AK Substitute Form W-9 2011 free printable template

Show details

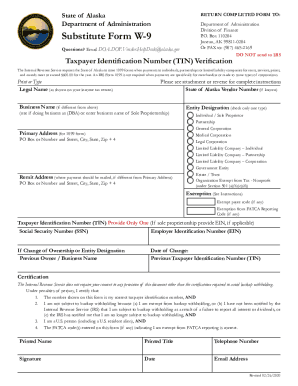

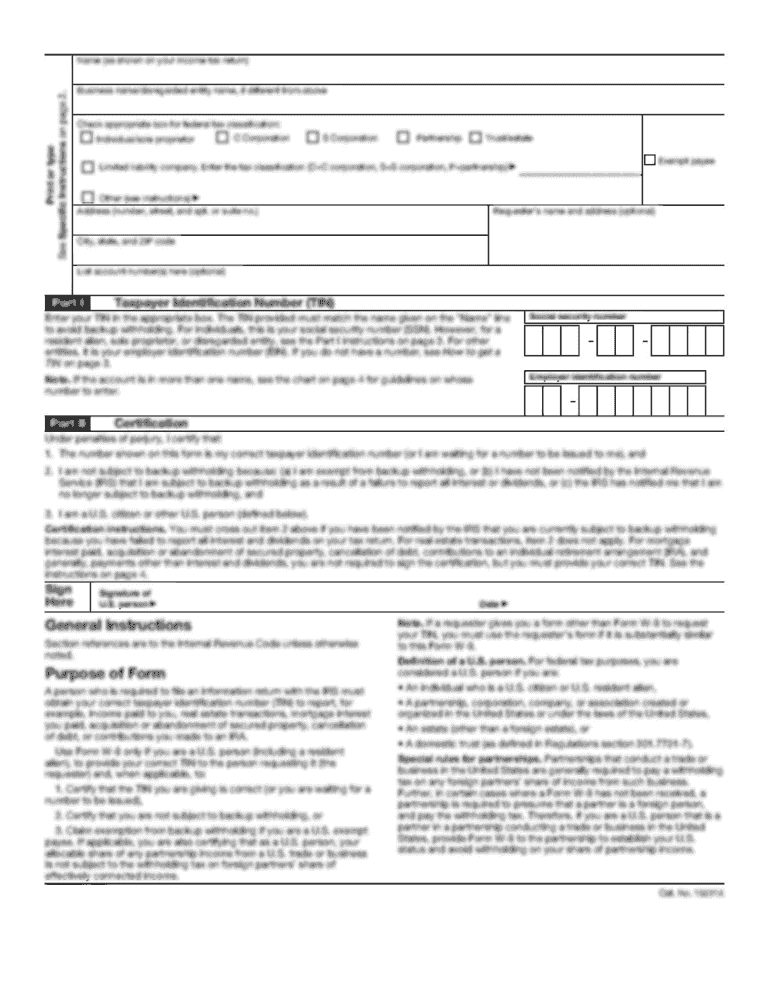

RETURN COMPLETED FORM TO State of Alaska Fax Attention To be completed by State of Alaska Phone Department Address Request for Taxpayer ID and Information Substitute Form W-9 Vendor The Internal Revenue Service requires the State of Alaska to issue 1099 forms when payments to individuals partnerships or limited liability companies for rents services prizes and awards meet or exceed 600.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AK Substitute Form W-9

Edit your AK Substitute Form W-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AK Substitute Form W-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AK Substitute Form W-9 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AK Substitute Form W-9. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Substitute Form W-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AK Substitute Form W-9

How to fill out AK Substitute Form W-9

01

Obtain the AK Substitute Form W-9 from the appropriate Alaska state department or website.

02

Fill in your name in the designated field, ensuring it matches the name on your tax return.

03

Complete the business name field if applicable (for business entities).

04

In the 'Taxpayer Identification Number' section, provide your Social Security Number (SSN) or Employer Identification Number (EIN).

05

Indicate your tax classification by checking the appropriate box (individual, corporation, partnership, etc.).

06

Provide your address including street, city, state, and ZIP code.

07

If applicable, fill in any exemptions if you're claiming exemption from backup withholding.

08

Sign and date the form at the bottom to certify that the information provided is correct.

Who needs AK Substitute Form W-9?

01

Any individual or business entity that is required to provide their taxpayer information for reporting to the IRS or state tax authorities in Alaska.

02

It is commonly needed by contractors, freelancers, or anyone receiving payments that require tax documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is a W9 form used for?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

Is W9 form mandatory?

Who needs to fill out a W-9 form? Employers who work with independent contractors must provide them with a W-9 form to fill out before starting work. There are specific criteria for who is classified as an “independent contractor” and will need to fill out a W-9 form.

At what point is a w9 required?

In general, W-9s are required only for business-to-business relationships where more than $600 is paid in the calendar year. The $600 rule applies to labor and services.

How do I fill out a w9 myself?

0:14 2:30 Filling Out a Form W-9 as an Individual or Sole Proprietor without YouTube Start of suggested clip End of suggested clip It may already be filled in for you by the bank. And then you'd come down and put your social.MoreIt may already be filled in for you by the bank. And then you'd come down and put your social.

Can you fill out a w9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

Can I fill out a W9 form online?

If you work as an independent contractor or freelancer, you need to fill out a W-9 form for each of your clients for tax filing purposes. Printing and scanning each form can get a little cumbersome, but filling out the form online can save you time.

What app can I use to fill out a w9?

E-taxfiller offers a secure and convenient method of completing tax docs even if you are away from your computer. The app allows you to fill out common IRS forms, including W-9, W-2, 1040, and 1099 on your iPhone, iPad, or iPod Touch.

Do you have to pay taxes on w9?

In general, income that results from a W-9 arrangement is not subject to IRS withholding. Rather, it is the payee's responsibility to claim the income on his or her tax return, and to pay any appropriate taxes.

Who is required to fill out a W9?

A W-9 form is an IRS tax form that a freelancer or contractor fills out. W-9 forms are required for all self-employed workers, like independent contractors, vendors, freelancers, and consultants.

Why would someone need a w9 from you?

Who Needs to Complete Form W-9? You will usually submit a W-9 form when you engage with a company where reporting information to the IRS might be necessary, such as receiving payments for services you provide as an independent contractor, paying interest on your mortgage or even contributing money to your IRA account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AK Substitute Form W-9 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your AK Substitute Form W-9 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute AK Substitute Form W-9 online?

pdfFiller has made it simple to fill out and eSign AK Substitute Form W-9. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit AK Substitute Form W-9 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share AK Substitute Form W-9 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is AK Substitute Form W-9?

AK Substitute Form W-9 is a variant of the standard IRS Form W-9 used in Alaska, designed for individuals and entities to provide their taxpayer identification information to requesters.

Who is required to file AK Substitute Form W-9?

Individuals and businesses who receive payments that are subject to IRS information reporting, such as freelance workers, contractors, or any persons and entities that will receive taxable income, are required to file AK Substitute Form W-9.

How to fill out AK Substitute Form W-9?

To fill out AK Substitute Form W-9, you should provide your name, business name (if applicable), address, taxpayer identification number (TIN), and certify that the information provided is accurate by signing the form.

What is the purpose of AK Substitute Form W-9?

The purpose of AK Substitute Form W-9 is to collect necessary taxpayer information from individuals and businesses so that payments can be reported to the IRS, ensuring compliance with tax regulations.

What information must be reported on AK Substitute Form W-9?

The information that must be reported on AK Substitute Form W-9 includes the individual's or entity's name, business name (if applicable), address, taxpayer identification number (either Social Security Number or Employer Identification Number), and certification of accuracy.

Fill out your AK Substitute Form W-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AK Substitute Form W-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.