KS ST-28F 2022 free printable template

Show details

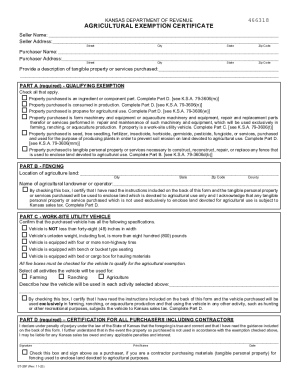

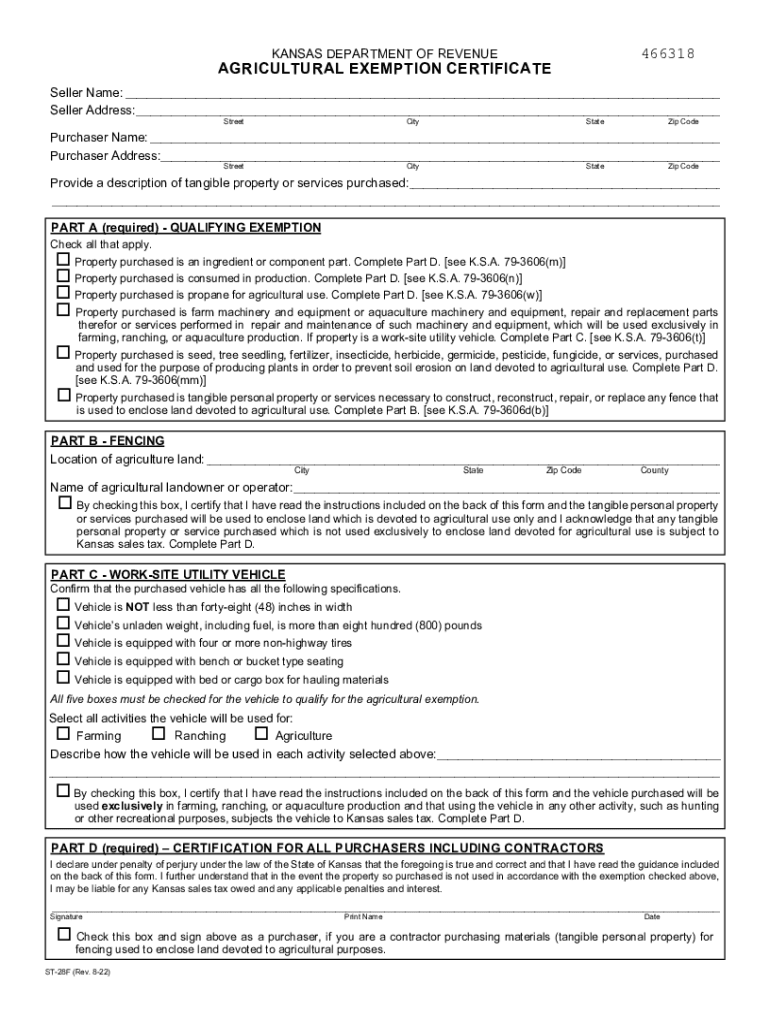

KANSAS DEPARTMENT OF REVENUE

AGRICULTURAL EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller:___

Business Headdress: ___

Street,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS ST-28F

Edit your KS ST-28F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS ST-28F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS ST-28F online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS ST-28F. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS ST-28F Form Versions

Version

Form Popularity

Fillable & printabley

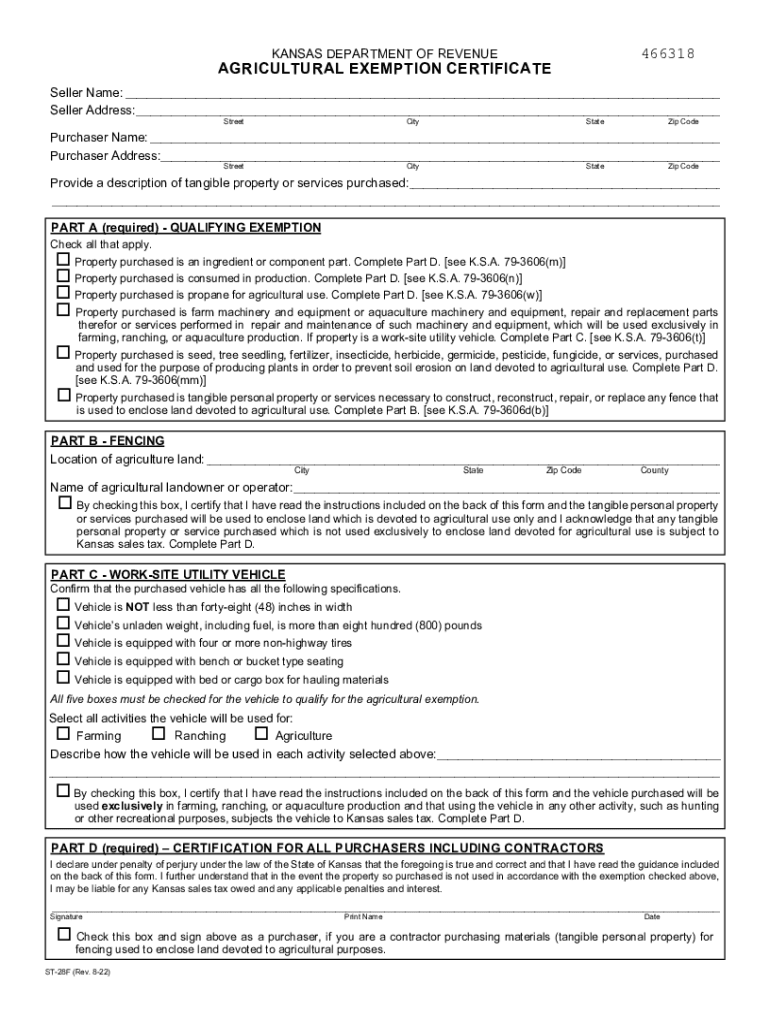

How to fill out KS ST-28F

How to fill out KS ST-28F

01

Download the KS ST-28F form from the Kansas Department of Revenue website.

02

Provide your business information, including name, address, and tax identification number.

03

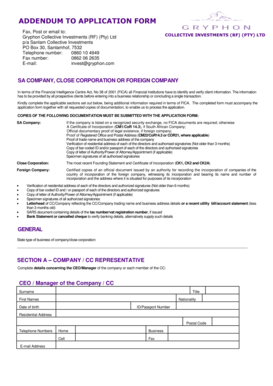

Specify the type of exemption you are applying for in the appropriate section of the form.

04

Detail the specific items or services for which you are claiming the exemption.

05

Calculate the total amount of exempt sales accurately.

06

Sign and date the form to certify that all information is correct.

07

Submit the completed form to the appropriate local or state authority as directed.

Who needs KS ST-28F?

01

Businesses or individuals in Kansas seeking a sales tax exemption for specific purchases.

02

Non-profit organizations that qualify for sales tax exemptions.

03

Certain governmental entities that are exempt from paying sales tax on specific transactions.

Fill

form

: Try Risk Free

People Also Ask about

Do chickens count for ag exemption in Texas?

Chickens do qualify for the Texas Ag exemption, but there are some important guidelines that must be met in order to qualify. If you are a large-scale farmer who raises and sells chickens (or their eggs) for profit, you should research Ag exemption and find out whether you qualify.

What animals qualify for tax exemption in Texas?

Which animals qualify? Cattle, sheep, goats and bees typically qualify for special ag valuation. However, each Texas county has its own rules. To understand your specific opportunities, contact the appraisal district in which your property is located.

How many cows do you need to be tax exempt in Texas?

How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

How do I get farm tax exempt in KS?

Two conditions must be met to claim this exemption. The buyer must be engaged in farming or ranching as defined on this page, and the property purchased, repaired or serviced must be used only in farming and ranching.

How many acres do you need for ag exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

What qualifies as a farm deduction?

Deductible farming expenses Some of the expenses that farmers commonly deduct cover the cost of livestock and feed, seeds, fertilizer, wages paid to employees, interest paid during the year on farm-related loans, depreciation to recover a portion of equipment costs, utilities and insurance premiums.

Can you write off a hobby farm on your taxes?

Tax Benefits of Turning Your Hobby Into a Business You can deduct your farm-related expenses, even if they go above your farm income. So if your farm operates at a loss, that loss can be used to offset your tax burden on your overall income.

What is exempt from agricultural property tax in Kansas?

The following are eligible for agricultural exemption in Kansas: ingredient or component parts; parts consumed in production; propane for agricultural use; property purchased is farm or aquaculture machinery or equipment, repair/replacement parts, or labor services on farm or aquaculture machinery; seeds, fertilizers,

How many cows per acre for ag exemption Texas?

Stocking Rates in Texas vary from 1 cow per acre on heavily managed pasture in the Eastern portion of the state to 1 cow per 150 acres (4 cows per section) in the Trans Pecos Region of the state.

What qualifies as a farm for tax purposes in Kansas?

For the purpose of applying sales tax, Kansas tax law defines farming or ranching as any activity which is ordinary and necessary for the growing or raising of agricultural products; the operation of a feedlot; or, farm and ranch work for hire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KS ST-28F without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including KS ST-28F, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in KS ST-28F?

With pdfFiller, the editing process is straightforward. Open your KS ST-28F in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the KS ST-28F in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your KS ST-28F in seconds.

What is KS ST-28F?

KS ST-28F is a form used in the state of Kansas for reporting certain tax-related information.

Who is required to file KS ST-28F?

Entities and individuals involved in specific transactions or activities that necessitate reporting to the Kansas Department of Revenue are required to file KS ST-28F.

How to fill out KS ST-28F?

To fill out KS ST-28F, enter the required information in each section, ensuring accuracy for reporting amounts, dates, and any applicable identifiers.

What is the purpose of KS ST-28F?

The purpose of KS ST-28F is to collect information to ensure compliance with Kansas tax laws and to facilitate the proper assessment and collection of taxes.

What information must be reported on KS ST-28F?

Information that must be reported includes transaction details, taxpayer identification information, and any applicable financial amounts.

Fill out your KS ST-28F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS ST-28f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.