Get the free FY15 and Later FDR Standard 1 22 16 USE FOR PDF - arts

Show details

OMBNo.31350112Expires11/30/2016 NationalEndowmentfortheArts FY15&LaterFINALDESCRIPTIVEREPORTStandard December2014 SubmityourFinalDescriptiveReport(FDR)within90daysaftertheperiodofperformanceenddate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fy15 and later fdr

Edit your fy15 and later fdr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fy15 and later fdr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fy15 and later fdr online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fy15 and later fdr. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fy15 and later fdr

How to fill out FY15 and later FDR:

01

Gather all necessary financial documents: Before you start filling out the FY15 and later FDR (Financial Disclosure Report), you will need to collect all relevant financial documents such as income statements, tax returns, bank statements, and investment records. Having these documents ready will ensure accurate and detailed reporting.

02

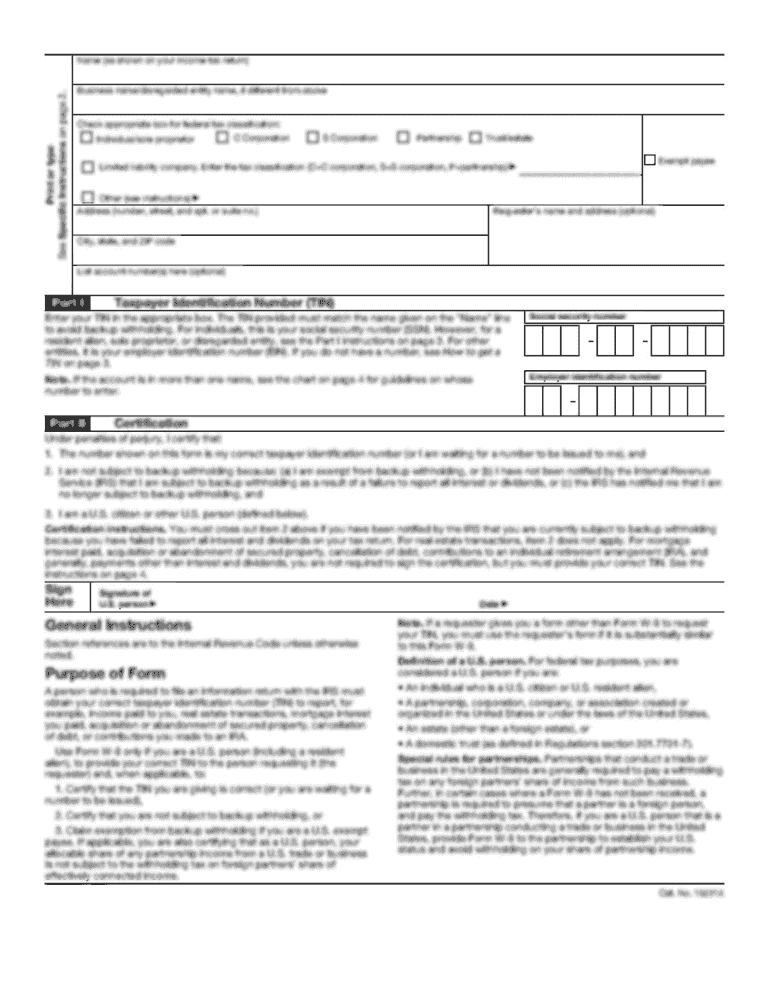

Begin with personal information: The first section of the FY15 and later FDR will require you to provide your personal information, including your name, address, Social Security number, and contact details. Make sure to enter this information accurately and double-check for any errors.

03

Report sources of income: The next step is to report all sources of income. This includes salaries, wages, dividends, rental income, and any other sources of earnings. Provide detailed information about each income source, including the amount earned and the frequency (e.g., monthly or annually).

04

Disclose financial assets and liabilities: In this section, you will disclose your financial assets, such as real estate properties, investments, retirement accounts, and any other valuable possessions. Be sure to specify the value of each asset and, if applicable, any associated liabilities or debts.

05

Report financial transactions: The FY15 and later FDR may require you to report any significant financial transactions, such as the purchase or sale of property, securities, or other assets. Include details about the nature of the transaction, the parties involved, and the financial value.

06

Provide additional information: Depending on the specific requirements of the FY15 and later FDR, you may need to provide additional information related to your financial situation. This could include information about loans, mortgages, gifts received, or any potential conflicts of interest.

Who needs FY15 and later FDR?

01

Government officials and employees: The FY15 and later FDR is typically required for federal government officials and employees to ensure transparency and disclosure of their financial interests. This includes members of Congress, cabinet members, agency heads, and certain government employees.

02

Individuals involved in federal contracting: Those involved in federal contracting, such as contractors, grantees, and subgrantees, may also be required to fill out the FY15 and later FDR. This helps ensure impartiality, avoid conflicts of interest, and maintain ethical standards in government contracting.

03

Public officials subject to ethics rules: Public officials at the state and local levels may also be required to file the FY15 and later FDR if they are subject to ethics rules or financial disclosure requirements. This helps promote transparency and prevents potential conflicts of interest in the public sector.

It is important to note that the specific requirements and eligibility for the FY15 and later FDR may vary depending on the jurisdiction and the specific role or position held by the individual. It is advisable to consult the appropriate guidelines and regulations to determine if you are required to fill out the FY15 and later FDR.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fy15 and later fdr in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fy15 and later fdr along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make edits in fy15 and later fdr without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fy15 and later fdr, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the fy15 and later fdr form on my smartphone?

Use the pdfFiller mobile app to complete and sign fy15 and later fdr on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is fy15 and later fdr?

FDR stands for Foreign Direct Investment Report.

Who is required to file fy15 and later fdr?

Any U.S. person who owned or controlled a foreign entity at any time during the fiscal year and meets certain reporting thresholds.

How to fill out fy15 and later fdr?

The FY15 and later FDR must be filed electronically through the BEA's eFile system.

What is the purpose of fy15 and later fdr?

The purpose of the FY15 and later FDR is to collect data on foreign direct investment in the U.S.

What information must be reported on fy15 and later fdr?

Information such as the name and address of the foreign entity, the value of the foreign entity's assets and liabilities, and details of the foreign entity's operations in the U.S.

Fill out your fy15 and later fdr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

fy15 And Later Fdr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.