NY DTF RP-425 2011 free printable template

Show details

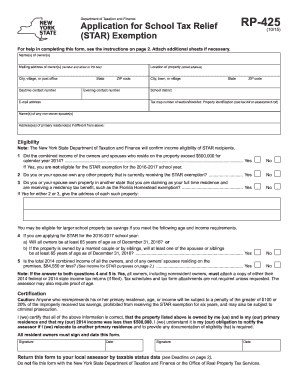

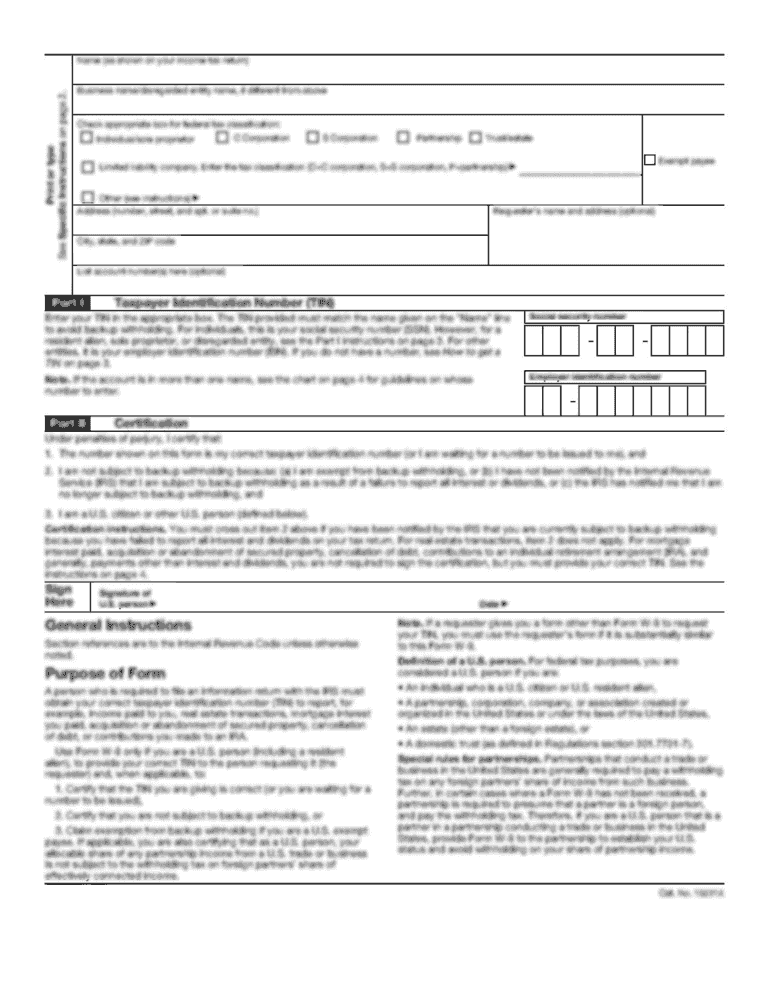

RP-425 rev. (07/11) NYS Department of Taxation & Finance Office of Real Property Tax Services Application for School Tax Relief (STAR) Exemption (See general information and instructions on the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nyc star exemption form

Edit your nyc star exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc star exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyc star exemption form online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nyc star exemption form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF RP-425 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc star exemption form

How to fill out NY DTF RP-425

01

Obtain Form RP-425 from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name, address, and contact information at the top of the form.

03

Indicate the type of taxpayer (individual, business, etc.) as appropriate.

04

Provide the required financial information accurately based on your records.

05

Complete sections on deductions and credits that apply to your situation.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed form to the appropriate tax authority or as directed in the instructions.

Who needs NY DTF RP-425?

01

Individuals or businesses claiming certain tax credits or refunds in New York.

02

Taxpayers who have overpaid or are eligible for tax relief under specific programs.

03

Those who are required to report capital gains or other income adjustments.

Fill

form

: Try Risk Free

People Also Ask about

How do you qualify for ny STAR exemption?

Total income of all owners and resident spouses or registered domestic partners must be $93,200 or less. * Income eligibility for the 2023 STAR credit is based on your federal or state income tax return from the 2021 tax year.

Who is eligible for the STAR program in ny?

The property must be the primary residence of at least one age-eligible owner. All owners must be at least age 65 as of December 31 of the year of the exemption, except where the property is jointly owned by only a married couple or only siblings, in which case only one owner needs to meet the age requirement.

Do I have to apply for Star every year in ny?

You don't need to register again in future years unless there is a change in the ownership of your home. After you register for the STAR credit, each year we will automatically review your application to determine whether you're eligible for the Basic or Enhanced STAR credit.

Is everyone in ny getting a star rebate check?

To be eligible for a homeowner tax rebate credit in 2022, you must have: qualified for a 2022 STAR credit or exemption, had income that was less than or equal to $250,000 for the 2020 income tax year, and. a school tax liability for the 2022-2023 school year that is more than your 2022 STAR benefit.

How do I enroll in New York State Star Program?

To apply for the Enhanced STAR exemption, submit the following to your assessor: Form RP-425-IVP, Supplement to Form RP-425-E , and. Form RP-425-E, Application for Enhanced STAR Exemption (include the Social Security numbers of all owners of the property and any of their spouses who reside at the property).

How do I apply for New York State Star Program?

To apply for the Enhanced STAR exemption, submit the following to your assessor: Form RP-425-IVP, Supplement to Form RP-425-E , and. Form RP-425-E, Application for Enhanced STAR Exemption (include the Social Security numbers of all owners of the property and any of their spouses who reside at the property).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nyc star exemption form for eSignature?

Once your nyc star exemption form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute nyc star exemption form online?

With pdfFiller, you may easily complete and sign nyc star exemption form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit nyc star exemption form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit nyc star exemption form.

What is NY DTF RP-425?

NY DTF RP-425 is a form used by individuals and businesses in New York State to report certain tax-related information to the New York State Department of Taxation and Finance.

Who is required to file NY DTF RP-425?

Entities and individuals who have conducted certain transactions involving the sale of real property or the transfer of interests in real property are required to file NY DTF RP-425.

How to fill out NY DTF RP-425?

To fill out NY DTF RP-425, taxpayers must provide information such as the names and addresses of the buyer and seller, descriptions of the property involved, and any applicable exemptions or deductions.

What is the purpose of NY DTF RP-425?

The purpose of NY DTF RP-425 is to ensure compliance with New York State tax laws by reporting real estate transactions and assessing any applicable transfer taxes.

What information must be reported on NY DTF RP-425?

NY DTF RP-425 requires reporting information such as the parties involved in the transaction, the property's location, sale price, date of transfer, and any claimed exemptions.

Fill out your nyc star exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc Star Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.