CO Pueblo County Marijuana Excise Tax Return 2019 free printable template

Show details

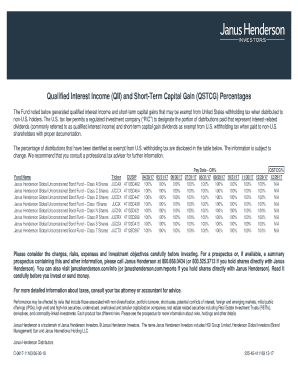

PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN Pueblo County Budget & Finance Office 215 W 10th Street, Ste 217 Pueblo, CO 81003 Taxes co.pueblo.co.us Business Name: State Tax ID: Unprocessed Retail Marijuana

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO Pueblo County Marijuana Excise Tax

Edit your CO Pueblo County Marijuana Excise Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO Pueblo County Marijuana Excise Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO Pueblo County Marijuana Excise Tax online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CO Pueblo County Marijuana Excise Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO Pueblo County Marijuana Excise Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO Pueblo County Marijuana Excise Tax

How to fill out CO Pueblo County Marijuana Excise Tax Return

01

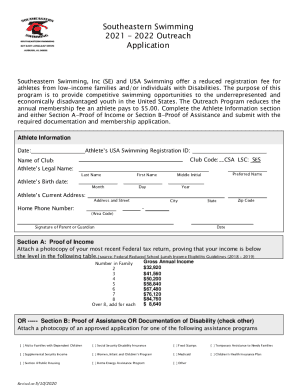

Obtain the CO Pueblo County Marijuana Excise Tax Return form from the appropriate governmental website or office.

02

Enter your business information, including name, address, and license number at the top of the form.

03

Report total sales of marijuana for the reporting period in the designated section.

04

Calculate the excise tax based on the reported sales using the applicable tax rate.

05

Complete any additional required fields, such as deductions or adjustments, if applicable.

06

Review the form for accuracy and ensure all necessary documentation is attached.

07

Submit the completed form along with payment for any owed taxes before the deadline.

Who needs CO Pueblo County Marijuana Excise Tax Return?

01

Any business that cultivates, sells, or distributes marijuana in Pueblo County, Colorado is required to file the CO Pueblo County Marijuana Excise Tax Return.

Fill

form

: Try Risk Free

People Also Ask about

What is the marijuana tax in Pueblo Colorado?

Legal obligations of Sales Tax - original 3.5% is used to underwrite salaries of the county employees who work on marijuana business and to pay any administrative costs incurred by this county department. A portion of these taxes are shared with the City of Pueblo for dispensaries located within the city limits.

What are the marijuana excise tax rules in Colorado?

A 15% state excise tax is imposed on the first sale or transfer from a retail marijuana cultivation facility to a retail marijuana store or retail marijuana product manufacturing facility. The industry may refer to retail marijuana as recreational or adult use marijuana.

What is the tax money on marijuana in Colorado?

The state collected a total of just over $325.1 million in marijuana taxes and business fees in 2022, DOR data shows, down about 23.3 percent from 2021, when nearly $423.5 million was collected.

Who has the highest marijuana tax?

For fiscal year 2022, California collected the most state cannabis tax revenue at $744.4 million, or $20 per capita. Cannabis taxes accounted for 0.3% of total state tax revenue (excluding local taxes). Washington state and Colorado had the highest per capita taxes for fiscal year 2022, at $67 and $61, respectively.

Is marijuana legal in Pueblo CO?

Must meet all applicable building and zoning regulations. Must not be detectable from outside by odor, sight or sound. NO ONE UNDER THE AGE OF 21 MAY HAVE ACCESS TO THE GROW. Marijuana may not be sold, gifted or exchanged to anyone living outside of the home.

What is the sales tax in Pueblo County Colorado?

What is the City sales and use tax rate? The sales and use tax rate is 3.7%. The total tax rate for Pueblo is 7.6%. The breakdown consists of 3.7% for the City tax, 2.9% for the state tax, and 1% for the county tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in CO Pueblo County Marijuana Excise Tax without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your CO Pueblo County Marijuana Excise Tax, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit CO Pueblo County Marijuana Excise Tax on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign CO Pueblo County Marijuana Excise Tax on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete CO Pueblo County Marijuana Excise Tax on an Android device?

Use the pdfFiller mobile app and complete your CO Pueblo County Marijuana Excise Tax and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CO Pueblo County Marijuana Excise Tax Return?

The CO Pueblo County Marijuana Excise Tax Return is a tax form used by businesses involved in the cultivation and distribution of marijuana to report and remit the excise tax imposed on the sale of marijuana in Pueblo County, Colorado.

Who is required to file CO Pueblo County Marijuana Excise Tax Return?

Any marijuana business operating in Pueblo County that is subject to the marijuana excise tax is required to file the CO Pueblo County Marijuana Excise Tax Return.

How to fill out CO Pueblo County Marijuana Excise Tax Return?

To fill out the CO Pueblo County Marijuana Excise Tax Return, businesses must provide detailed information about their sales of marijuana, including the quantity sold, the applicable tax rate, and the total excise tax owed, along with any required signatures and supporting documentation.

What is the purpose of CO Pueblo County Marijuana Excise Tax Return?

The purpose of the CO Pueblo County Marijuana Excise Tax Return is to ensure that marijuana businesses accurately report their sales and remit the appropriate excise taxes to local government authorities, thus contributing to public services and infrastructure.

What information must be reported on CO Pueblo County Marijuana Excise Tax Return?

The information that must be reported on the CO Pueblo County Marijuana Excise Tax Return includes the business's name and address, the date of the transaction, quantity of marijuana sold, sales price, applicable tax rate, total excise tax calculated, and any other relevant financial data as required by county regulations.

Fill out your CO Pueblo County Marijuana Excise Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO Pueblo County Marijuana Excise Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.