Get the free Investment Returns and Assumptions Report

Show details

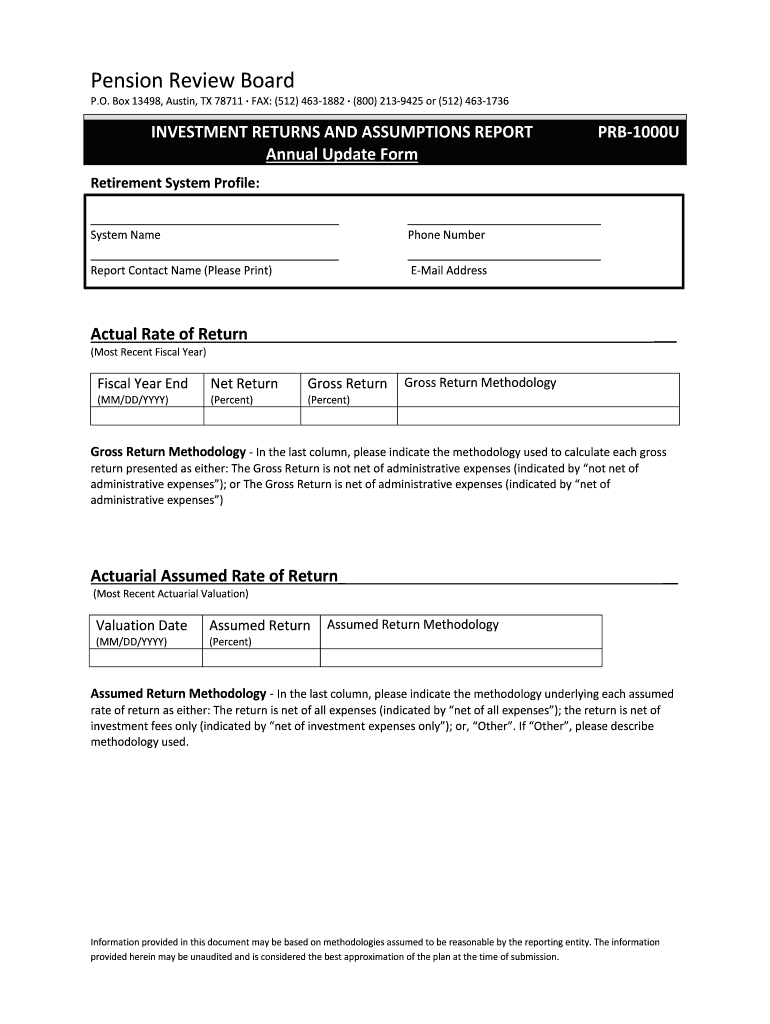

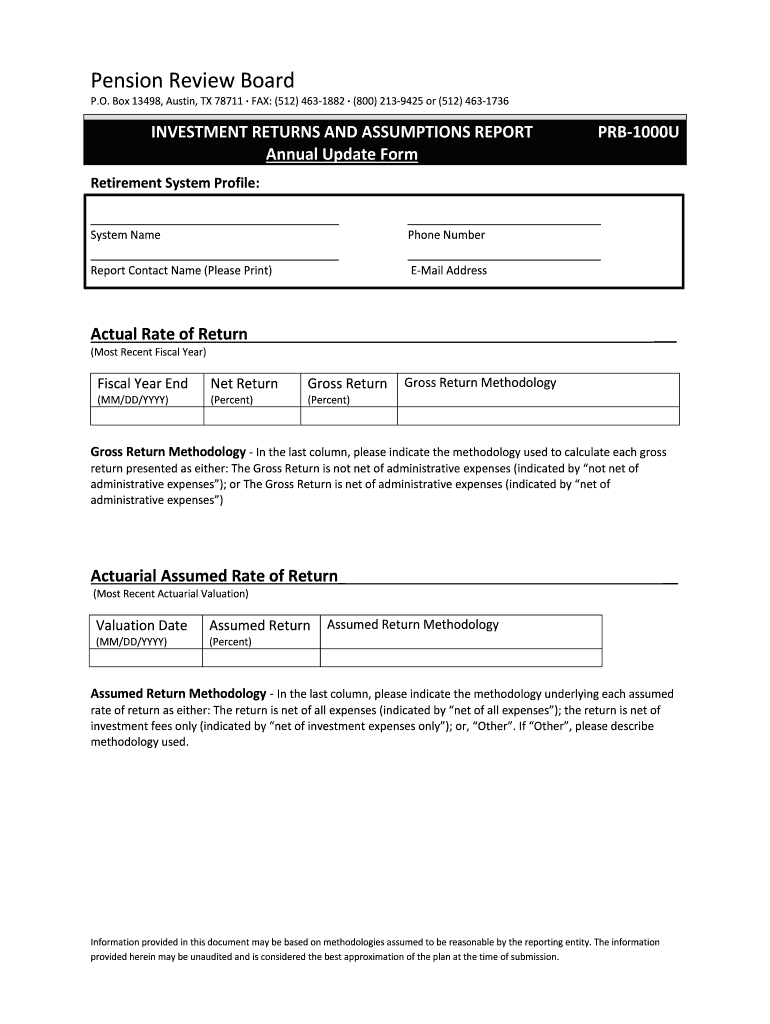

Submit by Email Investment Returns and Assumptions Report Section 802.108. REPORT OF INVESTMENT RETURNS AND ASSUMPTIONS. (a) A public retirement system shall, before the 211th day after the last day

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment returns and assumptions

Edit your investment returns and assumptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment returns and assumptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment returns and assumptions online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit investment returns and assumptions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment returns and assumptions

How to fill out investment returns and assumptions:

01

Start by understanding the purpose: Investment returns and assumptions are used to evaluate the performance and potential of an investment portfolio. They provide a basis for making informed decisions and projections regarding future investment outcomes.

02

Gather relevant information: To fill out investment returns and assumptions, you will need data such as historical returns, market trends, investment expenses, and financial projections. Collect these details from reliable sources, such as financial statements, investment reports, and market research.

03

Determine the time period: Decide on the time frame for which you are filling out the investment returns and assumptions. It could be a month, a quarter, a year, or a specific period relevant to your investment goals.

04

Calculate investment returns: Calculate the investment returns using the appropriate formulas based on the type of investment, such as stocks, bonds, or mutual funds. Include capital gains, dividends, interest income, and any other relevant sources of returns.

05

Consider assumptions and projections: Identify the assumptions you want to make for your investment analysis. These could include expected inflation rates, market growth rates, and other macroeconomic variables. Make sure these assumptions are realistic and align with historical data and market conditions.

06

Evaluate risk and return trade-offs: Assess the risks associated with your investments and how they might impact returns. Consider factors such as market volatility, industry trends, and investment diversification. Use risk models and analysis techniques to evaluate the potential returns and uncertainties involved.

07

Track and update regularly: Investment returns and assumptions should be regularly updated to reflect any changes in the market or your investment strategy. Stay informed about dynamic market conditions and adjust your assumptions accordingly.

Who needs investment returns and assumptions?

01

Individual investors: Individual investors who manage their own portfolios require investment returns and assumptions to gauge the performance of their investments, make informed decisions, and plan for their financial future.

02

Financial advisors: Financial advisors rely on investment returns and assumptions to provide personalized and objective advice to their clients. They use this information to analyze investment opportunities, create investment portfolios, and guide clients towards achieving their financial goals.

03

Institutional investors: Institutional investors, such as pension funds, insurance companies, and endowments, need accurate and thorough investment returns and assumptions to monitor their investment performance, manage risk, and meet their fiduciary responsibilities.

In summary, filling out investment returns and assumptions involves understanding the purpose, gathering relevant information, calculating returns, considering assumptions, evaluating risks, and regularly tracking and updating the data. Individual investors, financial advisors, and institutional investors are among those who require investment returns and assumptions for various decision-making and analysis purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete investment returns and assumptions online?

pdfFiller makes it easy to finish and sign investment returns and assumptions online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out investment returns and assumptions on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your investment returns and assumptions. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete investment returns and assumptions on an Android device?

On an Android device, use the pdfFiller mobile app to finish your investment returns and assumptions. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is investment returns and assumptions?

Investment returns and assumptions refer to the expected earnings and predictions related to investments.

Who is required to file investment returns and assumptions?

Individuals, companies, or organizations who have made investments are required to file investment returns and assumptions.

How to fill out investment returns and assumptions?

To fill out investment returns and assumptions, one must provide accurate details of their investments, expected returns, and assumptions made.

What is the purpose of investment returns and assumptions?

The purpose of investment returns and assumptions is to assess the performance and potential outcomes of investments.

What information must be reported on investment returns and assumptions?

Information such as investment amount, expected returns, risk assessment, and assumptions made must be reported on investment returns and assumptions.

Fill out your investment returns and assumptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Returns And Assumptions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.