Get the free Customer Small Business Loan Request - ubtcom

Show details

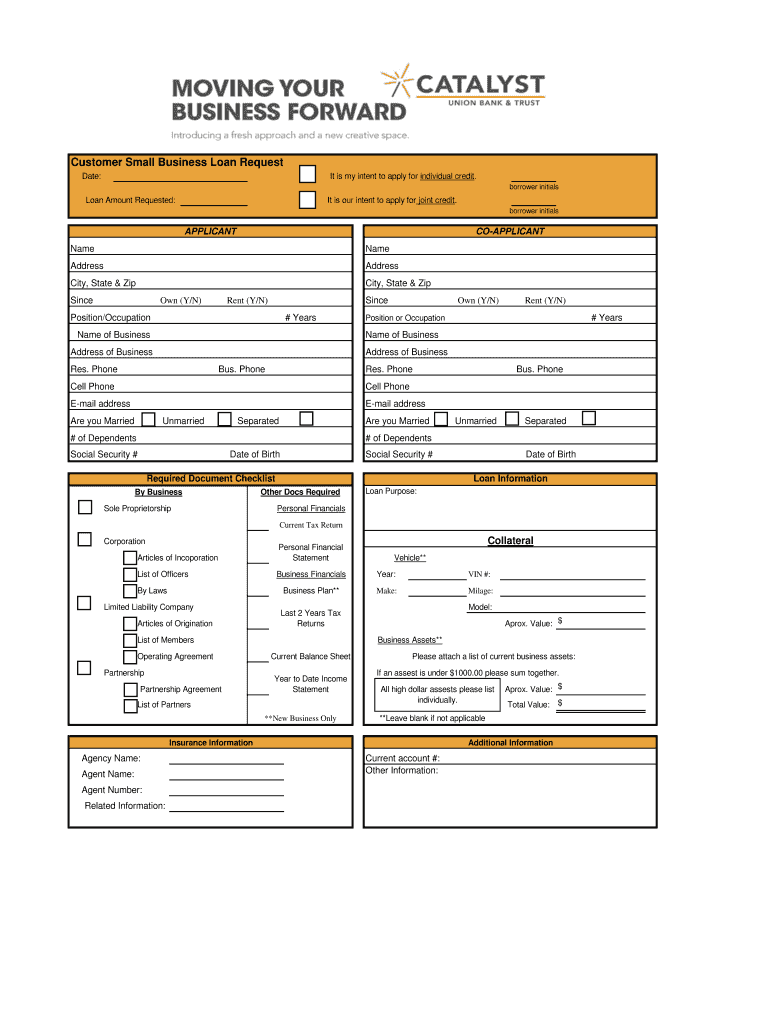

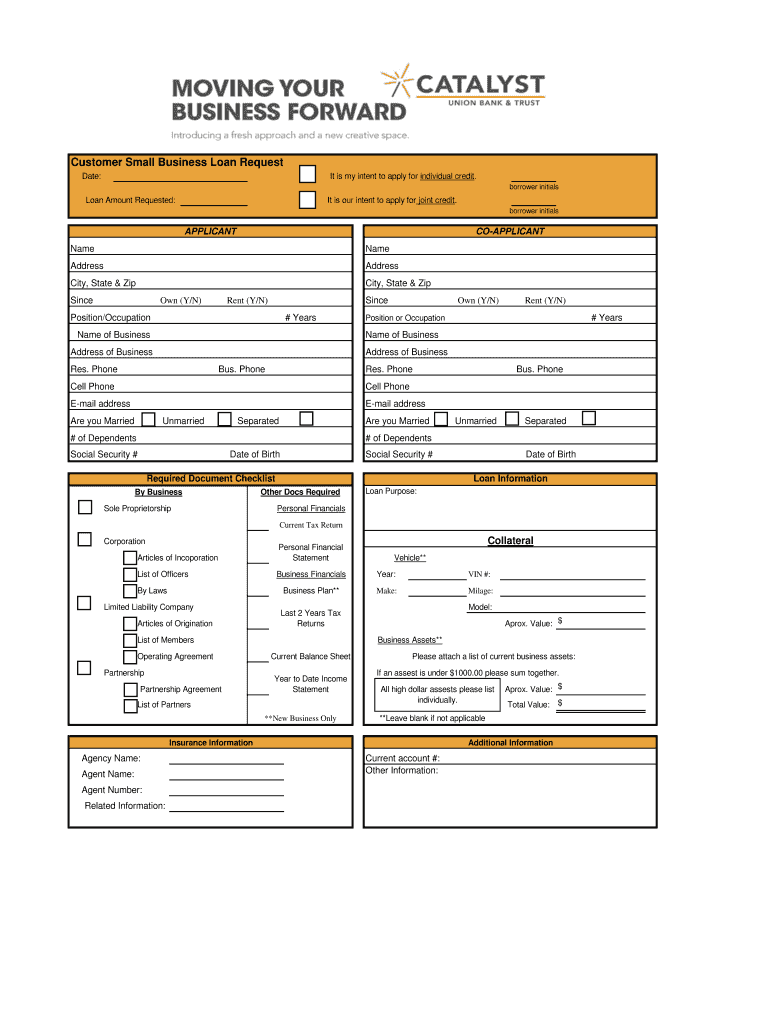

Customer Small Business Loan Request Date: It is my intent to apply for individual credit. Borrower initials Loan Amount Requested: It is our intent to apply for joint credit. Borrower initials APPLICANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer small business loan

Edit your customer small business loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer small business loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer small business loan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customer small business loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer small business loan

How to fill out a customer small business loan:

01

Research and prepare: Start by researching different lenders or financial institutions that offer small business loans. Look into their eligibility criteria, interest rates, terms, and conditions. Understand what documents and information will be required during the application process.

02

Gather required documents: Collect all the necessary documents and information that will need to be submitted with the loan application. This may include business financial statements, tax returns, bank statements, business plan, personal identification documents, proof of assets or collateral, and any other relevant paperwork.

03

Understand the loan purpose: Clearly define the purpose of the loan. Whether it is for purchasing equipment, expanding the business, hiring employees, or improving cash flow, having a clear understanding of how the funds will be utilized is essential.

04

Complete the loan application: Fill out the loan application form accurately and provide all requested information. Ensure that you thoroughly read and understand all the terms and conditions mentioned in the application.

05

Prepare a business plan: Many lenders ask for a detailed business plan as part of the loan application. Outline your business objectives, market analysis, target audience, sales strategy, and financial projections. This will demonstrate to the lender that you have a solid plan for using the loan effectively.

06

Provide financial information: Prepare financial statements, including income statements, balance sheets, and cash flow statements. These documents will give lenders an overview of your business's financial health.

07

Explain collateral or guarantors (if applicable): If you are providing collateral or a personal guarantor for the loan, make sure to provide all the necessary information and documentation regarding the collateral's value or the guarantor's financial situation.

08

Review and submit: Before submitting the loan application, carefully review all the information provided. Make sure all documents are properly filled out, signed, and attached. Check for any errors or missing information.

Who needs a customer small business loan?

01

Startups: Entrepreneurs or small business owners who have just started their ventures often require a customer small business loan to cover initial expenses, purchase equipment, or support cash flow until the business becomes profitable.

02

Existing businesses: Established businesses may require a small business loan to fund expansion plans, purchase additional inventory or equipment, hire new employees, implement marketing strategies, or overcome temporary financial setbacks.

03

Businesses with unpredictable cash flow: Some businesses have seasonal fluctuations or irregular revenue streams. In such cases, a small business loan can provide financial stability during slower periods and help cover operational expenses.

04

Businesses experiencing growth opportunities: When a business receives a contract or order that exceeds its current financial capacity, a small business loan can bridge the financial gap, allowing the business to fulfill the order and take advantage of growth opportunities.

05

Businesses looking to consolidate debt: If a business has multiple outstanding loans or high-interest debts, a small business loan can be used to consolidate and pay off those debts, leading to improved cash flow and potentially lower interest rates.

In summary, anyone starting a new business, looking to expand, dealing with irregular cash flow, experiencing growth opportunities, or wanting to consolidate debt could benefit from a customer small business loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my customer small business loan directly from Gmail?

customer small business loan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get customer small business loan?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific customer small business loan and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the customer small business loan in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your customer small business loan in seconds.

What is customer small business loan?

A customer small business loan is a type of loan specifically designed for small businesses to help them with their financial needs.

Who is required to file customer small business loan?

Small business owners or entrepreneurs who are seeking financial assistance through a loan for their small business are required to file for a customer small business loan.

How to fill out customer small business loan?

To fill out a customer small business loan, you will need to provide information about your business, such as financial statements, business plan, and any collateral you may have.

What is the purpose of customer small business loan?

The purpose of a customer small business loan is to provide financial assistance to small businesses to help them grow or cover expenses.

What information must be reported on customer small business loan?

Information such as business financials, credit score, business plan, and collateral must be reported on a customer small business loan application.

Fill out your customer small business loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Small Business Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.