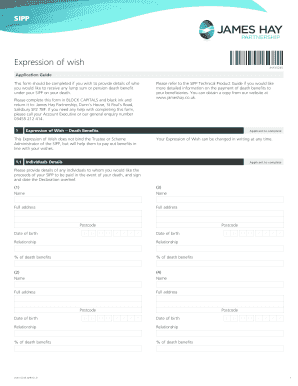

IRS 1040-ES 2024 free printable template

Instructions and Help about 1040 es

How to edit 1040 es

How to fill out 1040 es

Latest updates to 1040 es

All You Need to Know About 1040 es

What is 1040 es?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-ES

What should I do if I realize I've made a mistake after submitting my 1040 es?

If you discover an error in your submitted 1040 es, you need to file an amended return using Form 1040-X. It's important to correct any inaccuracies to avoid potential penalties or issues with the IRS. Ensure you follow the specific instructions for amending your return to reflect the changes accurately.

How can I verify if my 1040 es has been received and processed by the IRS?

To check the status of your 1040 es submission, you can use the IRS 'Where's My Amended Return?' tool available on their website. This tool allows you to enter your information to track the progress of your amended submission. Note that processing times may vary, so patience might be required.

What legal considerations should I keep in mind when e-signing my 1040 es?

When e-signing your 1040 es, make sure that your signature meets IRS standards for authenticity. Use the required PIN or electronic signature method stipulated in the IRS guidelines. Also, keep in mind that e-signed documents must comply with legal protocols for maintaining records and data security.

What should I consider regarding service fees when e-filing my 1040 es?

When e-filing your 1040 es, be aware that many tax preparation software programs may charge a fee for their services. It's essential to compare options to find a suitable service that fits your budget. If your e-filing is rejected, some services may also offer a refund or resolution support, so check their policies.

What steps should I take if I receive a notice from the IRS after filing my 1040 es?

If you receive a notice from the IRS regarding your 1040 es, read it carefully to understand the issue being addressed. Gather any requested documentation and respond promptly within the specified timeframe. If the notice involves significant complexity, consider seeking help from a tax professional to ensure compliance.

See what our users say