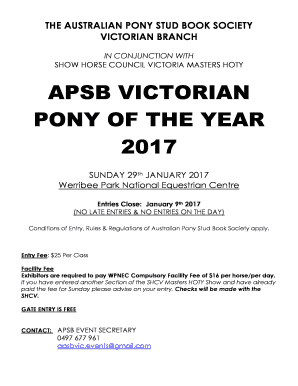

CO Pueblo County Marijuana Excise Tax Return 2016 free printable template

Show details

AKT Jan 2016 PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN Pueblo County Budget & Finance Office 215 W 10th Street, Ste 217 Pueblo, CO 81003 Taxes co.pueblo.co.us Business Name: State Tax ID: Unprocessed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO Pueblo County Marijuana Excise Tax

Edit your CO Pueblo County Marijuana Excise Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO Pueblo County Marijuana Excise Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO Pueblo County Marijuana Excise Tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CO Pueblo County Marijuana Excise Tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO Pueblo County Marijuana Excise Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO Pueblo County Marijuana Excise Tax

How to fill out CO Pueblo County Marijuana Excise Tax Return

01

Gather all necessary financial records related to marijuana sales and excise tax calculations.

02

Download the CO Pueblo County Marijuana Excise Tax Return form from the official Pueblo County website.

03

Fill in the business information section, including the business name, address, and tax ID number.

04

Report the total amount of marijuana sold during the reporting period.

05

Calculate the excise tax based on the current rate applied to the total sales.

06

Complete any additional sections for deductions or adjustments if applicable.

07

Double-check all calculations to ensure accuracy.

08

Sign and date the form to verify that the information provided is correct.

09

Submit the completed form by the due date, either electronically or via mail along with any payment owed.

Who needs CO Pueblo County Marijuana Excise Tax Return?

01

Every licensed marijuana business operating in Pueblo County that sells marijuana products and is subject to the excise tax.

Fill

form

: Try Risk Free

People Also Ask about

Where does tax money go in Colorado?

The state budget provides funding for state services, including health care, human services, higher education, state roads, and state courts and prisons.

What is the marijuana tax in Pueblo Colorado?

Legal obligations of Sales Tax - original 3.5% is used to underwrite salaries of the county employees who work on marijuana business and to pay any administrative costs incurred by this county department. A portion of these taxes are shared with the City of Pueblo for dispensaries located within the city limits.

How does marijuana generate tax revenue?

This includes California's cannabis excise tax, which generated $108 million; and $113.6 million in sales tax revenue from cannabis businesses. The total reported cannabis tax revenues do not include outstanding returns. They also do not include locally imposed taxes collected by cities and counties.

Where does the tax money from marijuana go in Colorado?

Revenue in the Marijuana Tax Cash Fund is required to be used for health care, health education, substance abuse prevention and treatment programs, and law enforcement.

How does the state of Colorado use marijuana tax revenue?

Public education in Colorado receives marijuana tax revenue through the state's Building Excellent Schools Today (BEST) fund — a matching grant program — and the Marijuana Tax Cash Fund. Local governments can distribute their own marijuana tax revenue to schools, as well.

What is the excise tax on retail marijuana in Colorado?

A 15% state excise tax is imposed on the first sale or transfer from a retail marijuana cultivation facility to a retail marijuana store or retail marijuana product manufacturing facility. The industry may refer to retail marijuana as recreational or adult use marijuana. Medical marijuana is not subject to excise tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CO Pueblo County Marijuana Excise Tax without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your CO Pueblo County Marijuana Excise Tax into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get CO Pueblo County Marijuana Excise Tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CO Pueblo County Marijuana Excise Tax in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my CO Pueblo County Marijuana Excise Tax in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CO Pueblo County Marijuana Excise Tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is CO Pueblo County Marijuana Excise Tax Return?

The CO Pueblo County Marijuana Excise Tax Return is a document that marijuana businesses in Pueblo County, Colorado must file to report and pay the excise tax imposed on the cultivation of marijuana.

Who is required to file CO Pueblo County Marijuana Excise Tax Return?

Marijuana cultivators and businesses operating in Pueblo County that grow marijuana for sale are required to file the CO Pueblo County Marijuana Excise Tax Return.

How to fill out CO Pueblo County Marijuana Excise Tax Return?

To fill out the CO Pueblo County Marijuana Excise Tax Return, businesses need to provide information about their cultivation activities, calculate the excise tax owed based on the amount of marijuana produced, and submit the completed form along with payment by the due date.

What is the purpose of CO Pueblo County Marijuana Excise Tax Return?

The purpose of the CO Pueblo County Marijuana Excise Tax Return is to collect tax revenue from marijuana cultivation to fund local government services and initiatives regarding public health and safety.

What information must be reported on CO Pueblo County Marijuana Excise Tax Return?

The CO Pueblo County Marijuana Excise Tax Return must report information such as the total weight of marijuana cultivated, the corresponding excise tax calculation, and any deductions or exemptions applicable to the business.

Fill out your CO Pueblo County Marijuana Excise Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO Pueblo County Marijuana Excise Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.