Get the free Unincorporated Business Organizations

Show details

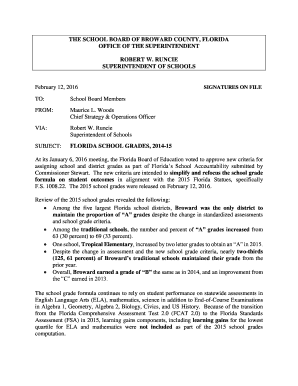

The Catholic University of America Columbus School of Law Unincorporated Business Organizations & Selected Agency Law Topics SPRING 2013 SYLLABUS LAW 514 Professor Raymond J. Kirsch Mon & Wed, 6:257:35

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unincorporated business organizations

Edit your unincorporated business organizations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unincorporated business organizations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unincorporated business organizations online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit unincorporated business organizations. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unincorporated business organizations

Point by point how to fill out unincorporated business organizations:

01

Understand the purpose: Before filling out any paperwork, it is crucial to have a clear understanding of why you need an unincorporated business organization. Unincorporated business organizations are generally used for small businesses or sole proprietorships where the owner wants to operate without the formalities and legal requirements of a corporation.

02

Choose the appropriate structure: There are different forms of unincorporated business organizations, such as sole proprietorships, partnerships, and limited liability companies (LLCs). You need to decide which structure suits your business needs best. Sole proprietorship is the simplest and most common, while partnerships involve multiple owners, and LLCs offer more flexibility and liability protection.

03

Research legal requirements: Depending on your jurisdiction, there might be specific legal requirements for establishing an unincorporated business organization. Research and understand the rules and regulations that apply to your situation. This can involve obtaining necessary licenses or permits, registering your business name, or applying for a tax identification number.

04

Obtain necessary forms: Once you have determined the appropriate structure and researched the legal requirements, gather the necessary forms and documents to fill out. These can include registration forms, partnership agreements, certifications, or tax-related documents.

05

Fill out the forms accurately: Take your time to carefully fill out the required forms. Provide accurate and complete information to ensure your business organization is established correctly. Pay attention to any specific instructions provided with the forms and double-check your entries for errors or inconsistencies.

06

Seek professional advice if needed: If you are unsure about any aspect of filling out the paperwork or establishing an unincorporated business organization, don't hesitate to seek professional advice. This can be from an attorney, accountant, or business consultant who specializes in this area. They can guide you through the process and ensure compliance with relevant laws.

07

Retain copies of all documents: Once you have filled out and submitted the necessary forms, make sure to keep copies of all documents for your records. These can be useful for future reference, tax filings, or any legal matters that may arise.

Who needs unincorporated business organizations:

01

Small business owners: Unincorporated business organizations are commonly chosen by small business owners who want to operate their businesses but avoid the legal formalities and complexities of a corporation.

02

Sole proprietors: Individuals who run businesses on their own may opt for a sole proprietorship as it is the simplest and least expensive form of an unincorporated business organization.

03

Partnerships: Businesses that involve multiple owners may choose to establish a partnership, where each partner has a share in the business's profits, losses, and decision-making.

04

Professionals and freelancers: Professionals working independently, such as lawyers, doctors, or consultants, often prefer unincorporated business organizations to maintain control over their practices and avoid the administrative burden of a corporation.

05

Startups and entrepreneurs: Unincorporated business organizations, like LLCs, offer flexibility and liability protection to startups and entrepreneurs who want to test their business ideas before committing to a more formal corporate structure.

Overall, unincorporated business organizations can be suitable for a range of individuals and business types, offering simplicity, flexibility, and control. However, it is important to carefully consider your specific needs and seek professional advice when necessary to make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit unincorporated business organizations from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like unincorporated business organizations, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit unincorporated business organizations in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your unincorporated business organizations, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit unincorporated business organizations on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign unincorporated business organizations on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is unincorporated business organizations?

Unincorporated business organizations are business structures that are not registered as corporations, such as sole proprietorships, partnerships, and limited liability companies (LLCs).

Who is required to file unincorporated business organizations?

Individuals or entities operating as unincorporated business organizations are required to file taxes.

How to fill out unincorporated business organizations?

To fill out unincorporated business organizations, you need to gather all financial records, report income and expenses, and file the necessary tax forms.

What is the purpose of unincorporated business organizations?

The purpose of unincorporated business organizations is to provide owners with flexibility and simplicity in managing their business operations.

What information must be reported on unincorporated business organizations?

Information such as income, expenses, deductions, credits, and other financial data must be reported on unincorporated business organizations.

Fill out your unincorporated business organizations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unincorporated Business Organizations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.