Get the free Credit Requirements

Show details

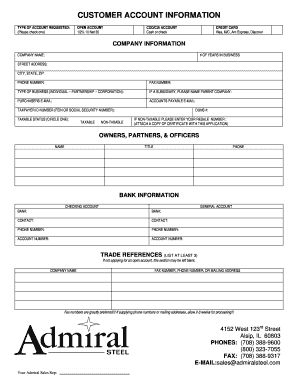

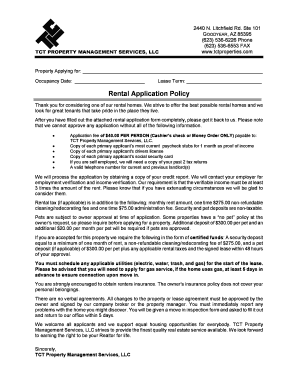

Exhibit Credit Requirements Applicants are required to meet the following requirements: 1. Applicants must submit to and satisfy a formal credit review and provide the necessary documents for its

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit requirements

Edit your credit requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit requirements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit requirements. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit requirements

How to fill out credit requirements:

01

Research the specific credit requirements: Begin by understanding the specific credit requirements for your situation. This may involve reviewing the criteria set by financial institutions, credit card companies, or other lenders. Take note of the minimum credit score, debt-to-income ratio, and other factors that may be considered.

02

Check your credit report: Obtain a copy of your credit report from a reputable credit reporting agency. Carefully review the information provided to ensure its accuracy. Look for any potential errors or discrepancies that could affect your credit score.

03

Establish a budget: Assess your current financial situation and create a budget to help manage your finances. This will allow you to determine how much you can afford to borrow and repay responsibly. Make sure to prioritize paying off any existing debts before considering new credit.

04

Improve your credit score: If your credit score is below the required threshold, take steps to improve it. This can involve paying bills on time, reducing credit card balances, avoiding new debt, and disputing any errors on your credit report. It may take time and effort, but a higher credit score will increase your chances of meeting credit requirements.

05

Gather necessary documents: Before applying for credit, gather all the required documents. This may include proof of income, bank statements, identification documents, and other relevant paperwork. Having these documents readily available will expedite the application process.

06

Compare and choose the right lender: Research different lenders and compare their credit requirements, interest rates, fees, and terms. Select a lender that best suits your needs and offers favorable credit terms. Consider seeking advice from a financial advisor or credit counselor to make an informed decision.

Who needs credit requirements?

01

Individuals applying for loans: Whether it's a mortgage, car loan, or personal loan, individuals seeking financial assistance typically need to meet specific credit requirements. This ensures that the lender has confidence in the borrower's ability to repay the borrowed funds.

02

Credit card applicants: Most credit card companies have certain credit requirements for applicants. These requirements help determine credit limits, interest rates, and other terms. By evaluating creditworthiness, credit card issuers can manage risks associated with lending money.

03

Renters: Some landlords perform credit checks on potential tenants to assess their financial reliability. Meeting the credit requirements may increase the chances of securing a lease agreement or improve the negotiating power when discussing rental terms.

04

Individuals seeking utility services: Certain utility companies, such as electric, gas, or internet providers, may run credit checks to determine whether to require a deposit or establish credit terms. Meeting credit requirements can help avoid additional costs or the need for deposits.

Overall, credit requirements are essential for various financial transactions and services. Understanding and meeting these requirements can facilitate access to credit and contribute to a healthier financial profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit requirements?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the credit requirements. Open it immediately and start altering it with sophisticated capabilities.

How do I edit credit requirements straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing credit requirements.

How do I fill out credit requirements on an Android device?

Use the pdfFiller mobile app to complete your credit requirements on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is credit requirements?

Credit requirements refer to the criteria that individuals or businesses must meet in order to be approved for credit, such as a certain credit score or income level.

Who is required to file credit requirements?

Individuals or businesses that are applying for credit, loans, or financing are required to meet the credit requirements set by the lender.

How to fill out credit requirements?

To fill out credit requirements, individuals or businesses typically need to provide information such as their credit history, income, assets, and liabilities.

What is the purpose of credit requirements?

The purpose of credit requirements is to help lenders assess the creditworthiness of borrowers and determine the likelihood that they will repay their loans.

What information must be reported on credit requirements?

Information such as credit scores, income, employment history, debt-to-income ratio, and assets may need to be reported on credit requirements.

Fill out your credit requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.