IRS 1040 - Schedule C 2012 free printable template

Show details

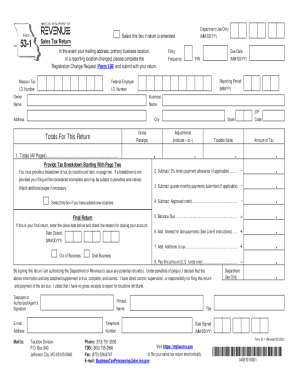

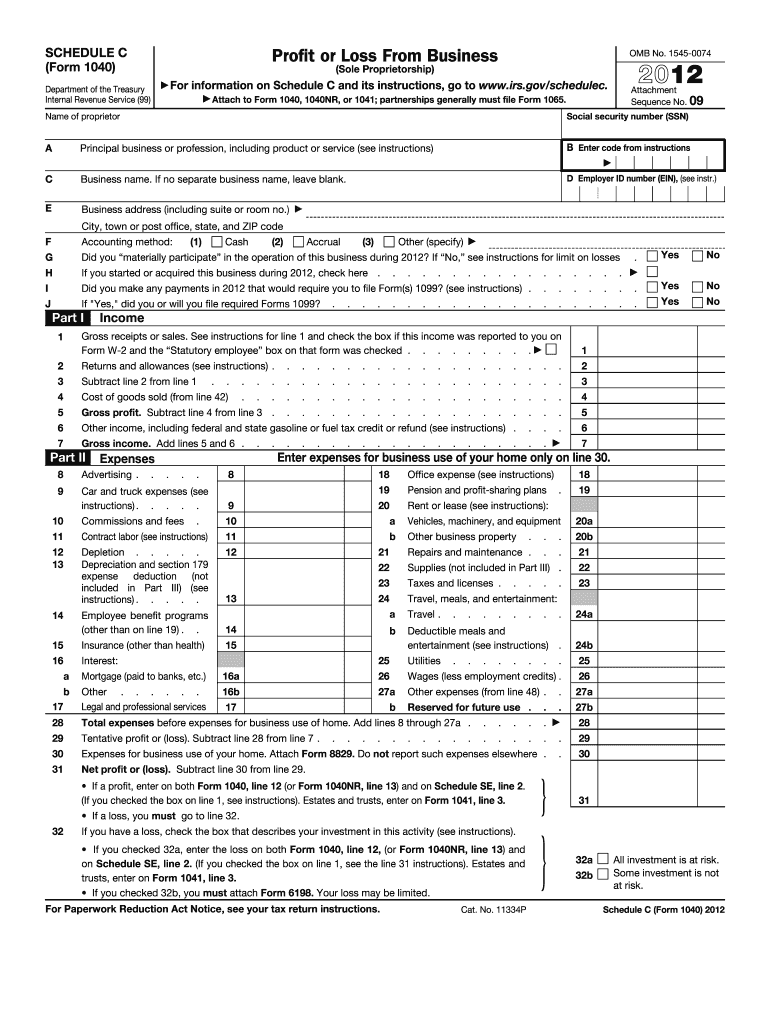

Some investment is not at risk. Schedule C Form 1040 2012 Page 2 Method s used to value closing inventory Was there any change in determining quantities costs or valuations between opening and closing inventory If Yes attach explanation. SCHEDULE C Form 1040 Profit or Loss From Business OMB No. 1545-0074 Sole Proprietorship For Department of the Treasury Internal Revenue Service 99 information on Schedule C and its instructions go to www.irs.gov/schedulec. Attach Attachment Sequence No. 09 to...Form 1040 1040NR or 1041 partnerships generally must file Form 1065. Name of proprietor Social security number SSN A B Enter code from instructions Principal business or profession including product or service see instructions C Business name. If no separate business name leave blank. E Business address including suite or room no. F G H City town or post office state and ZIP code Cash Accrual Other specify Accounting method Did you materially participate in the operation of this business during...2012 If No see instructions for limit on losses If you started or acquired this business during 2012 check here. See the instructions for line 13 to find out if you must file Form 4562. / When did you place your vehicle in service for business purposes month day year Of the total number of miles you drove your vehicle during 2012 enter the number of miles you used your vehicle for b Commuting see instructions Business c Other Was your vehicle available for personal use during off-duty hours Do...you or your spouse have another vehicle available for personal use. Name of proprietor Social security number SSN A B Enter code from instructions Principal business or profession including product or service see instructions C Business name. If no separate business name leave blank. E Business address including suite or room no. F G H City town or post office state and ZIP code Cash Accrual Other specify Accounting method Did you materially participate in the operation of this business during...2012 If No see instructions for limit on losses If you started or acquired this business during 2012 check here. I J Did you make any payments in 2012 that would require you to file Form s 1099 see instructions. If Yes did you or will you file required Forms 1099. SCHEDULE C Form 1040 Profit or Loss From Business OMB No* 1545-0074 Sole Proprietorship For Department of the Treasury Internal Revenue Service 99 information on Schedule C and its instructions go to www*irs*gov/schedulec* Attach...Attachment Sequence No* 09 to Form 1040 1040NR or 1041 partnerships generally must file Form 1065. Name of proprietor Social security number SSN A B Enter code from instructions Principal business or profession including product or service see instructions C Business name. If no separate business name leave blank. E Business address including suite or room no. F G H City town or post office state and ZIP code Cash Accrual Other specify Accounting method Did you materially participate in the...operation of this business during 2012 If No see instructions for limit on losses If you started or acquired this business during 2012 check here.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

To edit the IRS 1040 - Schedule C, you can utilize platforms like pdfFiller, which offer tools for modifying tax forms easily. Start by uploading your existing Schedule C form to pdfFiller. Use the editing tools to make necessary changes, ensuring all information is accurate before finalizing the document.

How to fill out IRS 1040 - Schedule C

Filling out the IRS 1040 - Schedule C requires specific information about your business income and expenses. Begin with the basic identification information such as your name, Social Security number, and the business name. Next, report your gross receipts, cost of goods sold, and various business expenses in the designated sections. It's important to be thorough and accurate to avoid potential audit issues.

About IRS 1040 - Schedule C 2012 previous version

What is IRS 1040 - Schedule C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule C 2012 previous version

What is IRS 1040 - Schedule C?

The IRS 1040 - Schedule C is a tax form used by sole proprietors to report income or loss from their business. This form is filed alongside the individual income tax return, Form 1040. It provides the IRS with detailed information about a taxpayer's business operations.

What is the purpose of this form?

The purpose of the IRS 1040 - Schedule C is to detail the income earned and expenses incurred by self-employed individuals. Completing this form allows taxpayers to calculate their net profit or loss, which is then transferred to their Form 1040 when filing their annual tax return.

Who needs the form?

Individuals who are self-employed, including sole proprietors, freelancers, and independent contractors, need to complete IRS 1040 - Schedule C. If you earn income from a business that you operate or a profession you practice independently, this form is necessary for your tax filings.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule C if your business did not have any income during the tax year. Additionally, if you are considered an employee and receive a W-2 from your employer, you do not need to file this form. Always check the IRS guidelines for the latest exemptions.

Components of the form

The IRS 1040 - Schedule C consists of several components: Part I captures general business information and gross receipts; Part II outlines costs and deductions; Part III allows for vehicle expenses; and Part IV contains information about other expenses. Each section has specific lines for entering data accurately.

What are the penalties for not issuing the form?

Failing to file the IRS 1040 - Schedule C when required can lead to penalties, including a failure-to-file penalty which can reach up to 5% of the unpaid tax amount for each month the return is late. Moreover, if you underreport income or claim excessive deductions, you may also face accuracy-related penalties.

What information do you need when you file the form?

When filing the IRS 1040 - Schedule C, you will need various pieces of information. This includes your business name, business address, taxpayer identification number, type of business, gross receipts, cost of goods sold, and a detailed breakdown of expenses. Accurate records and documentation of all income and expenses are essential for a successful filing.

Is the form accompanied by other forms?

The IRS 1040 - Schedule C should typically be submitted with Form 1040, your personal income tax return. Depending on your business structure and specific circumstances, you might also need to file additional forms such as Schedule SE for self-employment tax or other supporting documentation.

Where do I send the form?

The completed IRS 1040 - Schedule C, along with Form 1040, should be mailed to the address listed on the IRS instructions for Form 1040. Ensure you check for the correct mailing address, which may vary based on your state of residence and whether you are enclosing payment.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Paul was great and I'm very happy with PDF Filler.

I AM A NEW CUSTOMER. after A WHILE I AM ABLE TO DO SURVEY

See what our users say