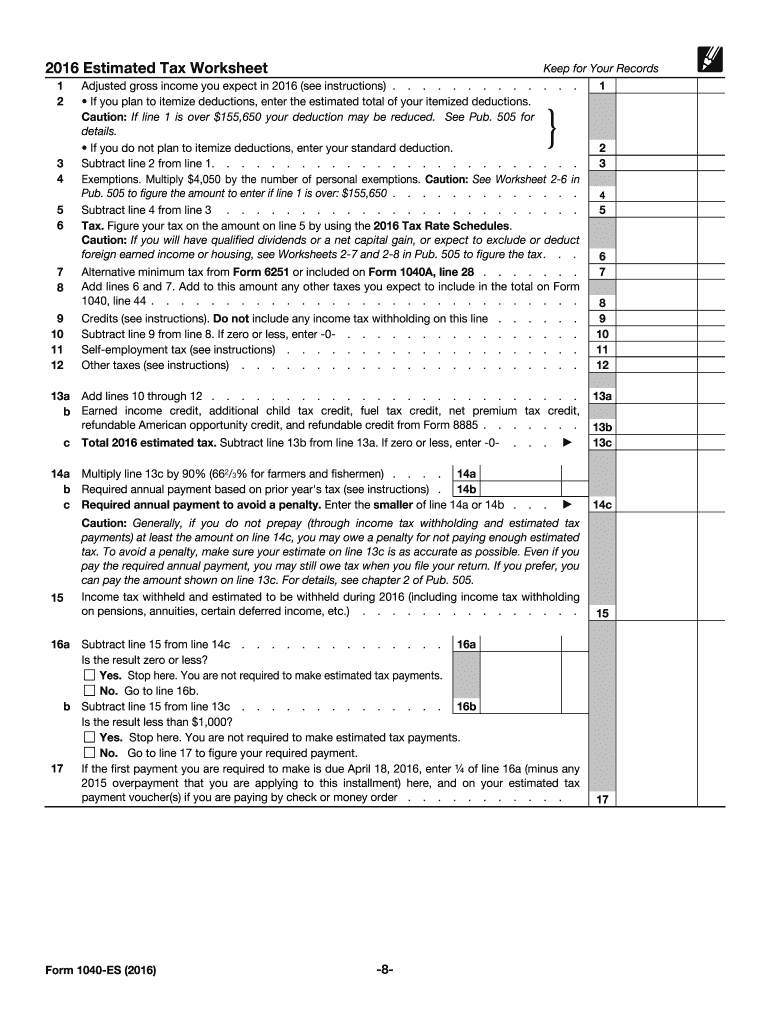

IRS 1040-ES 2016 free printable template

Instructions and Help about IRS 1040-ES

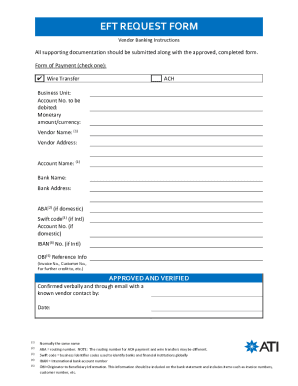

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

About IRS 1040-ES 2016 previous version

What is IRS 1040-ES?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-ES

What should I do if I made a mistake on my IRS 1040-ES?

If you realize you've made an error on your IRS 1040-ES after submission, you can correct it by filing an amended return using Form 1040-X. It's important to clearly indicate what changes were made and keep records of the original form to support your corrections.

How can I verify if my IRS 1040-ES has been received?

To verify the receipt of your filed IRS 1040-ES, you can check the status through the IRS's online system or call their customer service. Keep in mind that processing times may vary, so allow a few days before checking.

What privacy measures should I take when filing my IRS 1040-ES electronically?

When e-filing your IRS 1040-ES, ensure that you use secure connections and trusted software. Most reputable e-filing services incorporate encryption and data protection measures to safeguard your personal information from unauthorized access.

How should I handle a notice or audit from the IRS regarding my 1040-ES?

If you receive a notice or are audited regarding your IRS 1040-ES, carefully review the documentation sent by the IRS. Prepare relevant records and, if necessary, consult a tax professional for guidance on how to respond appropriately.

What are common errors that filers make on the IRS 1040-ES?

Common errors on the IRS 1040-ES include incorrect payment amounts, miscalculation of estimated taxes, or missing required information. To avoid these mistakes, double-check your figures and ensure all necessary documents are included before submission.

See what our users say