MN CR-PTE 2014 free printable template

Show details

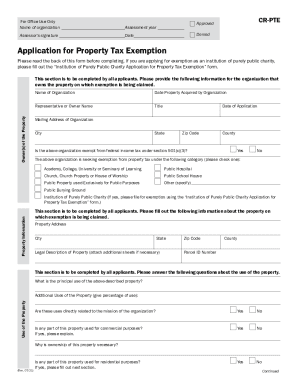

For Office Use Only Name of organizationAssessment year Assessor s signatureDate CR-PTE Approved Denied Application for Property Tax Exemption Please read the back of this form before completing. Signature of owner or authorized representative. By signing below I certify that the above information is true and correct to the best of my knowledge and I am the owner of the property or authorized representative of the organization that owns the property for which exemption is being claimed....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN CR-PTE

Edit your MN CR-PTE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN CR-PTE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN CR-PTE online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN CR-PTE. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN CR-PTE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN CR-PTE

How to fill out MN CR-PTE

01

Obtain the MN CR-PTE form from the official Minnesota Department of Revenue website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including name, address, and Social Security number.

04

Indicate the type of income you are reporting in the appropriate section.

05

List any deductions or credits you may be eligible for.

06

Double-check the information entered for accuracy.

07

Sign and date the form before submitting it.

08

Send the completed form to the address specified in the instructions.

Who needs MN CR-PTE?

01

Residents of Minnesota who have income from sources outside of Minnesota.

02

Individuals who have a tax obligation to Minnesota due to their income.

03

Taxpayers who are claiming a credit for taxes paid to another state.

Instructions and Help about MN CR-PTE

Fill

form

: Try Risk Free

People Also Ask about

What are PTE payments?

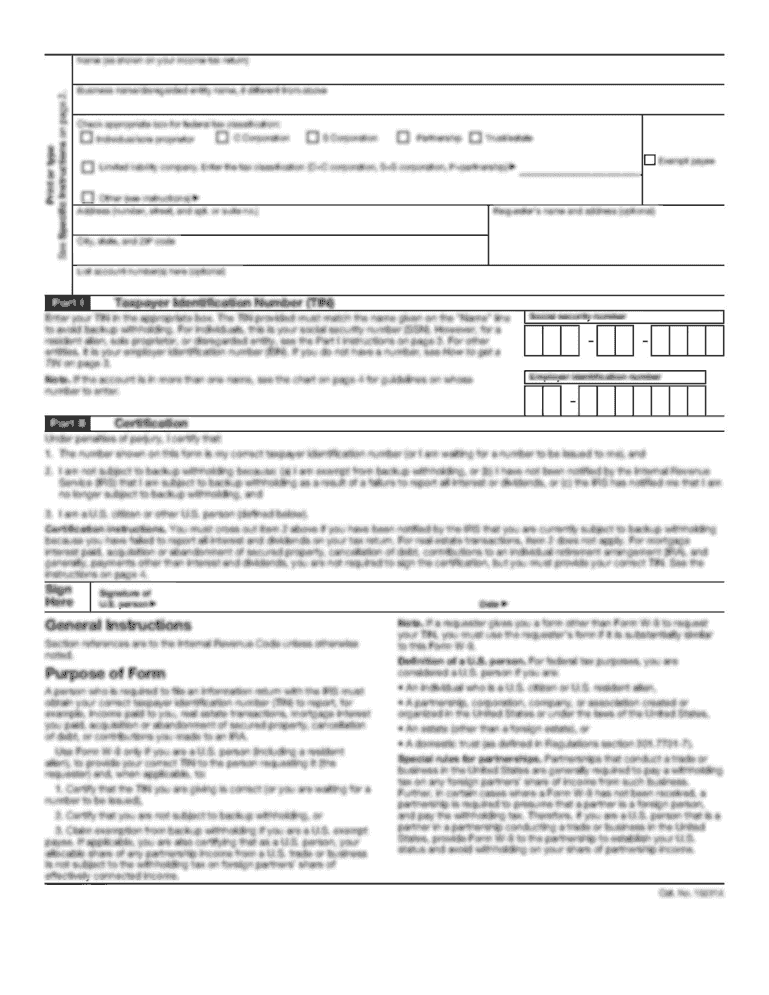

PTE elective tax calculation The elective tax is 9.3% of the entity's qualified net income, which is the sum of the pro rata or distributive share and guaranteed payments of each qualified taxpayers' income subject to California personal income tax.

What is a PTE form?

Pass-through entity (PTE) elective tax.

What is a PTE for tax purposes?

What Is an Elective Pass-Through Entity Tax? The owners of a PTE are typically responsible for paying the taxes on the entity's taxable income. The optional tax allows eligible PTEs to shift the payment of state income taxes to the entity.

Why do I have to file Form 3804 CR?

A. Purpose. Use form FTB 3804-CR to claim the amount of the credit that equals 9.3 percent of the sum of the taxpayer's pro rata share or distributive share and guaranteed payments of qualified net income subject to the election made by an electing qualified entity under the Small Business Relief Act.

What is a PTE for business tax?

A pass-through entity (PTE) is a business that “passes through” any income or loss to the owners, members, partners, or shareholders. PTEs include: Sole Proprietorships. Partnerships.

What does PTE mean payment?

The Pass-Through Entity (PTE) Tax allows an entity to pay a tax on behalf of their partners, members, or shareholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MN CR-PTE online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your MN CR-PTE and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in MN CR-PTE without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your MN CR-PTE, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit MN CR-PTE on an iOS device?

Create, edit, and share MN CR-PTE from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is MN CR-PTE?

MN CR-PTE is the Minnesota Corporate Franchise Tax Exemption for Partnerships, Family Farmers, and East Indian Corporations, which allows qualifying entities to claim certain tax benefits.

Who is required to file MN CR-PTE?

Entities such as partnerships, limited liability companies, and S corporations that meet specific criteria must file the MN CR-PTE.

How to fill out MN CR-PTE?

To fill out MN CR-PTE, gather the required financial information, complete the form following the instructions provided, and submit it to the Minnesota Department of Revenue.

What is the purpose of MN CR-PTE?

The purpose of MN CR-PTE is to provide qualifying partnerships and other entities with a formal mechanism to report and claim tax exemptions, thereby reducing their overall tax liability.

What information must be reported on MN CR-PTE?

Information that must be reported includes details about the entity's income, deductions, credits, and any qualifying activities that support the claim for tax exemption.

Fill out your MN CR-PTE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN CR-PTE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.