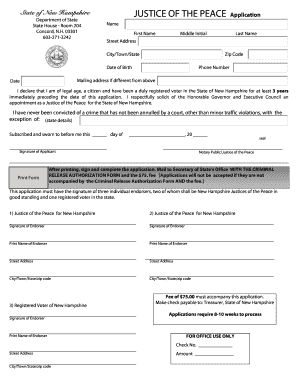

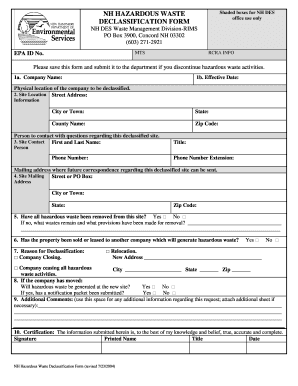

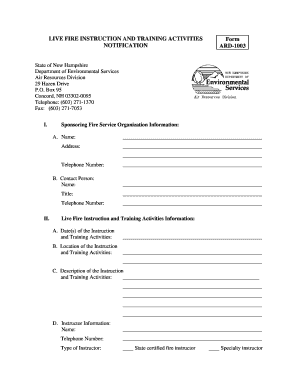

Get the free Catch Mortgage Fraud

Show details

Catch Mortgage Fraud

Before It Sinks You

By Greg Holmes

When I was a kid, my

grandfather used to take

me fishing. Sometimes we

would catch and release,

and other times we would bring home fish

to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign catch mortgage fraud

Edit your catch mortgage fraud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your catch mortgage fraud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit catch mortgage fraud online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit catch mortgage fraud. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out catch mortgage fraud

How to Fill Out and Catch Mortgage Fraud:

Be familiar with the signs of mortgage fraud:

01

Research and educate yourself on common types of mortgage fraud, such as straw buyers, fraudulent documentation, and inflated appraisals.

02

Stay updated on the latest scams and fraud techniques in the real estate and mortgage industry.

Review and analyze mortgage documents carefully:

01

Thoroughly examine all loan documents, contracts, and disclosures involved in the mortgage transaction.

02

Look for any inconsistencies, discrepancies, or suspicious information.

03

Pay attention to the borrower's financial information, employment history, and property details.

Verify information provided by the borrower:

01

Cross-reference the borrower's information, such as income, assets, debts, and employment, with independent sources.

02

Contact employers, banks, and other relevant parties to confirm the accuracy of the provided information.

03

Investigate any gaps or discrepancies in the borrower's financial history or employment records.

Conduct a thorough property appraisal:

01

Hire a professional and reputable appraiser to assess the value of the property.

02

Compare the appraiser's findings with recent comparable sales in the area.

03

Look for any signs of inflated appraisals or manipulation of property values.

Collaborate with fraud experts and law enforcement:

01

If you suspect mortgage fraud, contact local law enforcement agencies, such as the police or the FBI, to report your findings.

02

Work closely with fraud investigators or forensic accountants who specialize in mortgage fraud.

03

Provide them with all relevant documentation and evidence to support your case.

Who needs to catch mortgage fraud?

Homebuyers and homeowners:

01

Protect your investment and financial well-being by being vigilant for any signs of mortgage fraud.

02

Perform due diligence when selecting mortgage lenders, brokers, or real estate professionals.

03

Stay proactive and monitor your account statements and credit reports regularly.

Lending institutions and mortgage lenders:

01

It is vital for lending institutions to identify and prevent mortgage fraud to maintain the integrity of their business.

02

Implement robust internal controls and thorough verification processes to minimize the risk of fraud.

03

Train employees and provide resources to recognize and report any suspicious activities.

Government regulatory agencies and law enforcement:

01

Government agencies, such as the Consumer Financial Protection Bureau (CFPB) and the Department of Justice, play a crucial role in investigating and prosecuting mortgage fraud cases.

02

Collaborate with industry stakeholders, share information, and create awareness campaigns to prevent mortgage fraud.

03

Enforce existing regulations and develop new strategies to combat emerging fraud schemes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send catch mortgage fraud to be eSigned by others?

catch mortgage fraud is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in catch mortgage fraud without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit catch mortgage fraud and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the catch mortgage fraud in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your catch mortgage fraud in minutes.

What is catch mortgage fraud?

Catch mortgage fraud is the act of identifying and preventing fraudulent activity related to mortgages, such as falsifying information on loan applications or misrepresenting financial status.

Who is required to file catch mortgage fraud?

Lenders, financial institutions, and individuals involved in the mortgage application process are required to file catch mortgage fraud.

How to fill out catch mortgage fraud?

To fill out catch mortgage fraud, one must carefully review loan applications, verify all information provided, and report any suspicious or fraudulent activity to the appropriate authorities.

What is the purpose of catch mortgage fraud?

The purpose of catch mortgage fraud is to protect lenders, borrowers, and the overall financial system from being defrauded by individuals seeking to obtain mortgages under false pretenses.

What information must be reported on catch mortgage fraud?

Information such as false income statements, forged documents, inflated property appraisals, and identity theft related to mortgage applications must be reported on catch mortgage fraud.

Fill out your catch mortgage fraud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Catch Mortgage Fraud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.