01

Individuals seeking to extend their stay in Canada under a specific immigration category.

02

Those who need to apply for a Temporary Resident Permit.

03

Applicants who have faced changes in their life circumstances that require them to update their immigration status.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a resale certificate in Nebraska?

To get a resale certificate in Nebraska, you will need to fill out the Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption (Form 13).

How do I get a tax exempt certificate in Nebraska?

To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

How do I get a Nebraska sales tax ID number?

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

How to apply for Nebraska state ID number?

When applying for your initial State Identification card you must bring the following documentation to the DMV: Proof of U.S. Citizenship or Lawful Status, containing Name and Date of Birth, and Identity. Principal Address in Nebraska (at least two documents are required).

Do Nebraska resale certificates expire?

The certificate of exemption expires every 5 years. (See Nebraska Common or Contract Carrier Information Guide).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Canada FLR 13 online?

Completing and signing Canada FLR 13 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in Canada FLR 13?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada FLR 13 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit Canada FLR 13 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share Canada FLR 13 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Canada FLR 13?

Canada FLR 13 is a financial institution reporting form used in Canada to report certain transactions and account information to meet regulatory requirements.

Who is required to file Canada FLR 13?

Financial institutions, including banks and credit unions, are required to file Canada FLR 13 if they engage in transactions that meet specified thresholds.

How to fill out Canada FLR 13?

To fill out Canada FLR 13, gather necessary transaction details, complete the form following the provided guidelines, and submit it to the appropriate regulatory authority.

What is the purpose of Canada FLR 13?

The purpose of Canada FLR 13 is to enhance financial transparency and compliance with anti-money laundering regulations by tracking significant financial transactions.

What information must be reported on Canada FLR 13?

The information that must be reported on Canada FLR 13 includes details of the transaction, the parties involved, the amount, and any other pertinent account information as specified by the regulatory authority.

Fill out your Canada FLR 13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FLR 13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.