Get the free Home Mortgage Foreclosures in Maine - Pine Tree Legal - ptla

Show details

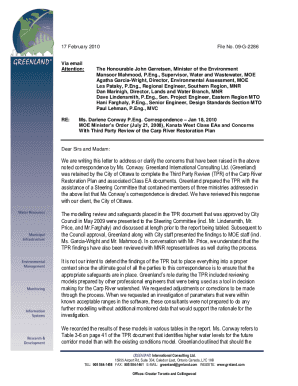

Home Mortgage Foreclosures in Maine Find more pastored legal information at www.ptla.org Important Note: This is very general information about home mortgage and foreclosure rules in Maine. It is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home mortgage foreclosures in

Edit your home mortgage foreclosures in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home mortgage foreclosures in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home mortgage foreclosures in online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit home mortgage foreclosures in. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home mortgage foreclosures in

How to fill out home mortgage foreclosures in:

01

Start by gathering all necessary documents related to your mortgage, including the loan agreement, payment history, and any correspondence from your lender.

02

Review the foreclosure process and requirements outlined in your loan agreement or state laws. This will help you understand the steps involved and any specific forms or deadlines you need to comply with.

03

Contact your lender or loan servicer to notify them about your intention to fill out home mortgage foreclosures. They will provide you with the appropriate forms or direct you to where you can find them.

04

Carefully fill out all the required information on the foreclosure forms. This may include details about your loan, the reason for the foreclosure, and your current financial situation.

05

Double-check all the information you have provided to ensure accuracy. Mistakes or missing information can delay the process or even lead to rejection.

06

Attach any supporting documents that may be required, such as proof of income, financial statements, or hardship letters. These documents can strengthen your case and provide a comprehensive view of your financial situation.

07

Once you have completed the forms and assembled all the necessary documents, submit them to your lender or the appropriate foreclosure department. Make sure to follow any instructions regarding submission methods or deadlines.

08

Keep copies of all the documents you submit for your records. This will help you keep track of the foreclosure process and may be useful if any discrepancies or disputes arise.

Who needs home mortgage foreclosures in:

01

Homeowners who are facing financial hardship and are unable to make their mortgage payments may need to consider home mortgage foreclosures. This option allows them to address their financial situation and potentially avoid more severe consequences such as eviction.

02

Lenders or loan servicers also need home mortgage foreclosures when borrowers default on their mortgage payments. They initiate the foreclosure process to recover the outstanding loan balance and regain possession of the property.

03

Legal professionals specializing in real estate law or foreclosure defense may also need information about home mortgage foreclosures. They help homeowners navigate the process, understand their rights, and potentially find alternatives to foreclosure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit home mortgage foreclosures in from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your home mortgage foreclosures in into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find home mortgage foreclosures in?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the home mortgage foreclosures in in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit home mortgage foreclosures in on an iOS device?

Create, modify, and share home mortgage foreclosures in using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is home mortgage foreclosures in?

Home mortgage foreclosure is the legal process by which a lender takes possession of a property when the borrower fails to make their mortgage payments.

Who is required to file home mortgage foreclosures in?

The lender or the entity that holds the mortgage is required to file home mortgage foreclosures.

How to fill out home mortgage foreclosures in?

Home mortgage foreclosures must be filled out according to the specific requirements of the state or jurisdiction in which the property is located.

What is the purpose of home mortgage foreclosures in?

The purpose of home mortgage foreclosures is to protect the lender's interest in the property and recover the amount owed on the mortgage.

What information must be reported on home mortgage foreclosures in?

The information required on home mortgage foreclosures typically includes details about the property, the borrower, the amount owed, and the reason for the foreclosure.

Fill out your home mortgage foreclosures in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Mortgage Foreclosures In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.