Get the free Allowance for Impairment

Show details

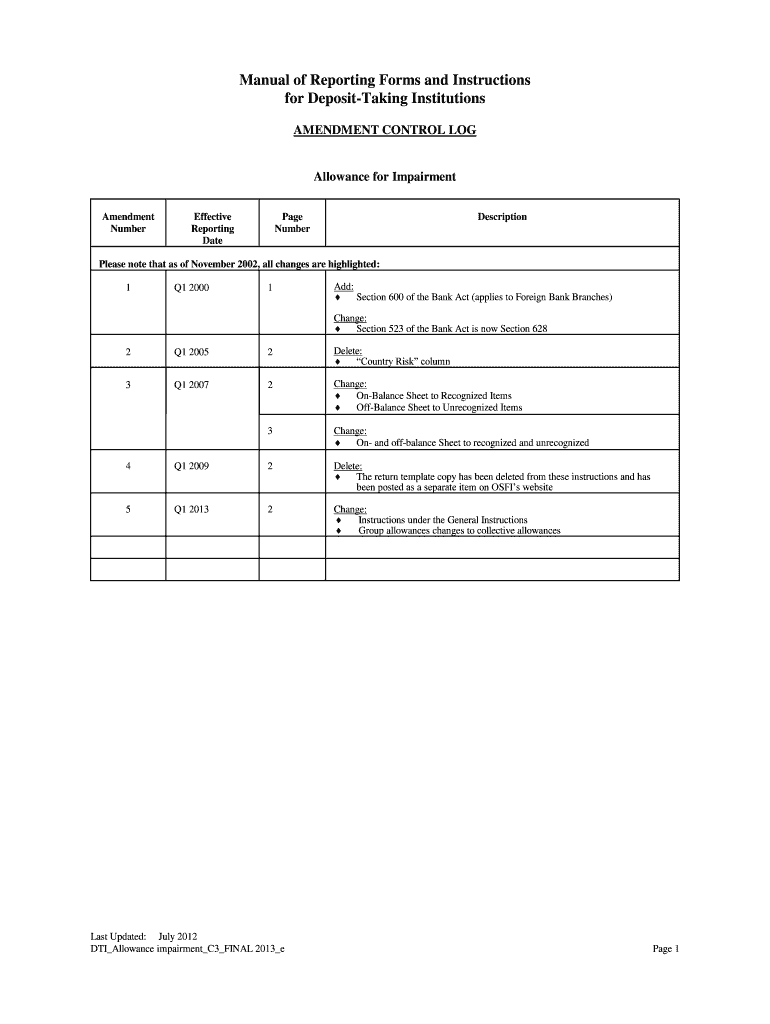

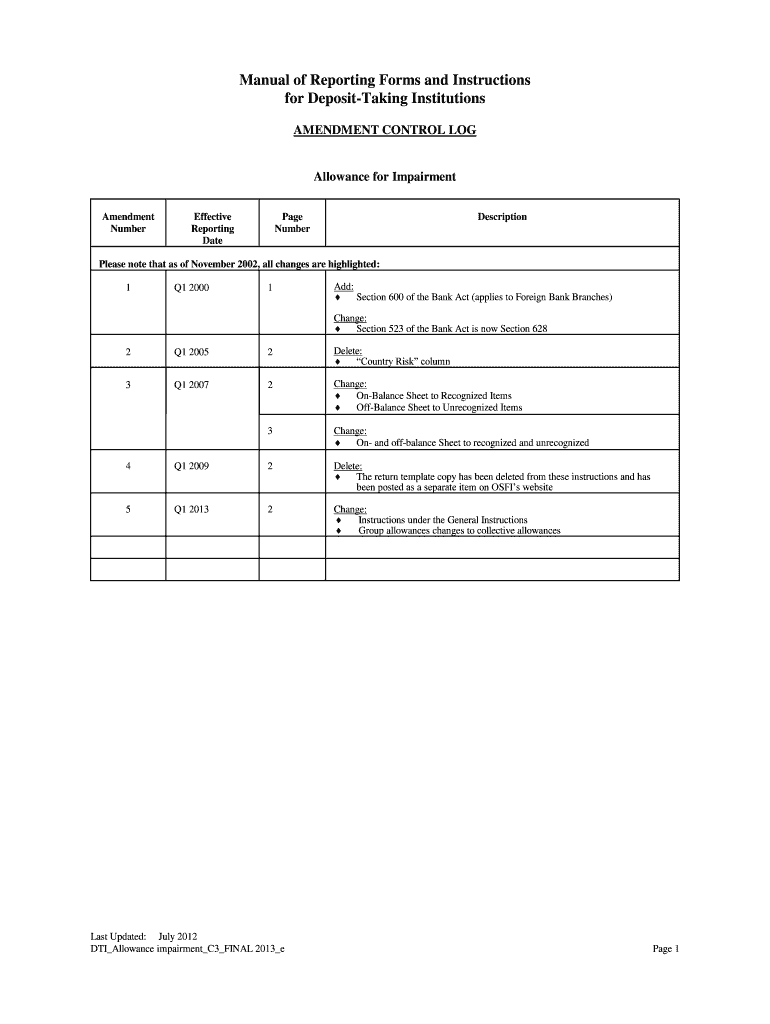

Manual of Reporting Forms and Instructions for Depositing Institutions AMENDMENT CONTROL LOG Allowance for Impairment Amendment Number Effective Reporting Date Page Number Description Please note

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign allowance for impairment

Edit your allowance for impairment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your allowance for impairment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit allowance for impairment online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit allowance for impairment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out allowance for impairment

01

To fill out the allowance for impairment, start by gathering all relevant financial information and documentation related to the impaired asset or investment. This includes any balance sheets, income statements, and notes related to the specific asset.

02

Next, assess the impairment of the asset by comparing its current fair value to its original cost or book value. This will help determine if there is a potential impairment and the extent of it.

03

Calculate the impairment loss by subtracting the current fair value of the asset from its original cost or book value. This loss should be recorded in the financial statements to reflect the decrease in value.

04

Determine the allowance for impairment by reviewing any specific accounting policies or regulations applicable to your industry or country. Depending on the requirements, you may need to apply a specific percentage or factor to the impairment loss as a provision for potential losses.

05

Document the calculation and decision-making process for the allowance for impairment, ensuring transparency and compliance with accounting standards. This includes maintaining proper records and supporting documents for audit purposes.

Who needs allowance for impairment?

01

Companies or organizations that follow generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) are required to calculate and maintain an allowance for impairment.

02

Banks and financial institutions often need to have a specific allowance for impairment as part of their risk management and regulatory compliance. The allowance helps account for potential credit losses in their loan portfolios.

03

Investors or individuals who hold impaired assets for investment purposes may also need to calculate and track an allowance for impairment to reflect the decrease in value and potential losses.

04

Government entities may require an allowance for impairment for their public assets, such as infrastructure or public utilities, to ensure accurate financial reporting and proper budgeting.

Overall, the allowance for impairment is necessary for any entity or individual that wants to accurately reflect the decrease in value of assets and properly account for potential losses. It helps provide a more transparent financial picture and maintain compliance with accounting standards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my allowance for impairment in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your allowance for impairment and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit allowance for impairment from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including allowance for impairment, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find allowance for impairment?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the allowance for impairment. Open it immediately and start altering it with sophisticated capabilities.

What is allowance for impairment?

Allowance for impairment is a contra-asset account on a company's balance sheet that reduces the book value of an asset. It is used to reflect the estimated amount of losses that a company expects to incur from customers who will not be able to pay what they owe.

Who is required to file allowance for impairment?

Companies that provide credit to customers or hold investments that may not be fully recovered are required to file allowance for impairment.

How to fill out allowance for impairment?

Allowance for impairment can be filled out by estimating the potential losses from uncollectible debts or investments and recording that amount as a contra-asset on the balance sheet.

What is the purpose of allowance for impairment?

The purpose of allowance for impairment is to accurately reflect the potential losses that a company may incur from customers who are unable to pay their debts or investments.

What information must be reported on allowance for impairment?

Information that must be reported on allowance for impairment includes the estimated amount of losses, the type of assets or investments being assessed, and the rationale for the estimates made.

Fill out your allowance for impairment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Allowance For Impairment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.