Get the free Business Loan Application - Michigan State University - msufcu

Show details

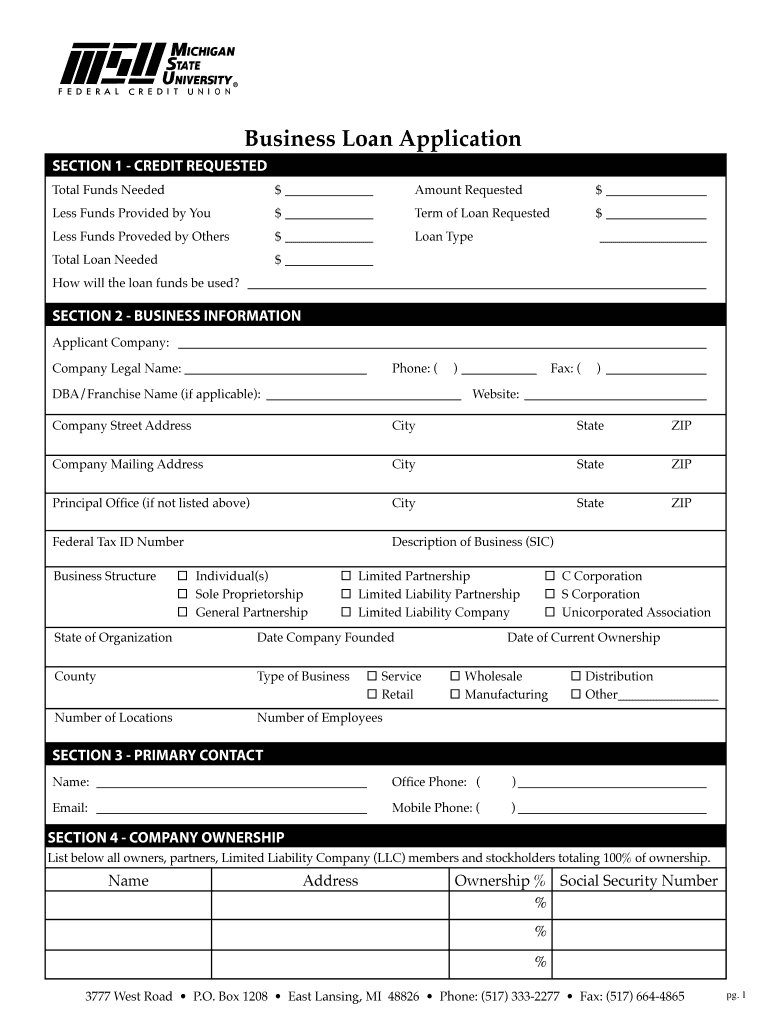

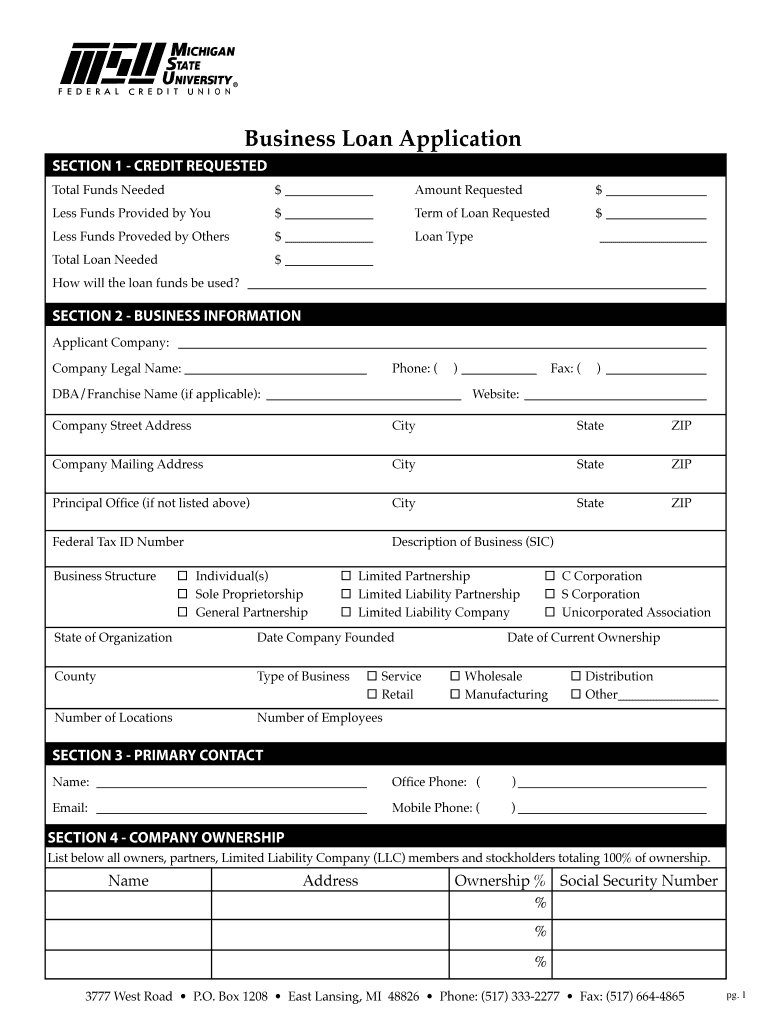

Business Loan Application SECTION 1 CREDIT REQUESTED Total Funds Needed $ Amount Requested $ Fewer Funds Provided by You $ Term of Loan Requested $ Fewer Funds Provided by Others $ Loan Type Total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application

Edit your business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business loan application online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business loan application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application

How to Fill Out a Business Loan Application:

01

Start by gathering all the necessary documents and information. This may include your business plan, financial statements, tax returns, bank statements, and any other relevant documentation.

02

Carefully review the application form and make sure you understand each section. Pay attention to any specific requirements or instructions provided by the lender.

03

Begin by providing your personal and business information. This typically includes your name, contact details, social security number, company name, address, and legal structure.

04

Provide details about your business, such as its industry, years in operation, number of employees, and ownership structure.

05

Describe the purpose of the loan and provide information about the amount you are seeking, the desired repayment term, and if applicable, the specific collateral you are offering.

06

Present your financial statements, which may include income statements, balance sheets, and cash flow statements. Ensure that these documents are accurately completed and up to date.

07

Include any additional information that can support the loan application, such as market analysis, growth projections, or your business's unique selling point.

08

Double-check and proofread your completed application to minimize errors and improve its overall professionalism.

09

Submit the application form along with the required supporting documents according to the lender's instructions.

Who Needs a Business Loan Application?

01

Entrepreneurs and small business owners looking for funding to start a new business or expand an existing one often require a business loan application.

02

Established businesses that need extra capital for purchasing inventory, upgrading equipment, or covering operational expenses may also need to fill out a business loan application.

03

Companies considering mergers, acquisitions, or other strategic initiatives may seek a business loan application to secure the necessary funds for these ventures.

04

Individuals who are looking to acquire a small business through a loan or invest in an established company might also need to complete a business loan application.

05

Startups that require initial funding to turn their innovative ideas into tangible businesses may require a business loan application to access the necessary capital.

06

Businesses facing financial hardships or temporary cash flow issues may need a business loan application to alleviate their financial stress and stabilize their operations.

07

Established businesses seeking to refinance existing debts or obtaining better loan terms may need to fill out a business loan application as part of the refinancing process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business loan application online?

Completing and signing business loan application online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit business loan application in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing business loan application and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out business loan application using my mobile device?

Use the pdfFiller mobile app to complete and sign business loan application on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is business loan application?

A business loan application is a formal request made by a business owner or representative to a financial institution for funding to support business operations or growth.

Who is required to file business loan application?

Any business owner or representative seeking financial assistance for their business is required to file a business loan application.

How to fill out business loan application?

To fill out a business loan application, you will typically need to provide information about your business, financial statements, credit history, and how the loan will be used.

What is the purpose of business loan application?

The purpose of a business loan application is to request funding to help a business grow, expand, or cover operational expenses.

What information must be reported on business loan application?

Information such as business financials, business plan, credit history, collateral, and loan amount requested must be reported on a business loan application.

Fill out your business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.