Get the free SCHEDULE C Tobacco Wholesale Dealer Supplier Product List

Show details

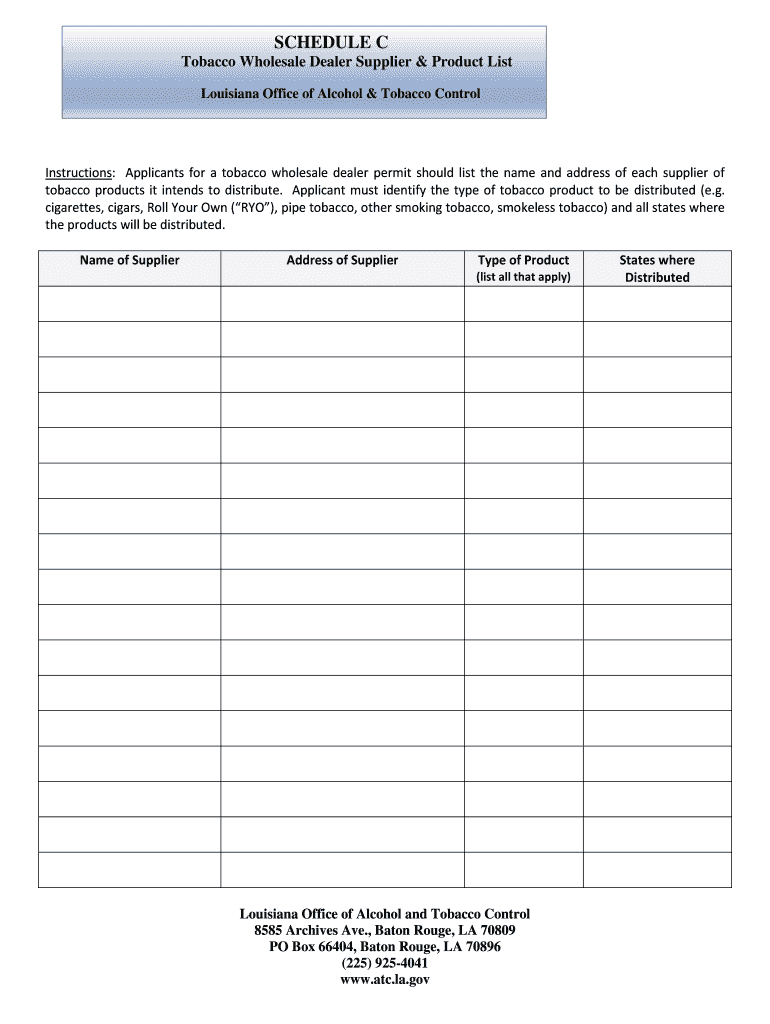

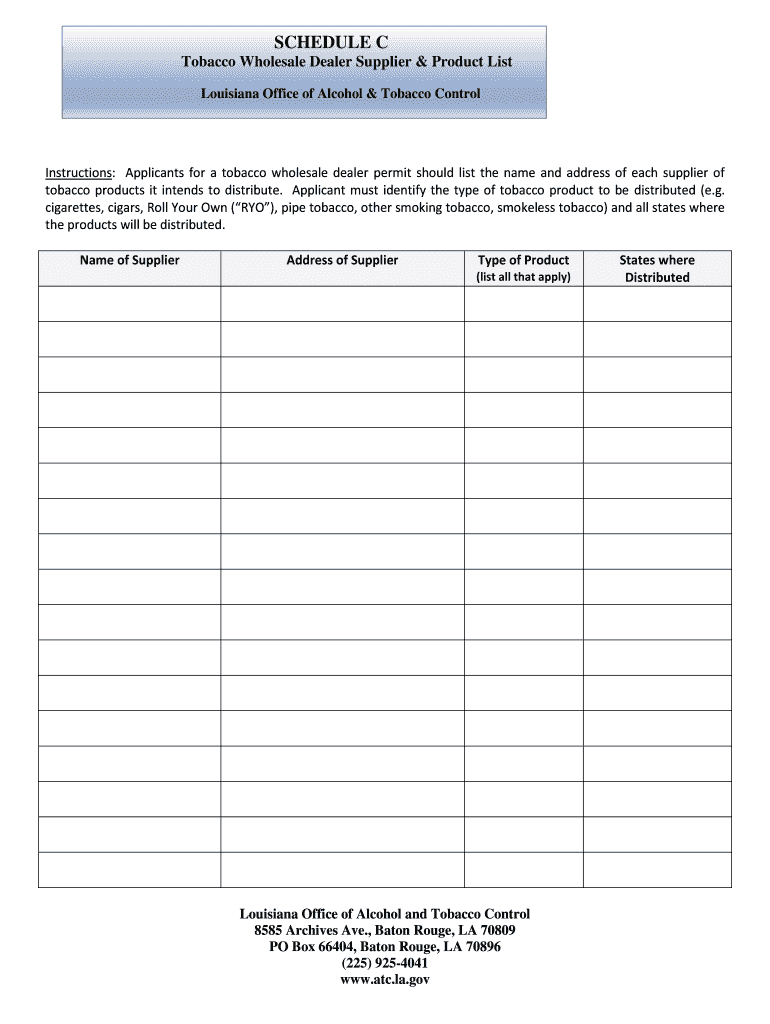

SCHEDULE C Tobacco Wholesale Dealer Supplier & Product List Louisiana Office of Alcohol & Tobacco Control, Commissioner Instructions: Applicants for a tobacco wholesale dealer permit should list the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule c tobacco wholesale

Edit your schedule c tobacco wholesale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c tobacco wholesale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule c tobacco wholesale online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule c tobacco wholesale. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c tobacco wholesale

How to fill out Schedule C tobacco wholesale?

01

Gather all necessary documents: Before filling out Schedule C for tobacco wholesale, you will need to ensure that you have all the relevant documents at hand. This may include your sales records, expenses, inventory details, and any other relevant financial information.

02

Enter your business information: Start by entering your business information at the top of Schedule C. This includes your business name, address, and employer identification number (EIN). If you don't have an EIN, you can use your Social Security number.

03

Report your gross receipts: Provide accurate information about your total gross receipts from your tobacco wholesale business. This includes all the income you have received from selling tobacco products during the tax year. Ensure that you have proper documentation to support these figures.

04

Deduct your cost of goods sold: Calculate and report your cost of goods sold (COGS) for your tobacco wholesale business. This includes the costs directly associated with obtaining and producing the tobacco products you sell. It may involve factors such as the purchase price, shipping costs, and any other expenses directly related to the cost of the products.

05

Calculate your gross profit: Subtract your COGS from your gross receipts to determine your gross profit. This figure represents the amount you have earned before deducting any other expenses.

06

Report your business expenses: You can deduct various business expenses related to your tobacco wholesale operation. These may include costs for rent, utilities, advertising, transportation, insurance, and any other expenses necessary for running your business. Make sure to keep accurate records and supporting documents for each expense.

07

Determine your net profit or loss: By subtracting your total business expenses from your gross profit, you will arrive at your net profit or loss. If your expenses exceed your gross profit, you may have a net loss, which can be used to offset other income on your tax return.

Who needs schedule C tobacco wholesale?

01

Individuals engaged in tobacco wholesale: Any individual who operates a business involved in the wholesale of tobacco products will typically need to report their income and expenses on Schedule C. This could include wholesalers of cigarettes, cigars, tobacco pipes, vaping products, and other tobacco-related items.

02

Self-employed individuals in the tobacco industry: If you are self-employed and derive most of your income from the tobacco wholesale business, you will likely need to file Schedule C. This applies to sole proprietors, single-member LLCs, and other entities where the individual is personally responsible for the business's income and expenses.

03

Those meeting certain income thresholds: The requirement to file Schedule C for tobacco wholesale may vary depending on your total income and filing status. Generally, if your gross receipts from the tobacco wholesale business exceed $400, you will need to file Schedule C along with your individual tax return.

Remember, it is always recommended to consult with a tax professional or use tax preparation software to ensure accurate completion of your Schedule C for tobacco wholesale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my schedule c tobacco wholesale directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your schedule c tobacco wholesale and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find schedule c tobacco wholesale?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific schedule c tobacco wholesale and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in schedule c tobacco wholesale?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your schedule c tobacco wholesale to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is schedule c tobacco wholesale?

Schedule C for tobacco wholesale is a form used to report income and expenses related to wholesale tobacco business.

Who is required to file schedule c tobacco wholesale?

Individuals or businesses involved in wholesale of tobacco products are required to file schedule C for tobacco wholesale.

How to fill out schedule c tobacco wholesale?

To fill out schedule C for tobacco wholesale, you need to report your income and expenses related to wholesale of tobacco products.

What is the purpose of schedule c tobacco wholesale?

The purpose of schedule C for tobacco wholesale is to calculate the profit or loss from wholesale tobacco business.

What information must be reported on schedule c tobacco wholesale?

Income, expenses, and other financial details related to wholesale of tobacco products must be reported on schedule C for tobacco wholesale.

Fill out your schedule c tobacco wholesale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule C Tobacco Wholesale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.