Get the free Partial Lump Sum Pension Distribution Pension Application Form - www1 sagph

Show details

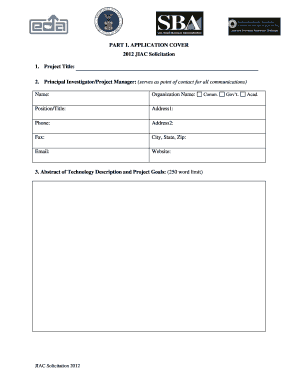

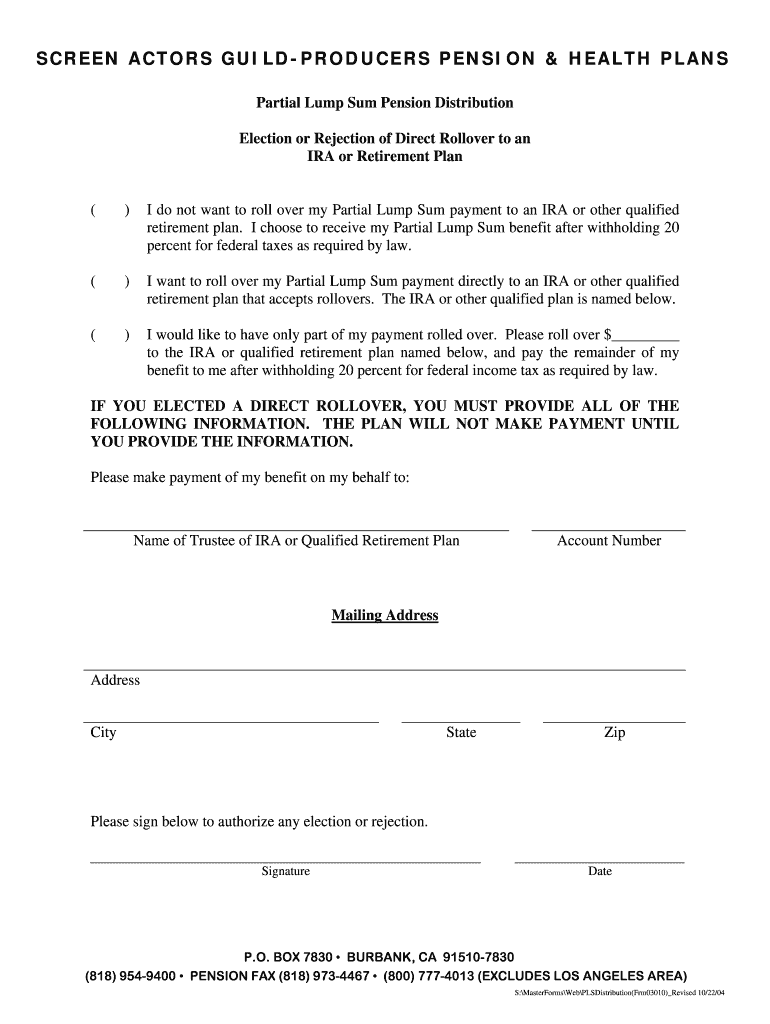

SCREEN ACTORS GUILDPRODUCERS PENSION & HEALTH PLANS Partial Lump Sum Pension Distribution Election or Rejection of Direct Rollover to an IRA or Retirement Plan () I do not want to roll over my Partial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partial lump sum pension

Edit your partial lump sum pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partial lump sum pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partial lump sum pension online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partial lump sum pension. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partial lump sum pension

How to fill out partial lump sum pension:

01

Gather necessary documents: Start by collecting all the relevant documents needed for filling out the partial lump sum pension application. This may include your identification documents, pension plan information, financial statements, and any other supporting documents required by your pension provider.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility criteria for receiving a partial lump sum pension. This may vary depending on your specific pension plan and the regulations set by your pension provider. Ensure that you meet all the necessary requirements before proceeding with the application.

03

Review your pension plan details: Take the time to review your pension plan details thoroughly. Understand the terms and conditions, as well as any options or choices available to you regarding the partial lump sum pension. It's essential to be aware of the potential impact on your future pension benefits or any other implications that may arise from choosing this option.

04

Complete the application form: Obtain the application form for the partial lump sum pension from your pension provider. Fill out all the required sections accurately and provide all the necessary information. Ensure that you double-check for any errors or missing details before submitting the application.

05

Seek professional advice if needed: If you have any doubts or concerns during the application process, consider seeking professional advice from a financial advisor or pension specialist. They can provide guidance specific to your situation and help you make an informed decision regarding the partial lump sum pension.

Who needs partial lump sum pension:

01

Individuals in need of a financial boost: Some individuals may require an immediate lump sum amount for various reasons, such as paying off debts, funding a large expense, or investing in a business venture. The partial lump sum pension can provide a significant amount of money upfront, which can address these financial needs.

02

Retirees with specific financial goals: Retirees who have specific financial goals or plans may opt for a partial lump sum pension. For example, they may intend to purchase a property, travel extensively, or support their loved ones financially. By receiving a lump sum, they can achieve these objectives more efficiently.

03

Individuals with health concerns: People who have health concerns or uncertain life expectancies may find the partial lump sum pension advantageous. By receiving a lump sum earlier, they can ensure they make the most of their pension funds while they need it the most, rather than waiting for regular monthly payments.

04

Those looking for investment opportunities: Some individuals may wish to invest the lump sum received from the partial lump sum pension into other ventures that can generate higher returns. This can potentially provide additional income or grow their wealth over time.

Remember, it's important to carefully consider your personal circumstances and consult with a financial professional to determine if a partial lump sum pension is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit partial lump sum pension in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing partial lump sum pension and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the partial lump sum pension electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your partial lump sum pension in seconds.

How do I complete partial lump sum pension on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your partial lump sum pension. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is partial lump sum pension?

Partial lump sum pension is a payment made to a retiree in a single, one-time installment instead of regular monthly payments.

Who is required to file partial lump sum pension?

Individuals who receive a partial lump sum pension from their retirement plan are required to report it on their tax return.

How to fill out partial lump sum pension?

To fill out a partial lump sum pension, individuals must include the amount received in the appropriate section of their tax return.

What is the purpose of partial lump sum pension?

The purpose of a partial lump sum pension is to provide retirees with a lump sum of cash upfront instead of spreading out payments over time.

What information must be reported on partial lump sum pension?

The amount of the partial lump sum pension received must be reported on the individual's tax return.

Fill out your partial lump sum pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partial Lump Sum Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.