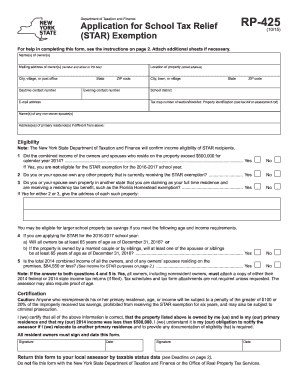

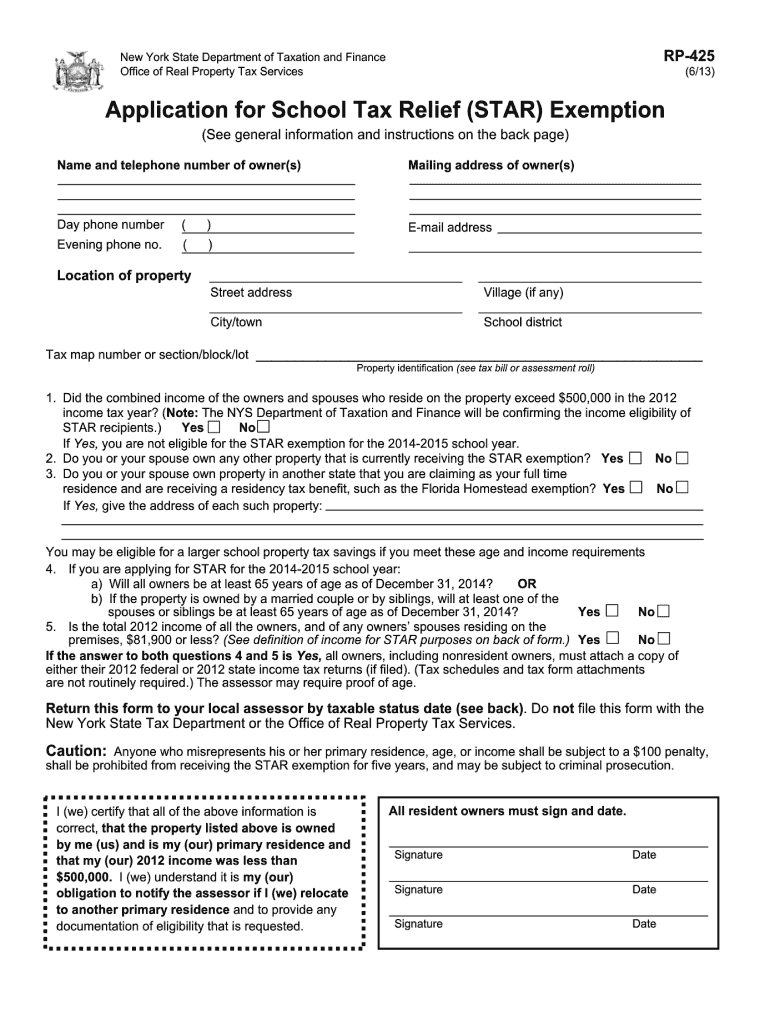

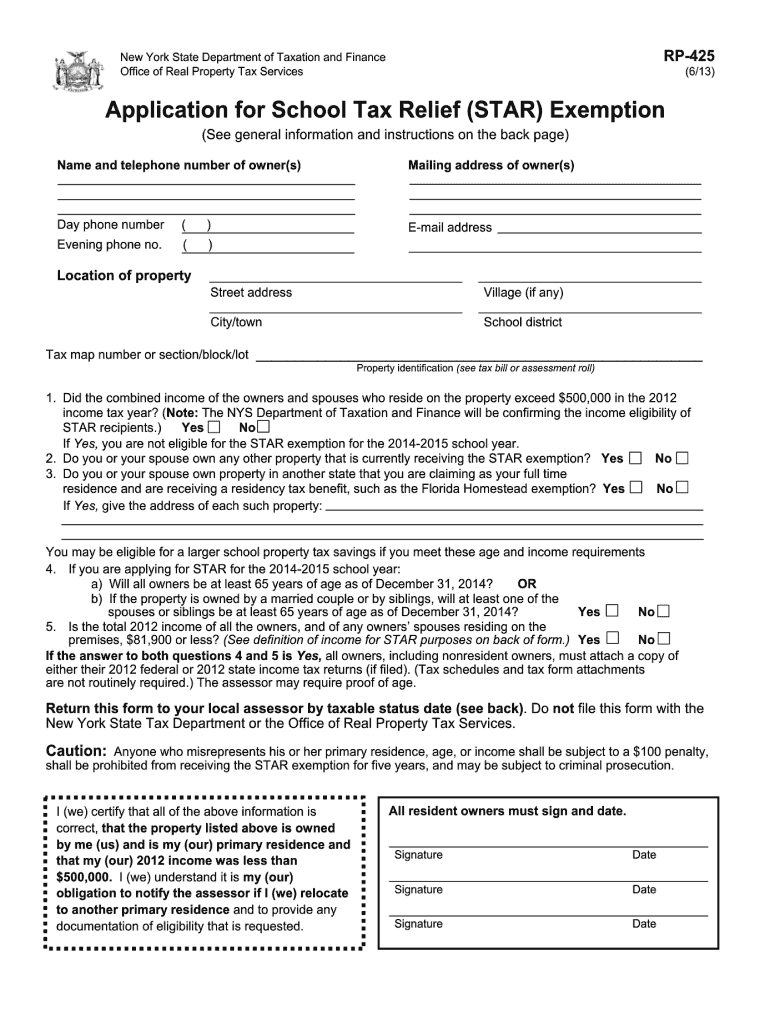

NY DTF RP-425 2013 free printable template

Show details

You may not use your 2013 tax forms. Form no. Title of income tax form IRS Form U.S. Individual Income Tax Return Line 37 minus line 15b 1040A 1040EZ Income Tax Return for Single Line 4 only adjusted gross income No adjustment needed for IRAs. and Joint Filers With No Dependents NYS Form IT-201 Resident Income Tax Return federal adjusted gross income minus taxable amount of IRA distributions This Area for Assessor s Use Only Application received Proof of age Proof of income Proof of residency...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2013 form application

Edit your 2013 form application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 form application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 form application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2013 form application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF RP-425 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2013 form application

How to fill out NY DTF RP-425

01

Obtain form NY DTF RP-425 from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and other identification information at the top of the form.

03

Indicate the type of tax benefit you are applying for, such as a credit or exemption.

04

Provide specific details related to the tax benefit, including relevant income or property information.

05

Sign and date the form, certifying that all information provided is correct to the best of your knowledge.

06

Submit the completed form according to the instructions, either by mail or electronically, as specified.

Who needs NY DTF RP-425?

01

Individuals or businesses seeking to claim certain tax benefits or exemptions in New York.

02

Taxpayers who have received a notice or request from the New York State Department of Taxation that requires them to complete the RP-425 form.

03

Anyone who is eligible for property tax exemptions or credits as defined by New York tax law.

Instructions and Help about 2013 form application

Fill

form

: Try Risk Free

People Also Ask about

How do I get my 1099 from previous years?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

How long can I go back to view IRS forms?

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online.

How do I get old IRS forms?

What You Get. You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information.

Does form 1310 need to be mailed?

3 If filing a Form 1310 along with a Form 1041, the IRS will issue the refund to the estate rather than to any individual. Form 1310 must be mailed to the IRS. It cannot be efiled.

Who must use form 1310?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2013 form application?

The editing procedure is simple with pdfFiller. Open your 2013 form application in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the 2013 form application in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2013 form application in seconds.

How do I edit 2013 form application on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 2013 form application on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NY DTF RP-425?

NY DTF RP-425 is a form used by the New York State Department of Taxation and Finance for reporting and tracking real property transfer gains for certain transactions.

Who is required to file NY DTF RP-425?

Any individual or entity that sells or transfers real property in New York State and meets specific criteria regarding the property and transaction value is required to file NY DTF RP-425.

How to fill out NY DTF RP-425?

To fill out NY DTF RP-425, you need to provide details about the property, the parties involved in the transaction, and the financial aspects of the sale or transfer, as per the instructions provided on the form.

What is the purpose of NY DTF RP-425?

The purpose of NY DTF RP-425 is to calculate and report any potential gains from the transfer of real property, ensure compliance with state tax regulations, and assess any taxes owed on those gains.

What information must be reported on NY DTF RP-425?

The information that must be reported on NY DTF RP-425 includes the names and addresses of the buyer and seller, a description of the property, the sales price, and the date of transfer, as well as other financial details relevant to the transaction.

Fill out your 2013 form application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Form Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.