Get the free cover for your home,

Show details

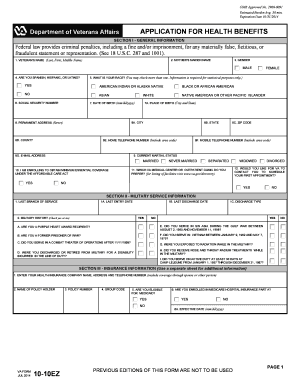

HOME INSURANCEYour Home Solutions policy booklet cover for your home, inside and out50261 1 3390195 1 1211 BOO. Indy 115/08/2012 12:25uSeful telephone numbers General Enquiries0845 604 6531New claims

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cover for your home

Edit your cover for your home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cover for your home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cover for your home online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cover for your home. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cover for your home

How to fill out cover for your home?

01

Gather necessary information: Before filling out a home insurance application, collect important details about your property, such as its location, size, age, construction materials, and any additional features like a swimming pool or detached garage.

02

Assess the level of coverage needed: Determine the value of your home and its contents to determine the appropriate amount of coverage. Consider factors like potential risks, such as natural disasters or theft, to ensure you have adequate protection.

03

Research insurance providers: Take the time to research different insurance companies and compare their policies, coverage options, and customer reviews. Look for reputable providers that offer comprehensive coverage at competitive rates.

04

Contact insurance agents: Reach out to insurance agents from the companies you are interested in or use online tools to request quotes. Discuss your specific needs and ask any questions you may have to fully understand the coverage they offer.

05

Review policy options: Once you have received quotes from multiple insurers, carefully review the policy options they provide. Pay attention to details such as the types of risks covered, deductibles, limits, and any additional coverage options for specific items or events.

06

Consider additional coverage: Depending on the location and condition of your home, you may want to consider additional coverage options beyond standard homeowners insurance. These may include flood insurance, earthquake insurance, or coverage for valuable personal belongings.

07

Fill out the application: After selecting an insurance provider and policy that best suits your needs, complete the application form. Provide accurate and detailed information about your property, personal information, and desired coverage.

08

Submit supporting documentation: Along with the application, you may be required to submit supporting documentation, such as a property appraisal, photographs, or proof of ownership for certain valuable items.

09

Review and sign the policy: Once the insurance company processes your application, carefully review the policy document. Ensure that all the information is accurate and that you understand the terms, conditions, and coverage details. Sign the policy to indicate your acceptance.

10

Pay the premium: To activate your home insurance coverage, make the necessary payment specified by the insurance company. This may involve a one-time annual payment or monthly installments, depending on the terms of the policy.

Who needs cover for your home?

01

Homeowners: Home insurance is essential for homeowners as it provides financial protection against potential risks, such as fire, theft, or natural disasters. It helps cover the cost of repairs, replacement of belongings, and liability claims.

02

Renters: Even though renters do not own the property they live in, they should still consider obtaining renters insurance. This type of coverage protects their personal belongings from damage or theft and provides liability coverage.

03

Landlords: Landlords who own residential properties should have landlord insurance, which covers not only the physical structure of the building but also any liability claims that may arise from injuries or property damage occurring on the premises.

04

Condo owners: Condo owners typically require a specific type of insurance known as condo insurance. This policy covers structural elements of the condominium unit, personal belongings, liability, and any upgrades made to the unit.

05

Homebuyers: Individuals in the process of purchasing a home should consider obtaining home insurance before the closing date. This ensures that their investment is protected from any potential risks from the moment they take ownership.

Overall, anyone who values their home and wants to protect their investment, belongings, and financial well-being should consider obtaining proper coverage for their home.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cover for your home without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including cover for your home, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out cover for your home using my mobile device?

Use the pdfFiller mobile app to fill out and sign cover for your home on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete cover for your home on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your cover for your home. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is cover for your home?

Cover for your home is a type of insurance policy that provides financial protection in case of damage or loss to your property.

Who is required to file cover for your home?

Homeowners are typically required to file cover for their home.

How to fill out cover for your home?

You can fill out cover for your home by contacting an insurance agent or company and providing information about your property.

What is the purpose of cover for your home?

The purpose of cover for your home is to protect you financially in case of damage to your property.

What information must be reported on cover for your home?

Information such as the value of your property, its location, and any upgrades or special features must be reported on cover for your home.

Fill out your cover for your home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cover For Your Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.