Get the free LONGTERM LOAN OR GUARANTEE APPLICATION - exim

Show details

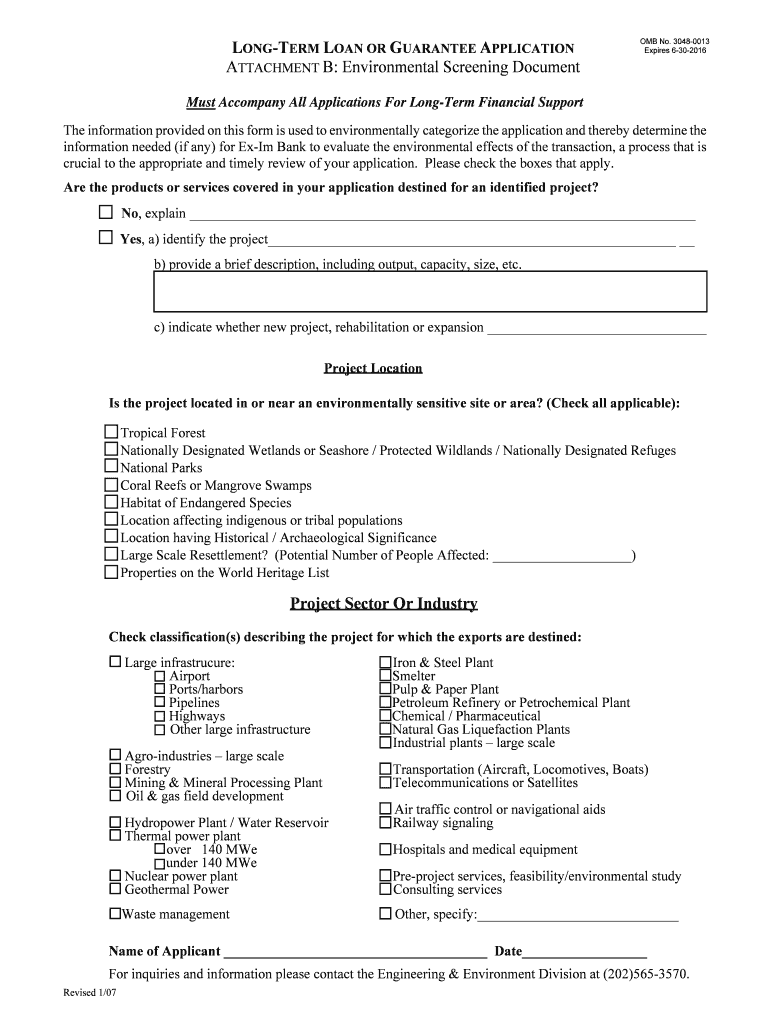

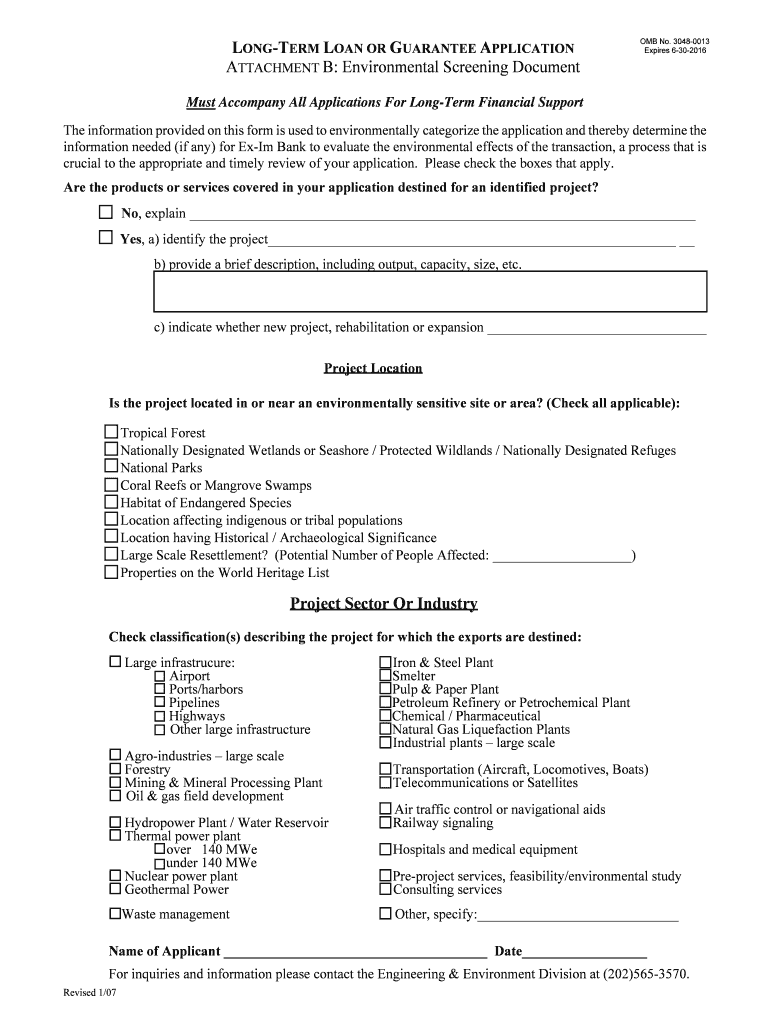

LONGER LOAN OR GUARANTEE APPLICATION ATTACHMENT B: Environmental Screening Document OMB No. 30480013 Expires 6302016 Must Accompany All Applications For Longer Financial Support The information provided

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign longterm loan or guarantee

Edit your longterm loan or guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your longterm loan or guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit longterm loan or guarantee online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit longterm loan or guarantee. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out longterm loan or guarantee

How to fill out a long-term loan or guarantee:

01

Gather all necessary documentation: Start by collecting important documents such as financial statements, tax returns, and credit reports. These documents will be needed to support your loan or guarantee application.

02

Research lending institutions: Research different lending institutions to find the one that best suits your needs. Compare interest rates, loan terms, and repayment options. Some institutions specialize in specific types of loans or guarantees, so choose wisely.

03

Understand the terms and conditions: Read through the loan or guarantee agreement carefully. Understand the interest rate, repayment schedule, any potential penalties or fees, and any collateral required.

04

Complete the application: Fill out the application form accurately and provide all the required information. Double-check to ensure that all information is correct before submitting the application. Inaccurate or incomplete information may delay the process.

05

Provide supporting documentation: Attach all the necessary supporting documents with your application. This may include bank statements, business plans, financial projections, or personal guarantees. Ensure that all documents are properly labeled and organized.

06

Review and revise: Review your application before submission. Check for any errors or omissions. Revise if necessary to strengthen your application.

07

Submit the application: Submit your complete application along with the required documentation to the lending institution. Follow their instructions for submission, whether it's by mail, online, or in person.

08

Await the decision: Once the application is submitted, it may take some time for the lending institution to review and process it. Be patient and wait for their decision.

Who needs a long-term loan or guarantee?

01

Small business owners: Many small business owners often require long-term loans or guarantees to finance their business operations, expansions, or equipment purchases.

02

Individuals purchasing property: Individuals looking to purchase a home or other significant property may need a long-term loan or guarantee to secure financing and make the purchase.

03

Startups and entrepreneurs: Startups or entrepreneurs seeking funding to launch their ventures often rely on long-term loans or guarantees to support their business activities and initial investments.

04

Students pursuing higher education: Students often rely on long-term loans or guarantees, such as student loans, to finance their education. These loans allow them to pay for tuition, living expenses, and other educational costs.

05

Nonprofit organizations: Nonprofit organizations may seek long-term loans or guarantees to finance projects, initiatives, or capital expenditures.

In summary, anyone requiring financial assistance for business ventures, property purchases, education, or other significant investments may consider a long-term loan or guarantee. Always evaluate your financial situation and requirements before proceeding with the application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit longterm loan or guarantee online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your longterm loan or guarantee and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my longterm loan or guarantee in Gmail?

Create your eSignature using pdfFiller and then eSign your longterm loan or guarantee immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete longterm loan or guarantee on an Android device?

Use the pdfFiller mobile app to complete your longterm loan or guarantee on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is longterm loan or guarantee?

A longterm loan or guarantee is a financial instrument where funds are borrowed for an extended period of time, usually more than one year, with an agreement to repay the principal amount and interest over the term.

Who is required to file longterm loan or guarantee?

Businesses, organizations, or individuals who have taken a longterm loan or provided a guarantee are required to file the necessary documentation.

How to fill out longterm loan or guarantee?

The longterm loan or guarantee form typically requires information such as the amount borrowed or guaranteed, the terms of repayment, any collateral provided, and contact information for both parties involved.

What is the purpose of longterm loan or guarantee?

The purpose of a longterm loan or guarantee is to provide financial support for projects, investments, or activities that require funding over an extended period of time.

What information must be reported on longterm loan or guarantee?

Information such as the amount borrowed or guaranteed, repayment terms, collateral details, and contact information for the involved parties must be reported on the longterm loan or guarantee form.

Fill out your longterm loan or guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Longterm Loan Or Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.