Get the free ASSETS REMAINING IN TRUSTEES HANDS - probatectorg

Show details

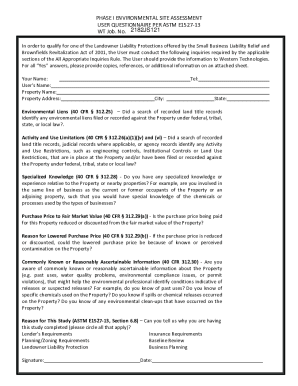

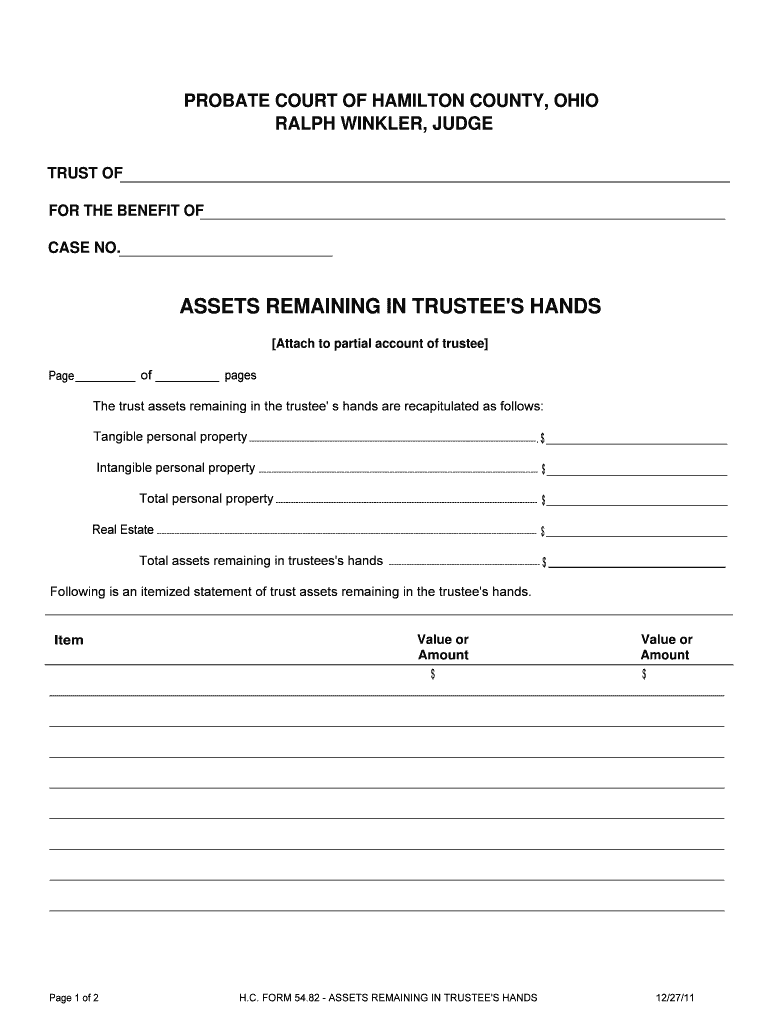

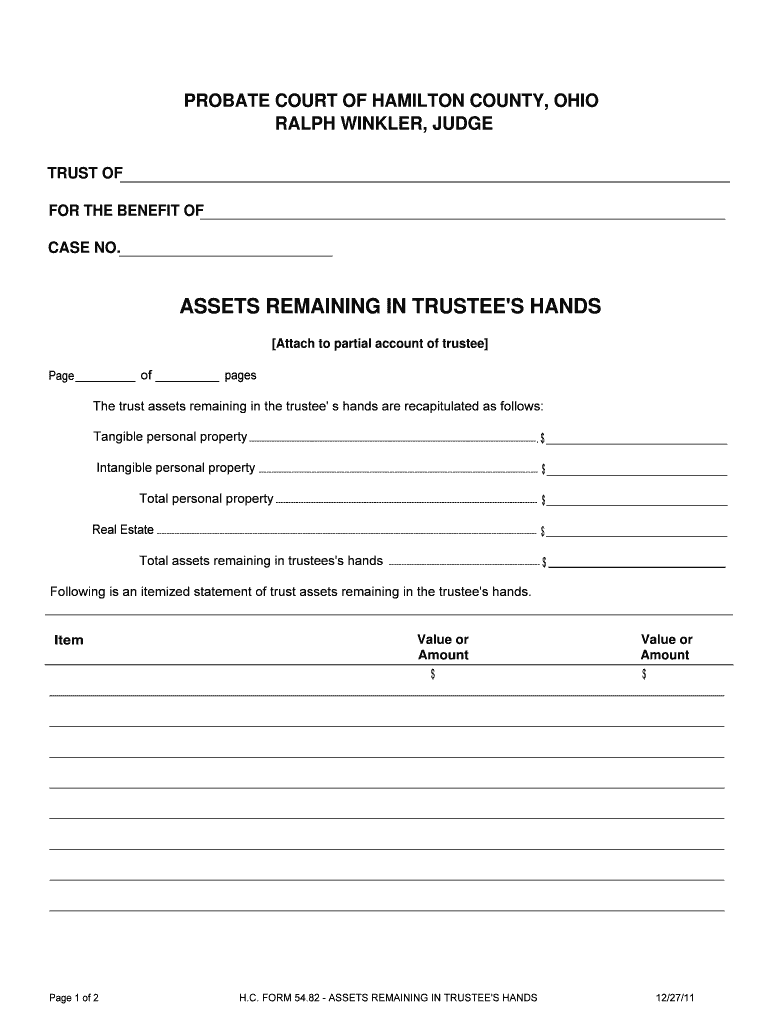

PROBATE COURT OF HAMILTON COUNTY, OHIO RALPH WINKLER, JUDGE TRUST OF FOR THE BENEFIT OF CASE NO. ASSETS REMAINING IN TRUSTEE IS HANDS Attach to partial account of trustee of Page pages The trust assets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assets remaining in trustees

Edit your assets remaining in trustees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assets remaining in trustees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing assets remaining in trustees online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit assets remaining in trustees. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assets remaining in trustees

How to fill out assets remaining in trustees:

01

Gather all relevant documentation: Before starting the process, gather all the necessary documents related to the assets remaining in trustees. This may include trust agreements, beneficiary information, and any other relevant paperwork.

02

Identify the assets: Determine the exact assets that remain in the trust. This could include real estate, financial accounts, investments, or personal property. Make a comprehensive inventory of all assets to ensure nothing is missed.

03

Determine the distribution plan: Review the trust document and any accompanying instructions to understand how the assets should be distributed. In some cases, the trust may specify specific beneficiaries and how the assets should be divided among them. If there are no specific instructions, consult with legal and financial professionals to develop a fair and legally sound distribution plan.

04

Prepare necessary legal documents: Depending on the jurisdiction and the complexity of the trust, you may need to prepare legal documents to transfer the assets to the beneficiaries. This could involve drafting a deed for transferring real estate or creating transfer documents for financial accounts. Seek legal assistance if needed to ensure all documents are correctly prepared.

05

Notify beneficiaries: Inform the beneficiaries of the trust about the remaining assets and the distribution plan. Provide them with the necessary information and documentation to support their claims on the assets. This step ensures transparency and allows beneficiaries to participate in the process if required.

06

Execute the distribution: Once all legal documents are prepared, and the beneficiaries are notified, proceed with the distribution of the assets. Follow the distribution plan outlined in the trust document, ensuring all assets are properly transferred to the beneficiaries.

Who needs assets remaining in trustees:

01

Beneficiaries: The primary individuals who require assets remaining in trustees are the beneficiaries of the trust. These could be family members, friends, or organizations named in the trust document to receive the assets. Beneficiaries have a legal right to claim their share of the assets as outlined in the trust.

02

Estate administrators: If the trust is part of an estate plan, the estate administrators or executors may also need to address the assets remaining in trustees. They are responsible for ensuring the proper distribution of assets and following the instructions in the trust document.

03

Legal and financial professionals: Attorneys and financial advisors play a crucial role in guiding the process of filling out assets remaining in trustees. They provide legal expertise and help navigate any complex legal issues that may arise during the process. Their knowledge ensures that all actions are compliant with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my assets remaining in trustees directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign assets remaining in trustees and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send assets remaining in trustees to be eSigned by others?

Once your assets remaining in trustees is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the assets remaining in trustees electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your assets remaining in trustees in seconds.

What is assets remaining in trustees?

Assets remaining in trustees refers to the assets that are still under the control and management of the trustees after a specific period of time.

Who is required to file assets remaining in trustees?

The trustees or the individuals appointed to manage the assets are required to file a report on the assets remaining in trustees.

How to fill out assets remaining in trustees?

To fill out assets remaining in trustees, the trustees must provide a detailed summary of the assets, their current value, any changes in ownership, and any income or expenses related to the assets.

What is the purpose of assets remaining in trustees?

The purpose of assets remaining in trustees is to provide transparency and accountability regarding the management of the assets to the beneficiaries or relevant authorities.

What information must be reported on assets remaining in trustees?

The report on assets remaining in trustees must include information on the types of assets held, their current value, any transactions or changes in ownership, any income or expenses related to the assets, and any distributions made to beneficiaries.

Fill out your assets remaining in trustees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assets Remaining In Trustees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.