Get the free Automatic Bank Deduction - Regencecom

Show details

Automatic Bank Deduction Authorization Medicare Script TM Basic (PDP) Medicare Script TM Enhanced (PDP) PO Box 1827 Medford, OR 97501 FORM 4416MS (Rev. 9/14) Making premium payments the easy way without

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic bank deduction

Edit your automatic bank deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic bank deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic bank deduction online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic bank deduction. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic bank deduction

How to fill out automatic bank deduction:

01

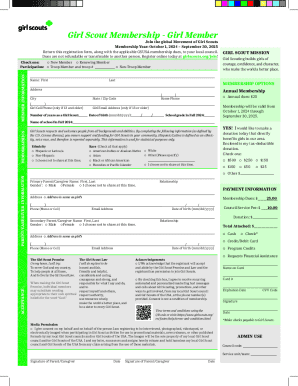

Gather necessary information: Before filling out the automatic bank deduction form, make sure you have all the required information. This may include your bank account details, such as the account number and routing number, as well as the name and contact information of the company or organization initiating the deduction.

02

Obtain the form: Depending on the specific requirements of the bank or company, you may need to obtain a physical form or access it online. Contact your bank or the organization initiating the deduction to find out how to obtain the form.

03

Complete personal information: Start by filling out your personal information accurately on the form. This usually includes your full name, address, contact number, and sometimes your email address. Make sure to check for any specific instructions or fields provided by the bank or organization.

04

Provide bank account details: Next, input your bank account details on the form. This typically includes your account number and routing number. Double-check the accuracy of these details to avoid any errors in the deduction process.

05

Specify the deduction details: Indicate the purpose or reason for the automatic bank deduction. This could be for loan repayments, monthly bills, charitable donations, or any other authorized payments. Include any specific instructions or preferences if required, such as the amount to be deducted and the frequency of deductions (e.g., weekly, monthly, quarterly).

06

Review and sign the form: Carefully review all the information you have provided on the form to ensure its accuracy. If everything appears correct, sign the form and date it as instructed. Keep a copy of the completed form for your records before submitting it.

Who needs automatic bank deduction:

01

Individuals with recurring payments: Automatic bank deduction can be beneficial for individuals who have regular bills or payments to make. By setting up this system, you ensure that your bills are paid on time without the hassle of manual payment processing.

02

Employees with direct deposit: Many employers now offer direct deposit options for employee salaries. By opting for automatic bank deduction, employees can have their paychecks deposited directly into their bank accounts.

03

Organizations with membership fees or subscription services: Associations, clubs, gyms, or any organization that charges membership fees or offers subscription-based services often utilize automatic bank deduction for convenience. Members or subscribers can authorize the organization to deduct the recurring fees automatically from their bank accounts.

04

Individuals with loan repayments: Borrowers who have taken out loans, such as student loans, mortgages, or personal loans, may opt for automatic bank deduction for their monthly repayments. This ensures that payments are made on time without the risk of missing any due dates.

By understanding how to fill out automatic bank deduction forms and knowing who can benefit from this service, you can ensure a seamless and convenient payment process while maintaining financial responsibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my automatic bank deduction in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your automatic bank deduction and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in automatic bank deduction?

With pdfFiller, it's easy to make changes. Open your automatic bank deduction in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete automatic bank deduction on an Android device?

Complete your automatic bank deduction and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is automatic bank deduction?

Automatic bank deduction is a process where a predetermined amount of money is withdrawn directly from a bank account to fulfill a payment obligation.

Who is required to file automatic bank deduction?

Individuals or businesses who have agreed to make regular payments through automatic bank deduction are required to file.

How to fill out automatic bank deduction?

To fill out automatic bank deduction, you need to provide your bank account information, the amount to be deducted, the frequency of deductions, and the purpose of the deductions.

What is the purpose of automatic bank deduction?

The purpose of automatic bank deduction is to ensure timely and hassle-free payments for recurring expenses such as bills, loan payments, and subscriptions.

What information must be reported on automatic bank deduction?

The information that must be reported on automatic bank deduction includes the name of the account holder, bank account number, routing number, amount to be deducted, frequency of deductions, and purpose of deductions.

Fill out your automatic bank deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Bank Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.