KS ST-28F 2007 free printable template

Show details

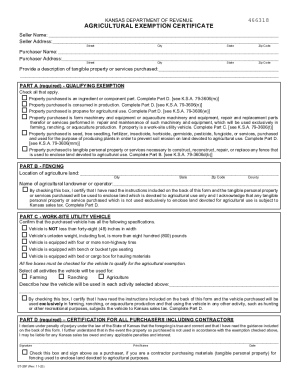

KANSAS DEPARTMENT OF REVENUE Reset AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from: Seller: Eagle Supply Company,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS ST-28F

Edit your KS ST-28F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS ST-28F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS ST-28F online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS ST-28F. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS ST-28F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS ST-28F

How to fill out KS ST-28F

01

Begin by downloading or obtaining the KS ST-28F form from the official Kansas Department of Revenue website.

02

Fill in your personal information, including your name, address, and taxpayer identification number at the top of the form.

03

Provide details regarding the vehicle, including make, model, year, and vehicle identification number (VIN).

04

Indicate the type of exemption you are requesting by selecting the appropriate box or writing it in the designated area.

05

If applicable, enter any additional information required by the specific exemption being claimed.

06

Review the form for accuracy, ensuring that all required fields are completed.

07

Sign and date the form at the bottom to certify that the information provided is true and correct.

08

Submit the completed form to the appropriate Kansas Department of Revenue office or as instructed.

Who needs KS ST-28F?

01

Individuals or businesses in Kansas seeking a vehicle sales tax exemption.

02

Applicants who qualify for specific exemptions, such as governmental agencies, non-profit organizations, or certain business entities.

03

Those purchasing vehicles for specific purposes outlined by Kansas tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do chickens count for ag exemption in Texas?

Chickens do qualify for the Texas Ag exemption, but there are some important guidelines that must be met in order to qualify. If you are a large-scale farmer who raises and sells chickens (or their eggs) for profit, you should research Ag exemption and find out whether you qualify.

What animals qualify for tax exemption in Texas?

Which animals qualify? Cattle, sheep, goats and bees typically qualify for special ag valuation. However, each Texas county has its own rules. To understand your specific opportunities, contact the appraisal district in which your property is located.

How many cows do you need to be tax exempt in Texas?

How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

How do I get farm tax exempt in KS?

Two conditions must be met to claim this exemption. The buyer must be engaged in farming or ranching as defined on this page, and the property purchased, repaired or serviced must be used only in farming and ranching.

How many acres do you need for ag exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

What qualifies as a farm deduction?

Deductible farming expenses Some of the expenses that farmers commonly deduct cover the cost of livestock and feed, seeds, fertilizer, wages paid to employees, interest paid during the year on farm-related loans, depreciation to recover a portion of equipment costs, utilities and insurance premiums.

Can you write off a hobby farm on your taxes?

Tax Benefits of Turning Your Hobby Into a Business You can deduct your farm-related expenses, even if they go above your farm income. So if your farm operates at a loss, that loss can be used to offset your tax burden on your overall income.

What is exempt from agricultural property tax in Kansas?

The following are eligible for agricultural exemption in Kansas: ingredient or component parts; parts consumed in production; propane for agricultural use; property purchased is farm or aquaculture machinery or equipment, repair/replacement parts, or labor services on farm or aquaculture machinery; seeds, fertilizers,

How many cows per acre for ag exemption Texas?

Stocking Rates in Texas vary from 1 cow per acre on heavily managed pasture in the Eastern portion of the state to 1 cow per 150 acres (4 cows per section) in the Trans Pecos Region of the state.

What qualifies as a farm for tax purposes in Kansas?

For the purpose of applying sales tax, Kansas tax law defines farming or ranching as any activity which is ordinary and necessary for the growing or raising of agricultural products; the operation of a feedlot; or, farm and ranch work for hire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS ST-28F for eSignature?

To distribute your KS ST-28F, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute KS ST-28F online?

pdfFiller has made it simple to fill out and eSign KS ST-28F. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the KS ST-28F in Gmail?

Create your eSignature using pdfFiller and then eSign your KS ST-28F immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is KS ST-28F?

KS ST-28F is a form used in the state of Kansas for the reporting of certain tax-related information, often related to sales tax exemptions.

Who is required to file KS ST-28F?

Businesses or individuals who claim a sales tax exemption must file KS ST-28F.

How to fill out KS ST-28F?

To fill out KS ST-28F, you need to provide the required information such as your name, address, and the reason for claiming the exemption, as well as details about the purchase.

What is the purpose of KS ST-28F?

The purpose of KS ST-28F is to certify that a purchase is exempt from sales tax due to specific circumstances.

What information must be reported on KS ST-28F?

The information that must be reported on KS ST-28F includes the purchaser's name and address, the seller's name and address, details about the items purchased, and the reason for the exemption.

Fill out your KS ST-28F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS ST-28f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.