Get the free DEBT-ELIMINATION CALENDAR

Show details

DETERMINATION CALENDAR

Credit

CardDepart.

StoreDentistAuto

Coeducation

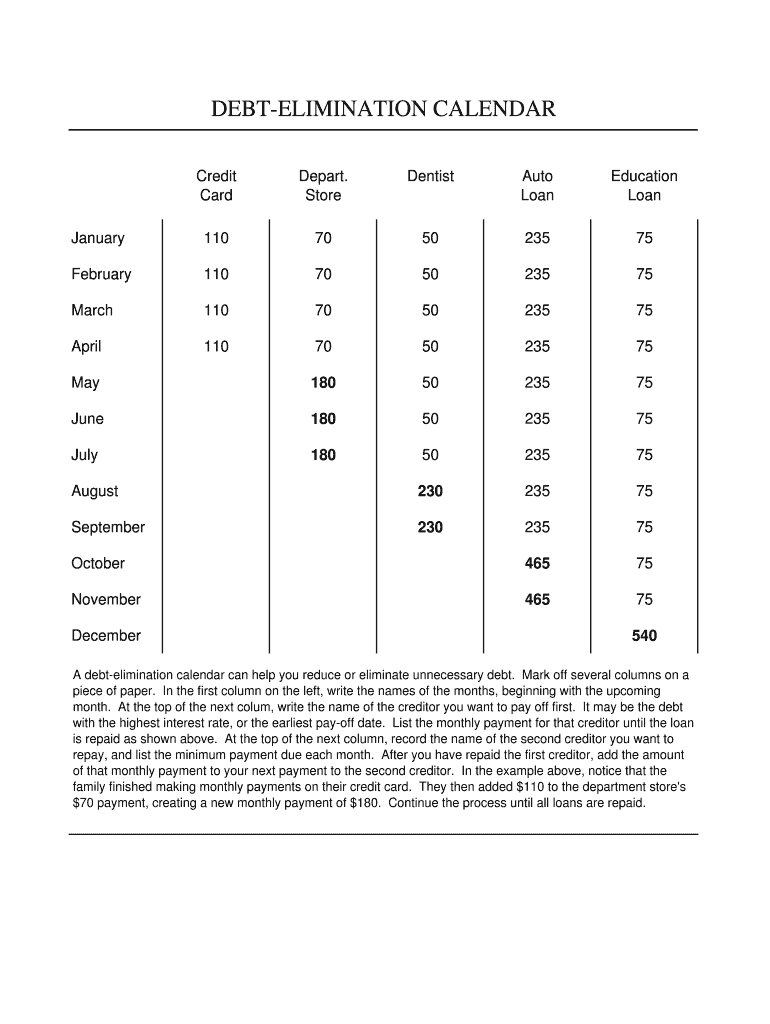

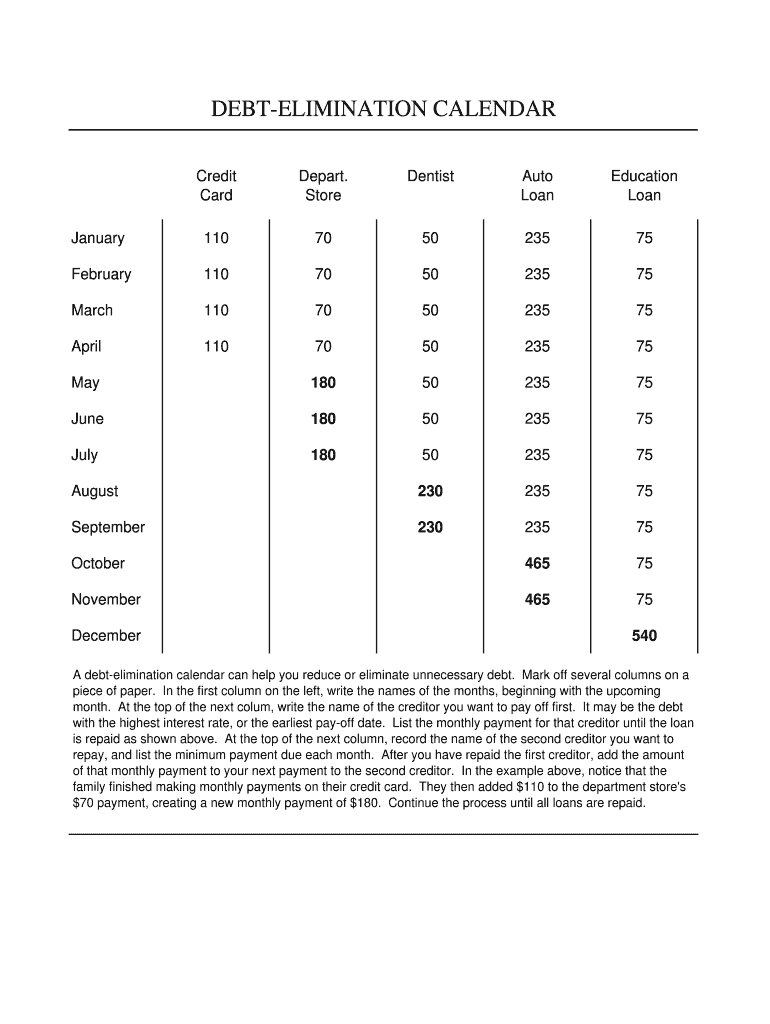

LoanJanuary110705023575February110705023575March110705023575April110705023575May1805023575June1805023575July1805023575August23023575September23023575October46575November46575December540A

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt-elimination calendar

Edit your debt-elimination calendar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt-elimination calendar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debt-elimination calendar online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit debt-elimination calendar. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt-elimination calendar

How to fill out a debt-elimination calendar:

01

Start by gathering all your debt-related information: Make a list of all your debts, including the creditor's name, the outstanding balance, the minimum monthly payment, and the interest rate.

02

Determine your budget: Evaluate your monthly income and expenses to determine how much money you can allocate towards debt repayment each month. This will help you identify how much extra you can contribute towards paying off your debts.

03

Prioritize your debts: Consider organizing your debts based on either the highest interest rate or the smallest balance. Both methods have their advantages, so choose the approach that aligns with your financial goals. By focusing on one debt at a time, you can make progress and stay motivated.

04

Fill out the calendar: Use a calendar or a debt-elimination tool to visually map out your debt repayment plan. Assign a specific payment amount to each debt based on your budget and the prioritization method you've chosen.

05

Track your progress: Regularly update your calendar as you make payments and track your progress. This will help you visualize how each payment reduces your debt and keeps you motivated throughout the process.

Who needs a debt-elimination calendar:

01

Individuals with multiple debts: A debt-elimination calendar can be beneficial for people who have numerous debts to manage. It helps them stay organized and focused on paying off their debts systematically.

02

Those aiming for financial freedom: If your goal is to become debt-free and achieve financial freedom, a debt-elimination calendar can provide a structured plan to reach your objective. It keeps you accountable and helps you stay on track.

03

People looking to save on interest: By prioritizing your debts based on interest rates, you can focus on paying off high-interest debts first. This helps you save money over time as you reduce the amount of interest that accrues.

Remember, a debt-elimination calendar is not a one-size-fits-all solution, but rather a tool to help you manage your debt effectively. Customize it to fit your financial situation and goals, and consult with a financial advisor if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify debt-elimination calendar without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your debt-elimination calendar into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit debt-elimination calendar straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing debt-elimination calendar, you can start right away.

How do I fill out the debt-elimination calendar form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign debt-elimination calendar and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is debt-elimination calendar?

Debt-elimination calendar is a tool used to track and prioritize debt payments in order to become debt-free.

Who is required to file debt-elimination calendar?

Individuals or households who have debts and are working towards paying them off may use a debt-elimination calendar.

How to fill out debt-elimination calendar?

You can fill out a debt-elimination calendar by listing all your debts, including the amount owed, interest rate, and minimum monthly payment. Then, you can prioritize your debts based on the debt-elimination strategy you choose to follow.

What is the purpose of debt-elimination calendar?

The purpose of a debt-elimination calendar is to help individuals or households create a structured plan to pay off their debts in a systematic way.

What information must be reported on debt-elimination calendar?

You must report details of all your debts including the name of the creditor, total amount owed, interest rate, minimum monthly payment, and any extra payments you plan to make towards each debt.

Fill out your debt-elimination calendar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt-Elimination Calendar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.