Get the free Mutual Fund Variable Annuity Switch Letter - pcstx

Show details

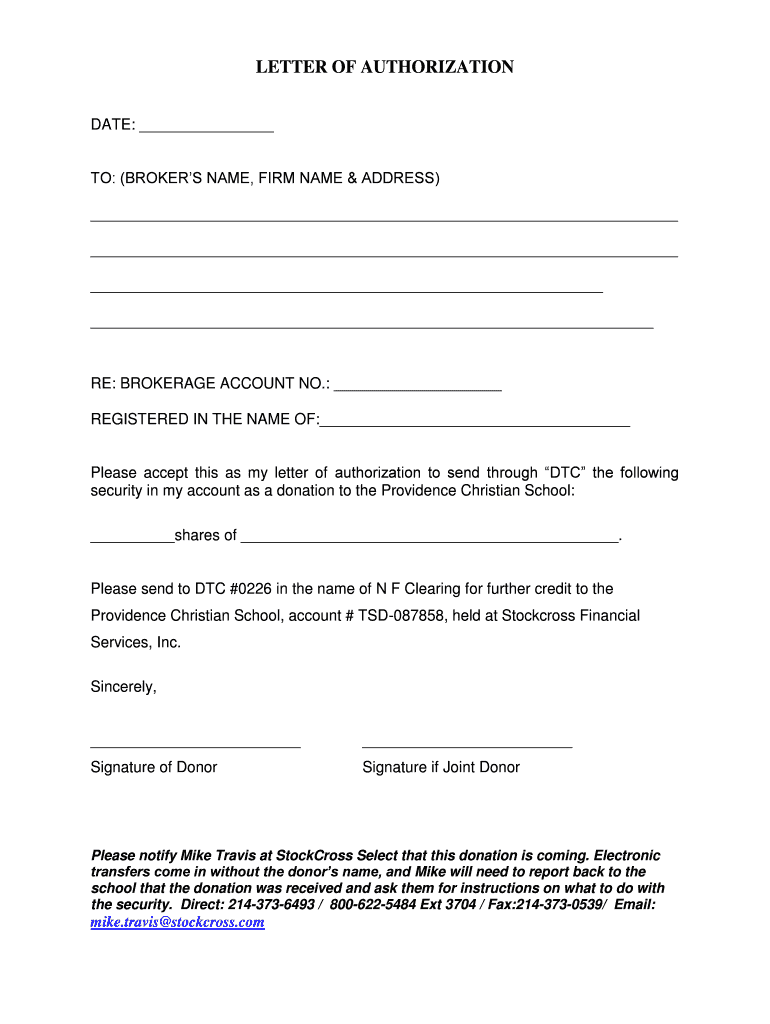

LETTER OF AUTHORIZATION DATE: TO: (BROKERS NAME, FIRM NAME & ADDRESS) RE: BROKERAGE ACCOUNT NO.: REGISTERED IN THE NAME OF: Please accept this as my letter of authorization to send through DTC the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund variable annuity

Edit your mutual fund variable annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund variable annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual fund variable annuity online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mutual fund variable annuity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund variable annuity

How to fill out mutual fund variable annuity:

01

Gather necessary documents: Start by collecting all the relevant documents required to fill out a mutual fund variable annuity. This may include identification proofs, social security number, tax returns, and financial statements.

02

Choose the right annuity: Research and compare different mutual fund variable annuity options available in the market. Consider factors such as fees, charges, investment options, and surrender penalties before selecting the most suitable one for your financial goals.

03

Understand the application: Carefully read and understand the annuity application form. Pay attention to any terms and conditions mentioned, as well as any questions that require specific documentation or information.

04

Provide personal details: Fill in your personal information accurately, including your name, address, date of birth, and contact details. Ensure that all the information provided is up to date and matches your official records.

05

Financial and investment information: Provide details about your financial situation, including your income, assets, liabilities, and investment preferences. This information helps the insurance company determine your risk profile and tailor the annuity product accordingly.

06

Beneficiary designation: Designate any beneficiaries who will receive the annuity proceeds in the event of your death. Include their names, relationship to you, and their contact information.

07

Review and sign: Before submitting the application, review all the information you have provided for accuracy. Ensure that you haven't left any sections incomplete or unanswered. Sign and date the application form as required.

08

Attach supporting documents: Attach any necessary supporting documents, such as a copy of your identification proof, social security number, and any additional forms required by the insurance company.

09

Submit the application: Follow the instructions provided by the insurance company to submit the completed application and supporting documents. This may involve mailing the application or submitting it online through a secure portal.

Who needs mutual fund variable annuity?

01

Individuals planning for retirement: Mutual fund variable annuities can act as a valuable retirement planning tool. They allow individuals to invest a portion of their savings in the stock market while providing tax deferral benefits and a guaranteed income stream in retirement.

02

Risk-averse investors: If you're someone who prefers a level of security and wants to participate in the potential growth of the stock market, a mutual fund variable annuity could be a suitable investment option. These annuities offer a balance between market participation and downside protection.

03

Those seeking tax advantages: Mutual fund variable annuities offer tax-deferred growth, meaning you won't have to pay taxes on any investment gains until you start making withdrawals. This can be advantageous for individuals in higher tax brackets who are looking to minimize their tax liability.

04

Long-term investors: Mutual fund variable annuities are designed for long-term investment goals. They are not suitable for those with short-term financial needs, as they usually have surrender charges if you withdraw funds within a certain period. However, for individuals with a longer investment horizon, these annuities can provide the potential for significant growth over time.

05

Individuals looking for estate planning benefits: Mutual fund variable annuities often include death benefit options, allowing you to pass on the annuity's value to your beneficiaries. This can be an attractive feature for those concerned about leaving a legacy or providing for their loved ones after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mutual fund variable annuity from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including mutual fund variable annuity, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find mutual fund variable annuity?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mutual fund variable annuity and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out mutual fund variable annuity on an Android device?

On Android, use the pdfFiller mobile app to finish your mutual fund variable annuity. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is mutual fund variable annuity?

A mutual fund variable annuity is a type of investment that combines elements of a mutual fund with features of a variable annuity.

Who is required to file mutual fund variable annuity?

Investors who hold a mutual fund variable annuity are required to file.

How to fill out mutual fund variable annuity?

To fill out a mutual fund variable annuity, investors must provide information on their investment choices and any beneficiary designations.

What is the purpose of mutual fund variable annuity?

The purpose of a mutual fund variable annuity is to provide investors with a combination of investment options and tax-deferred growth.

What information must be reported on mutual fund variable annuity?

Information such as investment performance, asset allocation, fees, and any changes to the investment must be reported on a mutual fund variable annuity.

Fill out your mutual fund variable annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund Variable Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.