AK Substitute Form W-9 2020-2025 free printable template

Show details

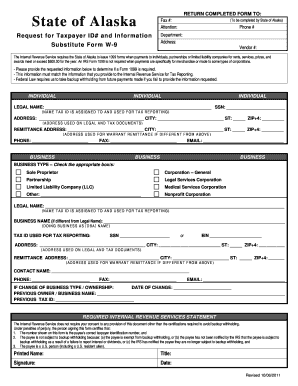

State of Alaska Department of AdministrationRETURN COMPLETED FORM TO:Substitute Form W9 Questions? Email DOA.DOF.Vendor.HelpDesk@alaska.govDepartment of Administration Division of Finance P.O. Box

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alaska form w9

Edit your alaska form w9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alaska form w9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alaska form w9 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit alaska form w9. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Substitute Form W-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alaska form w9

How to fill out AK Substitute Form W-9

01

Begin by downloading the AK Substitute Form W-9 from the official website or relevant authority.

02

Provide your name in the first field as it appears on your tax return.

03

Fill out your business name if applicable in the second field.

04

Indicate your federal tax classification by checking the appropriate box (individual, corporation, partnership, etc.).

05

Enter your address, including street, city, state, and ZIP code.

06

Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

07

If applicable, enter your account number (optional).

08

Certify that the information provided is correct by signing and dating the form.

09

Submit the completed form to the requester (the person or organization that asked for it).

Who needs AK Substitute Form W-9?

01

Individuals or entities that are required to provide their taxpayer identification information for tax reporting purposes.

02

Businesses making payments to contractors or freelancers who are U.S. persons.

03

Any individual or entity that needs to certify their taxpayer status to avoid backup withholding.

Fill

form

: Try Risk Free

People Also Ask about

What is a W9 form used for?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

Is W9 form mandatory?

Who needs to fill out a W-9 form? Employers who work with independent contractors must provide them with a W-9 form to fill out before starting work. There are specific criteria for who is classified as an “independent contractor” and will need to fill out a W-9 form.

At what point is a w9 required?

In general, W-9s are required only for business-to-business relationships where more than $600 is paid in the calendar year. The $600 rule applies to labor and services.

How do I fill out a w9 myself?

0:14 2:30 Filling Out a Form W-9 as an Individual or Sole Proprietor without YouTube Start of suggested clip End of suggested clip It may already be filled in for you by the bank. And then you'd come down and put your social.MoreIt may already be filled in for you by the bank. And then you'd come down and put your social.

Can you fill out a w9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

Can I fill out a W9 form online?

If you work as an independent contractor or freelancer, you need to fill out a W-9 form for each of your clients for tax filing purposes. Printing and scanning each form can get a little cumbersome, but filling out the form online can save you time.

What app can I use to fill out a w9?

E-taxfiller offers a secure and convenient method of completing tax docs even if you are away from your computer. The app allows you to fill out common IRS forms, including W-9, W-2, 1040, and 1099 on your iPhone, iPad, or iPod Touch.

Do you have to pay taxes on w9?

In general, income that results from a W-9 arrangement is not subject to IRS withholding. Rather, it is the payee's responsibility to claim the income on his or her tax return, and to pay any appropriate taxes.

Who is required to fill out a W9?

A W-9 form is an IRS tax form that a freelancer or contractor fills out. W-9 forms are required for all self-employed workers, like independent contractors, vendors, freelancers, and consultants.

Why would someone need a w9 from you?

Who Needs to Complete Form W-9? You will usually submit a W-9 form when you engage with a company where reporting information to the IRS might be necessary, such as receiving payments for services you provide as an independent contractor, paying interest on your mortgage or even contributing money to your IRA account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my alaska form w9 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your alaska form w9 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute alaska form w9 online?

With pdfFiller, you may easily complete and sign alaska form w9 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in alaska form w9?

The editing procedure is simple with pdfFiller. Open your alaska form w9 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is AK Substitute Form W-9?

The AK Substitute Form W-9 is a state-specific version of the IRS Form W-9 used to request a taxpayer's identification number and certification, primarily for Alaska.

Who is required to file AK Substitute Form W-9?

Individuals or entities that are receiving payments from a business in Alaska and need to provide their tax identification information are required to file the AK Substitute Form W-9.

How to fill out AK Substitute Form W-9?

To fill out the AK Substitute Form W-9, provide your name, business name (if applicable), address, taxpayer identification number (TIN), and sign to certify that the information is correct.

What is the purpose of AK Substitute Form W-9?

The purpose of the AK Substitute Form W-9 is to collect taxpayer information for income reporting and to ensure compliance with tax regulations for payments made within Alaska.

What information must be reported on AK Substitute Form W-9?

The information that must be reported includes the name, business name (if applicable), address, taxpayer identification number (TIN), and certification of the information provided.

Fill out your alaska form w9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alaska Form w9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.