Get the free lst exemption form

Show details

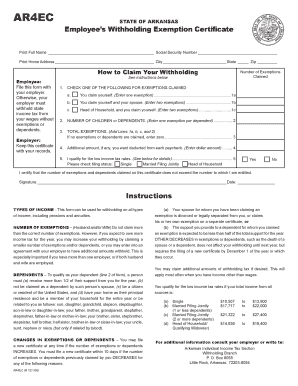

LOCAL SERVICES TAX EXEMPTION CERTIFICATE Tax Year APPLICATION FOR EXEMPTION FROM LOCAL SERVICES TAX A copy of this application for exemption from the Local Services Tax LST and all necessary supporting documents must be completed and presented to your employer AND to the political subdivision levying the Local Services Tax where you are principally employed. This application for exemption from the Local Services Tax must be signed and dated. No exemption will be approved until proper...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lst exemption form

Edit your lst exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lst exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lst exemption form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lst exemption form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lst exemption form

How to fill out lst exemption form:

01

Start by obtaining the form from the relevant tax authority or website.

02

Carefully read the instructions provided with the form to understand the requirements and necessary information.

03

Begin by providing your personal information, including your name, address, and Social Security number.

04

If applicable, indicate your filing status and any dependents you may have.

05

Proceed to complete the sections related to your income, including wages, dividends, interest, and any other sources of income.

06

Deduct your allowable exemptions, which may include expenses related to education, healthcare, or other qualifying expenses.

07

Review the form to ensure accuracy and completeness.

08

Sign the form and include the date.

09

Prepare any supporting documentation or schedules that may be required.

10

Make a copy of the completed form for your records.

Who needs lst exemption form:

01

Individuals who qualify for tax exemptions based on their income, expenses, or other qualifying criteria.

02

Businesses or organizations that are eligible for specific deductions or exemptions under the applicable tax laws.

03

Taxpayers who have been notified by the tax authority to complete the lst exemption form for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is an LST deduction?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

What is EIT and LST tax in PA?

Earned Income Tax. The Local Tax Enabling Act authorizes Local Earned Income Taxes (EIT) for municipalities and school districts. This tax is . 5% of your earned income for the municipality and between . 9% and 1.5% for the school district in which you reside.

What is PA lst exemption?

If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits are exempt from the tax.

What is the local services tax exempTion in Pennsylvania?

exempTion appLicaTion Income exemption for Local Services Tax is $12,000 or less from all sources of earned income and net profits, when the LST tax rate exceeds $10 per year. Attach copy(s) of final pay statement(s) from employer(s). You may also attach a copy of your prior year W-2(s).

What does LST mean on a pay stub?

Local Services Tax (LST) Translate. Select Language.

Who pays Pittsburgh LST tax?

The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lst exemption form?

It is difficult to determine the specific meaning of "lst exemption form" without further context. However, an exemption form is generally a document used to request and document an exemption or exception from a certain requirement or rule. The "lst" could refer to a specific type or category of exemption form, which would require more information to identify.

Who is required to file lst exemption form?

It is unclear what you mean by "lst exemption form." If you are referring to the exemption form for filing taxes, it generally depends on the individual's income and filing status. In the United States, for example, individuals with certain exemptions or deductions may need to fill out Form 1040 or another appropriate tax form. It is advisable to consult with a tax professional or check the specific tax laws of the country concerned for accurate information about who is required to file exemption forms.

How to fill out lst exemption form?

To fill out an LST exemption form, follow these steps:

1. Obtain the form: Obtain the LST exemption form from the appropriate authority or department. This could be the tax office, municipality, or any other relevant authority that oversees the Local Services Tax.

2. Read the instructions: Carefully read the instructions provided with the form. The instructions will guide you on how to properly fill out the form and provide any necessary documentation.

3. Personal information: Start by providing your personal information, such as your full name, address, contact information, and Social Security number.

4. Exemption eligibility: Determine if you meet the eligibility criteria for an exemption. Common exemptions could include being below a certain income threshold, being disabled, or being a full-time student. If you meet any of these exemptions, mark the applicable checkbox or provide the necessary information to support your exemption claim.

5. Employer information: If you are claiming an exemption due to your employment, provide information about your employer, such as the name, address, and contact information.

6. Signature and certification: Review your completed form to ensure accuracy. Sign and date the form at the appropriate place. If required, include any necessary certifications, such as those from your employer or physician, as outlined in the instructions.

7. Submit the form: Once completed, submit the form to the designated authority, such as the tax office or municipality. Follow any additional instructions for submission, such as submitting electronically, mailing, or hand-delivering the form.

It is important to note that each jurisdiction may have specific requirements and instructions for their LST exemption forms. Make sure to carefully review the instructions provided with the specific form you are using to ensure accuracy and compliance.

How can I send lst exemption form for eSignature?

Once you are ready to share your lst exemption form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find lst exemption form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the lst exemption form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete lst exemption form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your lst exemption form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your lst exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lst Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.