MD Application For Lien Certificate - Anne Arundel County 2020 free printable template

Show details

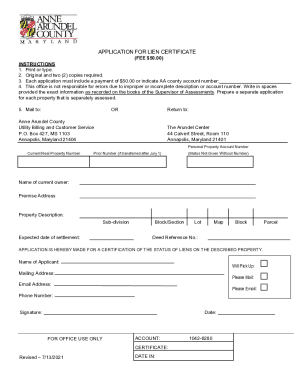

APPLICATION FOR LIEN CERTIFICATE (FEE $50.00) INSTRUCTIONS 1. Print or type. 2. Original and two (2) copies required. 3. Each application must include a payment of $50.00 or indicate charge number.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Application For Lien Certificate - Anne

Edit your MD Application For Lien Certificate - Anne form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Application For Lien Certificate - Anne form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD Application For Lien Certificate - Anne online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD Application For Lien Certificate - Anne. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Application For Lien Certificate - Anne Arundel County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Application For Lien Certificate - Anne

How to fill out MD Application For Lien Certificate - Anne Arundel

01

Obtain the MD Application for Lien Certificate form from the Anne Arundel County website or office.

02

Fill out the necessary personal information including your name, address, and contact information.

03

Provide property details, including the address and tax identification number of the property.

04

Indicate the purpose for requesting the lien certificate.

05

Review the application for accuracy and completeness.

06

Sign and date the application form.

07

Submit the application via mail or in person at the appropriate Anne Arundel County office along with the required fees.

Who needs MD Application For Lien Certificate - Anne Arundel?

01

Property owners in Anne Arundel County who need to verify outstanding liens on their property.

02

Buyers or sellers of real estate in Anne Arundel County during a property transaction.

03

Attorneys who require lien information for legal purposes.

04

Lenders offering mortgages who need to assess the lien status of a property.

Fill

form

: Try Risk Free

People Also Ask about

How do tax liens work in Maryland?

Any unpaid State, County and city (municipal) taxes on real property constitute a lien on the real property from the date they become due until paid (Section 14-804). It is mandatory that the Collector of Taxes sell, at the time prescribed by local law, any property on which taxes are in arrears (Section 14-808).

Who is responsible for recording deeds in the Maryland Land Records?

A deed to be recorded can be prepared by an attorney licensed in Maryland or by one of the parties named in the deed.

How long can property taxes go unpaid in Maryland?

Under Maryland law, you'll receive a notice saying that the property will be sold if the arrears, interest, and penalties aren't paid within 30 days. (Md. Code Ann., Tax-Prop. § 14-812.)

How long are Maryland state tax liens good for?

For many years, Maryland state tax liens had no time limits. However, in 2019, Maryland Governor Larry Hogan signed a law that created a statute of limitations for certain tax liens. So, Maryland state tax liens can eventually expire, but the statute of limitations is very long: 20 years.

How do I get a copy of my deed in Anne Arundel County?

Manual Recording Process for Deeds Step 1: (City of Annapolis Property Only) City Hall, 160 Duke of Gloucester Street, Annapolis, MD Phone: 410-263-7953. To request a copy of a recorded document thru the mail you must provide us with the current book and page number and the total number of pages to be copied.

How are deeds recorded in Maryland?

Recording the deed: Once all necessary taxes and fees have been paid, take the original deed, a copy of the deed, and the completed and signed Land Instrument Intake Sheet to the Division of Land Records at the Circuit Court. You must pay the recording fee.

Who can put a lien on a property?

Once a person's property is discovered, a judgment creditor can take action toward the property. He or she can place lien against the real property that the debtor owns. Some states will automatically impose a lien on the judgment debtor's property once the judgment is secured.

Is Maryland a tax lien state?

A Maryland tax lien works the same way, but it will occur because of unpaid state taxes and will come from the Comptroller of Maryland. Imagine a tax lien as an octopus with a lot of tentacles: it can attach to all sorts of different assets you own, and it will stay latched on until you pay off your tax debt.

How long does a lien stay on your property in Maryland?

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

What is a recorded lien in Maryland?

Main_Content. A lien is a record maintained by the MVA of the debt owed by a vehicle owner to a secured party (lender).

What is a lien certificate in Maryland?

A lien is a charge upon your real property for the satisfaction of debt arising by the statute of law. The lien is security against the real property for the ultimate payment of the debt.

Who pays transfer taxes in Baltimore?

transfer tax shall be shared equally between the grantor and grantee. . . . (2) The entire amount of State transfer tax shall be paid by the seller of improved, residential real property that is sold to a first-time Maryland home buyer who will occupy the property as a principal residence.

How do I pay off a tax lien in Maryland?

The only way to get a tax lien released is to pay your Maryland tax balance. After doing so, you can visit the applicable circuit court to obtain a certified copy of the lien release. This can be submitted to the three major credit agencies so your credit report will reflect the lien release.

Can someone take your property by paying the taxes in Maryland?

Foreclosing the Right of Redemption If you do not redeem the property, the tax certificate holder can file a lawsuit to take ownership of the property. The lawsuit is called foreclosing the right of redemption. The lawsuit can be filed any time after 6 months (9 months in Baltimore City).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MD Application For Lien Certificate - Anne online?

pdfFiller makes it easy to finish and sign MD Application For Lien Certificate - Anne online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit MD Application For Lien Certificate - Anne in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your MD Application For Lien Certificate - Anne, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my MD Application For Lien Certificate - Anne in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your MD Application For Lien Certificate - Anne right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is MD Application For Lien Certificate - Anne Arundel?

MD Application For Lien Certificate - Anne Arundel is a formal request submitted to obtain a lien certificate for properties in Anne Arundel County, Maryland. This certificate provides information regarding any liens or encumbrances on the property.

Who is required to file MD Application For Lien Certificate - Anne Arundel?

Anyone seeking to obtain a lien certificate for a property in Anne Arundel County, including property owners, potential buyers, or lenders, is required to file the MD Application For Lien Certificate.

How to fill out MD Application For Lien Certificate - Anne Arundel?

To fill out the MD Application For Lien Certificate, applicants must provide specific details such as the property address, owner's information, and any related ownership history, along with a signed request and payment of any applicable fees.

What is the purpose of MD Application For Lien Certificate - Anne Arundel?

The purpose of the MD Application For Lien Certificate is to officially document and disclose any existing liens on a property, ensuring transparency and protecting the interests of buyers and lenders.

What information must be reported on MD Application For Lien Certificate - Anne Arundel?

Information that must be reported includes the property address, owner's name, parcel identification number, any existing liens, and any relevant details that help identify the property and its encumbrances.

Fill out your MD Application For Lien Certificate - Anne online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Application For Lien Certificate - Anne is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.