Get the free MORTGAGE BROKER SURETY BOND This SURETY BOND is given by the Principal: Company Name...

Show details

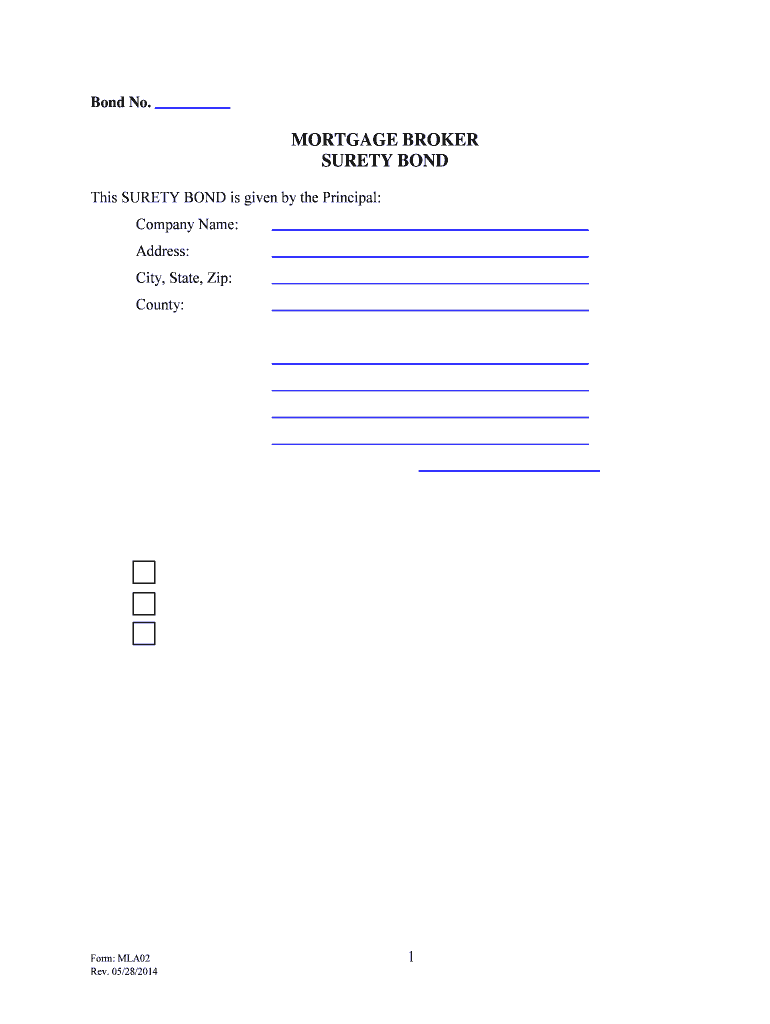

Bond No. MORTGAGE BROKER SURETY BOND This SURETY BOND is given by the Principal: Company Name: Address: City, State, Zip: County:. The Surety is: Company Name: Address: City, State, Zip: County:,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage broker surety bond

Edit your mortgage broker surety bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage broker surety bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage broker surety bond online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage broker surety bond. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage broker surety bond

How to Fill Out Mortgage Broker Surety Bond?

01

Determine the bond requirement: The first step in filling out a mortgage broker surety bond is to understand the specific bond requirement for your state or jurisdiction. Each state may have different bond amounts and regulations, so it is important to consult the relevant authority or licensing agency to determine the exact bond requirement.

02

Find a reputable surety bond provider: Once you know the bond requirement, you will need to find a reputable surety bond provider. It is essential to work with a reliable company that specializes in surety bonds for mortgage brokers. Research different providers, compare quotes, and ensure that the chosen company is licensed and accredited.

03

Gather necessary documentation: To fill out the bond application accurately, you will need to gather the necessary documentation. This typically includes personal information such as your name, contact details, business address, and license number. You may also need to provide financial statements, proof of insurance, and copies of your mortgage broker license or registration.

04

Complete the application form: Once you have all the required documentation, you can proceed to complete the application form provided by the surety bond provider. Be sure to fill in each section accurately and double-check for any errors or omissions. Providing incorrect information can lead to delays or even rejection of your bond application.

05

Pay the bond premium: After completing the application form, you will need to pay the bond premium. The premium is usually a percentage of the bond amount, determined by factors such as your creditworthiness and the bond provider's assessment of risk. Make sure to review the terms and conditions of the bond agreement before making the payment.

06

Submit the application: Once you have paid the bond premium, submit the application and all relevant documents to the surety bond provider. They will review your application, conduct any necessary underwriting procedures, and issue the bond if approved. The turnaround time for approval can vary depending on the provider and the complexity of your application.

Who Needs Mortgage Broker Surety Bond?

Mortgage brokers are professionals who connect borrowers with lenders and assist in facilitating mortgage transactions. In many states, mortgage brokers are required to obtain a mortgage broker surety bond as a regulatory and consumer protection measure.

The bond provides financial protection to the state and consumers in case of fraudulent activities, violations of mortgage industry regulations, or failure to fulfill contractual obligations. It ensures that mortgage brokers operate ethically and within the legal framework, thereby safeguarding the interests of borrowers and lenders.

Therefore, anyone operating as a mortgage broker, either as an individual or a company, will typically need to obtain a mortgage broker surety bond to meet the licensing or registration requirements imposed by their state or jurisdiction.

Remember, it is essential to consult the specific regulations and bond requirements of your state or jurisdiction to ensure compliance and provide adequate protection to both yourself and your clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage broker surety bond for eSignature?

When you're ready to share your mortgage broker surety bond, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in mortgage broker surety bond without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit mortgage broker surety bond and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out mortgage broker surety bond on an Android device?

Use the pdfFiller app for Android to finish your mortgage broker surety bond. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is mortgage broker surety bond?

A mortgage broker surety bond is a type of bond that ensures mortgage brokers comply with state regulations and protects the consumers from any fraudulent activities.

Who is required to file mortgage broker surety bond?

Mortgage brokers are required to file a mortgage broker surety bond as a part of the licensing process in most states.

How to fill out mortgage broker surety bond?

To fill out a mortgage broker surety bond, the broker must contact a surety bond company, submit an application, and provide necessary financial information to determine the bond amount.

What is the purpose of mortgage broker surety bond?

The purpose of a mortgage broker surety bond is to guarantee that the broker will follow state regulations and protect their clients from financial harm.

What information must be reported on mortgage broker surety bond?

The mortgage broker surety bond typically includes information such as the name of the principal (broker), the bond amount, the name of the obligee (state regulatory agency), and the effective date of the bond.

Fill out your mortgage broker surety bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Broker Surety Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.