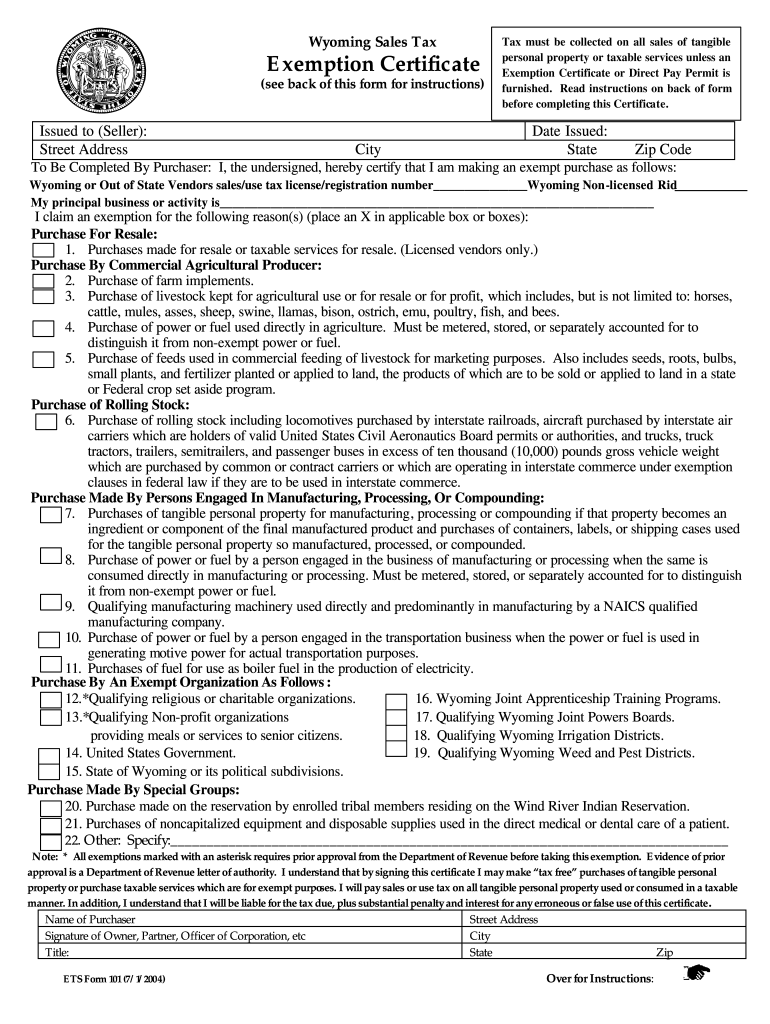

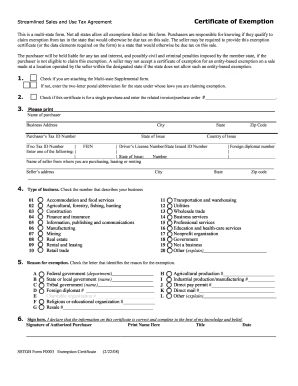

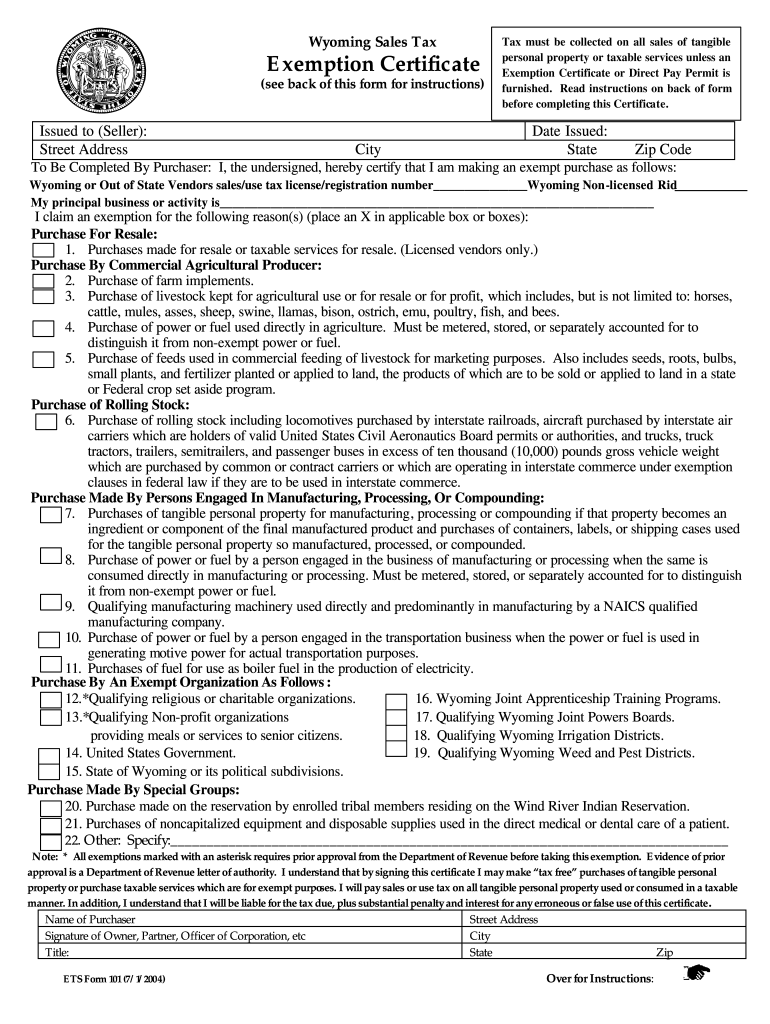

WY ETS 101 2004-2025 free printable template

Get, Create, Make and Sign wyoming form exemption fillable

How to edit wyoming ets exemption pdf online

Uncompromising security for your PDF editing and eSignature needs

WY ETS 101 Form Versions

How to fill out wyoming 101 exemption printable

How to fill out WY ETS 101

Who needs WY ETS 101?

Video instructions and help with filling out and completing wyoming 101 exemption printable

Instructions and Help about wyoming 101 exemption printable

If you live in Lincoln County you'll see a special-purpose excise tax on your ballot November 6th it's also called the six penny tax, and it would increase the sales tax in Lincoln County from 5 to 6 communities are asking voters for close to 14 million dollars to pay for infrastructure improvements like roads sewer and water and some maintenance equipment it can't be used for anybody's salary, and it must go to the specific projects each community decides on the six penny tax will last only until that amount is collected then it goes away it's expected to cost you about an extra dollar a week per person for about three and a half years head to Lincoln County six penny education initiative on Facebook for more information

People Also Ask about

What is the homeowners exemption in Wyoming?

What taxes do you pay in Wyoming?

Are groceries in Wyoming exempt from sales tax?

Is Wyoming a tax free state?

At what age do you stop paying property taxes in Wyoming?

Is Wyoming a tax exempt state?

What is the property exemption in Wyoming?

Does Wyoming exemption certificate expire?

How to fill Wyoming resale certificate?

What taxes are exempt in Wyoming?

Does Wyoming have a sales tax exemption form?

What items are tax exempt in Wyoming?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute wyoming 101 exemption printable online?

Can I create an electronic signature for signing my wyoming 101 exemption printable in Gmail?

How can I edit wyoming 101 exemption printable on a smartphone?

What is WY ETS 101?

Who is required to file WY ETS 101?

How to fill out WY ETS 101?

What is the purpose of WY ETS 101?

What information must be reported on WY ETS 101?

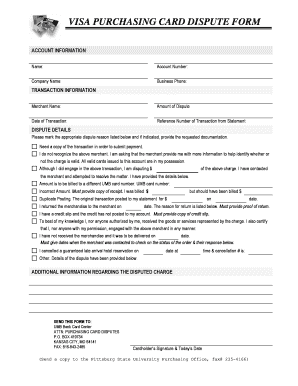

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.