Get the free ACCOUNTS PAYABLE CHECKS - cityofwaupaca

Show details

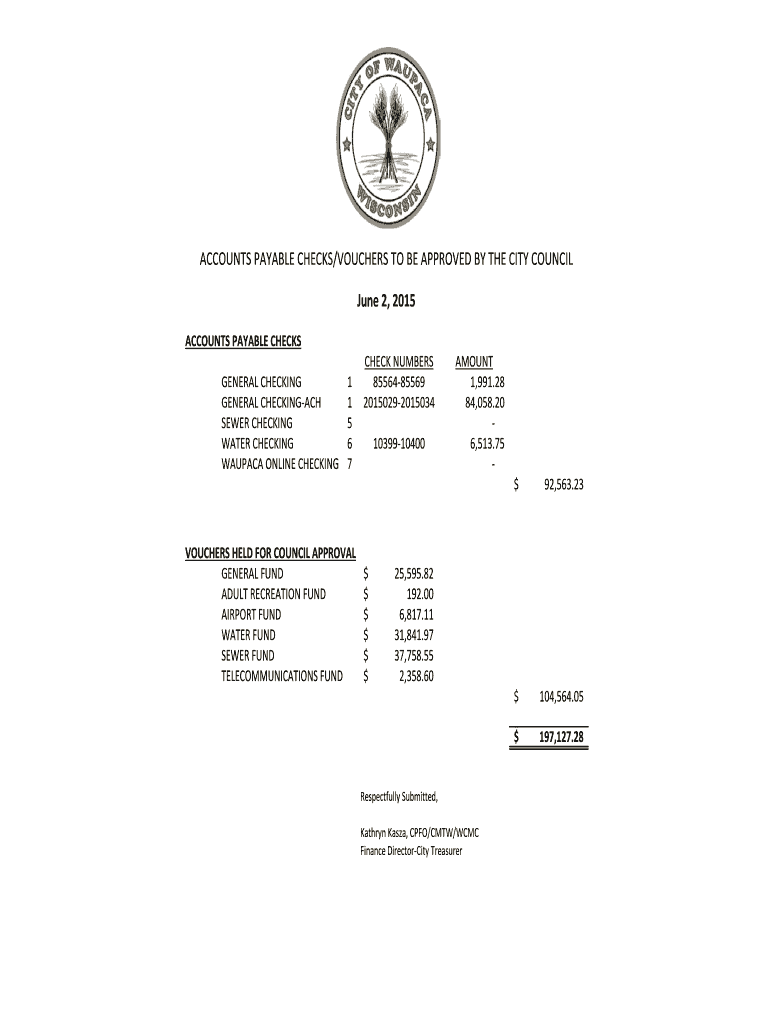

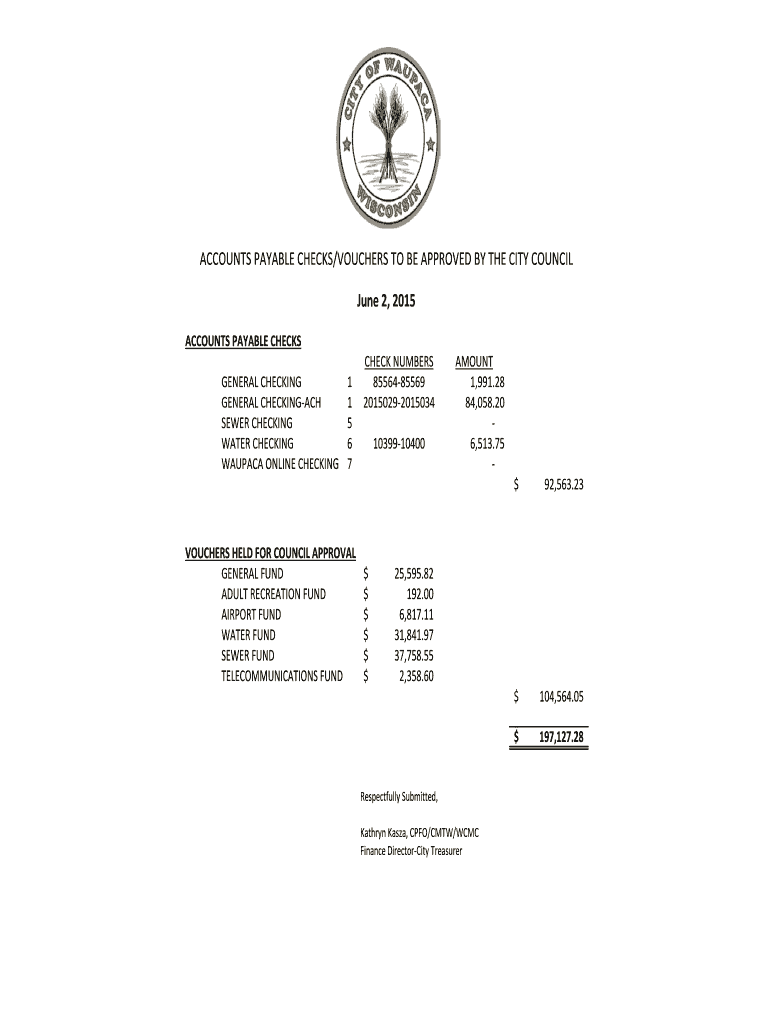

ACCOUNTS PAYABLE CHECKS/VOUCHERS TO BE APPROVED BY THE CITY COUNCIL June 2, 2015, ACCOUNTS PAYABLE CHECKS GENERAL CHECKING ACH SEWER CHECKING WATER CHECKING ALPACA ONLINE CHECKING 1 1 5 6 7 VOUCHERS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable checks

Edit your accounts payable checks form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable checks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts payable checks online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts payable checks. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable checks

How to fill out accounts payable checks:

01

Start by gathering all the necessary information. This includes the vendor's name, address, and contact details, as well as the invoice or bill number, payment due date, and the amount to be paid.

02

Open your checkbook or accounting software and locate the section for writing checks. Fill in the date on the designated line, ensuring its accuracy.

03

Write the name of the vendor or payee on the "Pay to the Order of" line. Double-check the name to avoid any mistakes.

04

In the box next to the payee's name, write the corresponding payment amount in numerals. Make sure to align the amount properly with the dollar sign.

05

On the line below the payee's name, write out the payment amount in words. Use both numbers and words to prevent any confusion.

06

Fill in the memo section with any additional information or references related to the payment. This can include an invoice number or a brief description of the payment purpose.

07

Look for the signature line on the bottom right-hand corner of the check. Sign your name exactly as it appears on the account to validate the check.

08

Finally, detach the check from your checkbook or software and keep a copy for your records. If using accounting software, you may have the option to print a physical check or generate an electronic copy.

Who needs accounts payable checks:

01

Businesses: Companies of all sizes, ranging from small startups to large corporations, use accounts payable checks to settle their financial obligations with vendors, suppliers, and service providers.

02

Non-profit organizations: Non-profits also utilize accounts payable checks to fulfill their payment responsibilities. This can include paying for supplies, services, or any other operational expenses.

03

Individuals: In some cases, individuals may need to issue accounts payable checks for personal transactions, such as paying rent or making payments to contractors or freelancers.

04

Government entities: Government agencies and departments often rely on accounts payable checks to process payments to their suppliers or contractors.

05

Educational institutions: Schools, colleges, and universities use accounts payable checks to manage their financial transactions, ranging from purchasing educational materials to paying employee salaries.

06

Healthcare organizations: Hospitals, clinics, and other healthcare facilities need accounts payable checks to handle various payments, such as purchasing medical supplies or paying healthcare providers.

07

Any organization or individual engaged in business-related transactions may require accounts payable checks to effectively manage and track their financial obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accounts payable checks for eSignature?

When you're ready to share your accounts payable checks, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit accounts payable checks in Chrome?

Install the pdfFiller Google Chrome Extension to edit accounts payable checks and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out accounts payable checks using my mobile device?

Use the pdfFiller mobile app to fill out and sign accounts payable checks. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is accounts payable checks?

Accounts payable checks are written payments made by a company to its vendors or suppliers for goods or services that have been received.

Who is required to file accounts payable checks?

All businesses that have accounts payable and issue checks to vendors or suppliers are required to file accounts payable checks.

How to fill out accounts payable checks?

Accounts payable checks are typically filled out by writing the name of the payee, the amount to be paid, the date, and any relevant invoice or account numbers.

What is the purpose of accounts payable checks?

The purpose of accounts payable checks is to ensure that vendors and suppliers are paid accurately and on time for goods or services provided to the company.

What information must be reported on accounts payable checks?

Accounts payable checks must include the name of the payee, the amount paid, the date of the payment, and any relevant invoice or account numbers.

Fill out your accounts payable checks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable Checks is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.