MN CR-PTE 2013 free printable template

Show details

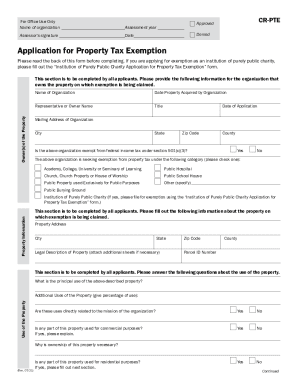

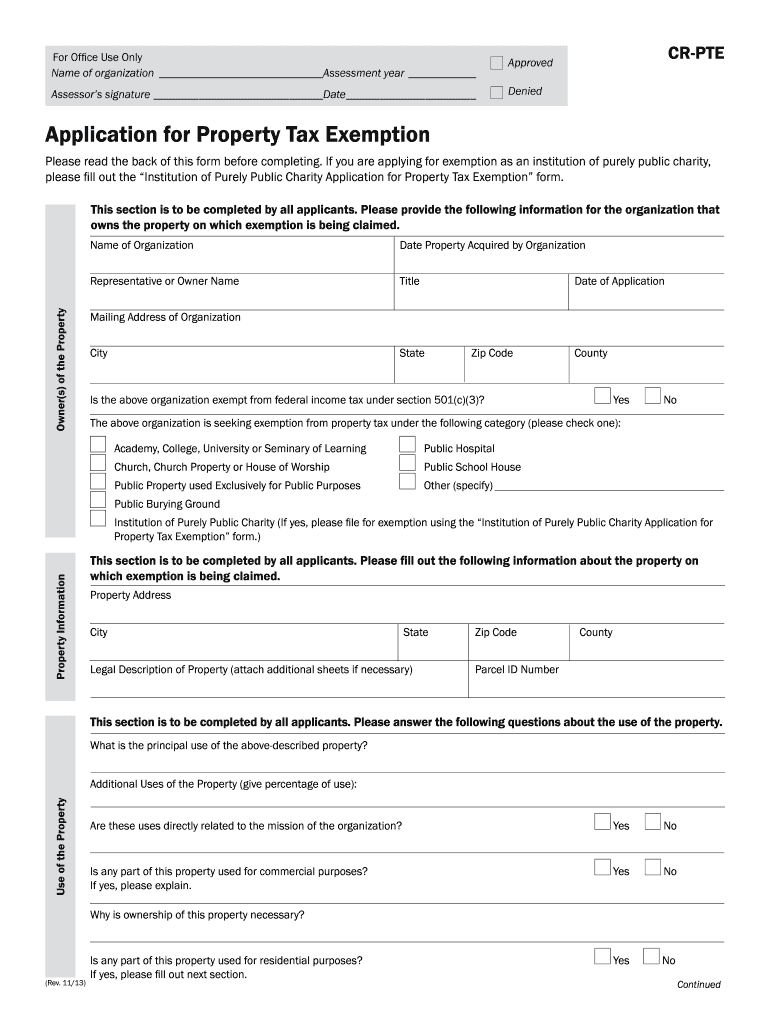

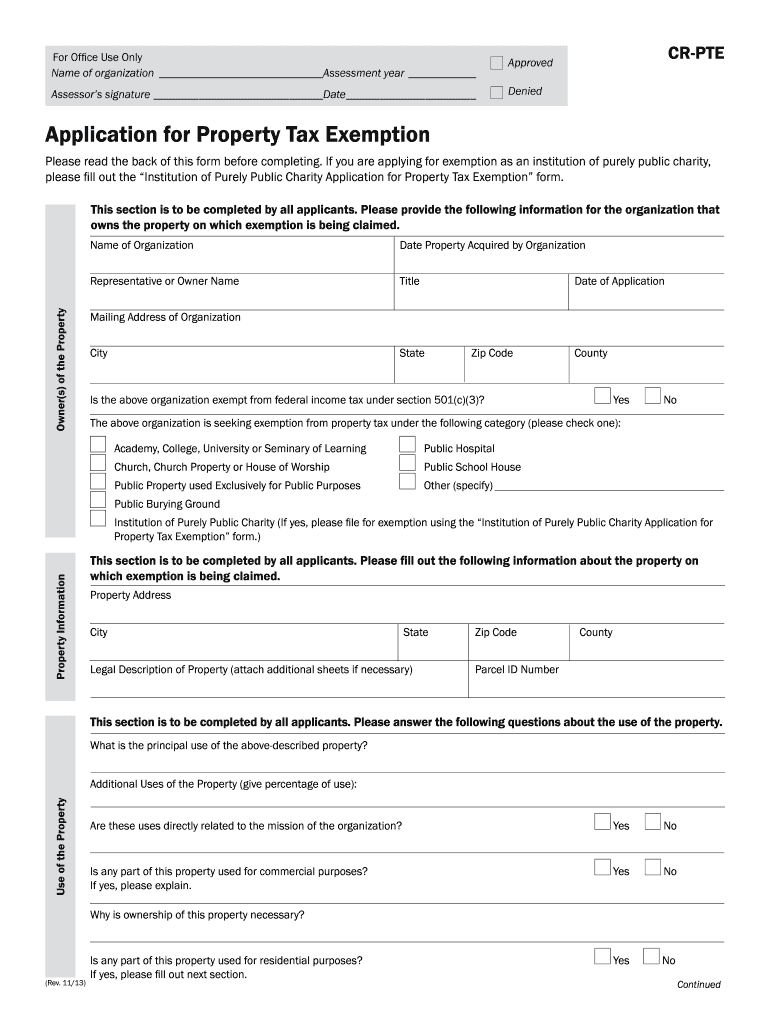

For Office Use Only Name of organizationAssessment year Assessor s signatureDate CR-PTE Approved Denied Application for Property Tax Exemption Please read the back of this form before completing. Signature of owner or authorized representative. By signing below I certify that the above information is true and correct to the best of my knowledge and I am the owner of the property or authorized representative of the organization that owns the property for which exemption is being claimed....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN CR-PTE

Edit your MN CR-PTE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN CR-PTE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN CR-PTE online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN CR-PTE. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN CR-PTE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN CR-PTE

How to fill out MN CR-PTE

01

Obtain the MN CR-PTE form from the official website or relevant authority.

02

Carefully read the instructions provided with the form.

03

Complete the applicant's information section, including name, address, and contact details.

04

Fill out the purpose of the request in the specified section.

05

Provide any required supporting documentation as outlined in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate department as mentioned in the instructions.

Who needs MN CR-PTE?

01

Individuals requesting a Certificate of Real Property Tax Exemption in Minnesota.

02

Property owners seeking to confirm their eligibility for tax exemption measures.

03

Non-profit organizations applying for property tax exemptions.

Instructions and Help about MN CR-PTE

Fill

form

: Try Risk Free

People Also Ask about

What are PTE payments?

PTE elective tax calculation The elective tax is 9.3% of the entity's qualified net income, which is the sum of the pro rata or distributive share and guaranteed payments of each qualified taxpayers' income subject to California personal income tax.

What is a PTE form?

Pass-through entity (PTE) elective tax.

What is a PTE for tax purposes?

What Is an Elective Pass-Through Entity Tax? The owners of a PTE are typically responsible for paying the taxes on the entity's taxable income. The optional tax allows eligible PTEs to shift the payment of state income taxes to the entity.

Why do I have to file Form 3804 CR?

A. Purpose. Use form FTB 3804-CR to claim the amount of the credit that equals 9.3 percent of the sum of the taxpayer's pro rata share or distributive share and guaranteed payments of qualified net income subject to the election made by an electing qualified entity under the Small Business Relief Act.

What is a PTE for business tax?

A pass-through entity (PTE) is a business that “passes through” any income or loss to the owners, members, partners, or shareholders. PTEs include: Sole Proprietorships. Partnerships.

What does PTE mean payment?

The Pass-Through Entity (PTE) Tax allows an entity to pay a tax on behalf of their partners, members, or shareholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MN CR-PTE?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MN CR-PTE and other forms. Find the template you need and change it using powerful tools.

How do I complete MN CR-PTE online?

pdfFiller has made it simple to fill out and eSign MN CR-PTE. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit MN CR-PTE on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as MN CR-PTE. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is MN CR-PTE?

MN CR-PTE is a form used in Minnesota to report tax information related to pass-through entities, such as partnerships and S corporations.

Who is required to file MN CR-PTE?

Pass-through entities that have Minnesota source income or are doing business in Minnesota are required to file MN CR-PTE.

How to fill out MN CR-PTE?

To fill out MN CR-PTE, you need to provide details about the entity, its income, and its owners or partners, following the instructions provided by the Minnesota Department of Revenue.

What is the purpose of MN CR-PTE?

The purpose of MN CR-PTE is to ensure that the income from pass-through entities is reported and taxed appropriately under Minnesota state law.

What information must be reported on MN CR-PTE?

Information such as the entity's name, federal identification number, income, deductions, and the distribution of income to partners or shareholders must be reported on MN CR-PTE.

Fill out your MN CR-PTE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN CR-PTE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.