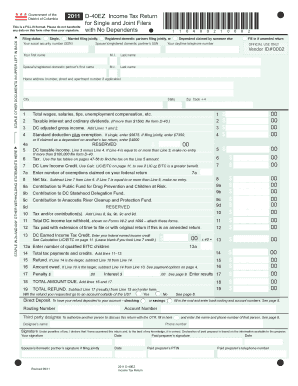

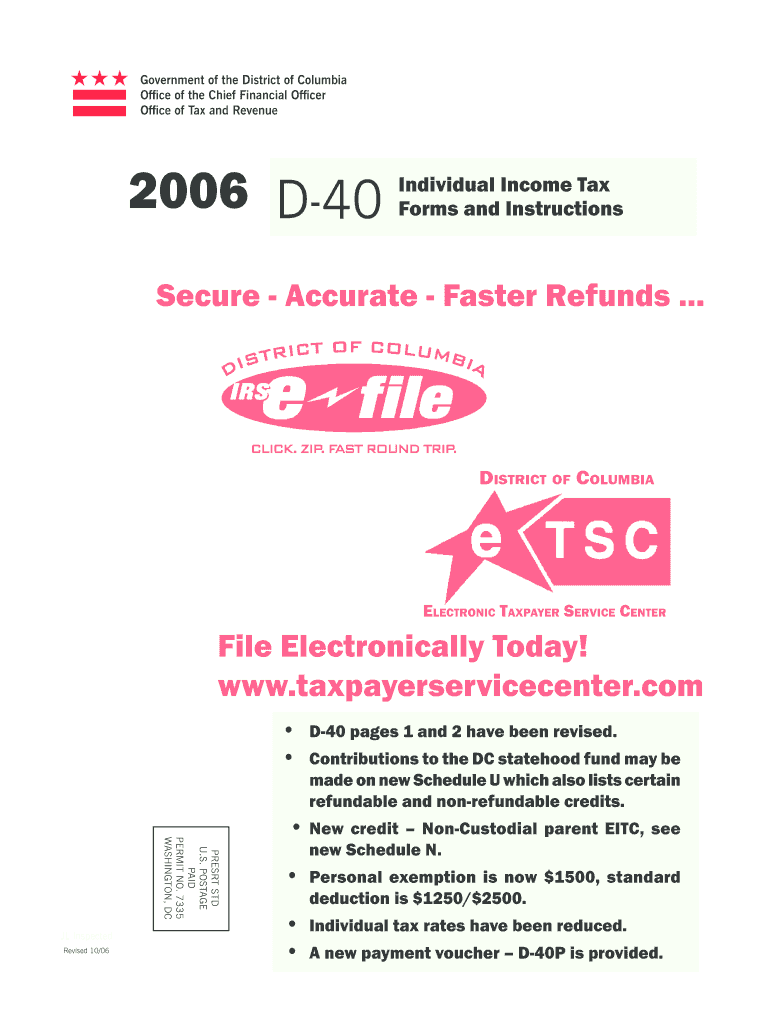

DC D-40EZ & D-40 2006 free printable template

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

How to fill out DC D-40EZ D-40

About DC D-40EZ D-40 2006 previous version

What is DC D-40EZ D-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about DC D-40EZ D-40

What should I do if I realize I've made a mistake after submitting my otr cfo?

If you notice an error on your submitted otr cfo, you can submit an amended form to correct it. Ensure that you clearly indicate that it's a correction. Follow the specific instructions for amended submissions to avoid further complications.

How can I track the status of my submitted otr cfo?

To verify the status of your otr cfo, check the e-filing portal or the agency's website where you submitted your form. Look for any tracking options they provide to monitor the processing of your submission.

What are common errors that can delay my otr cfo processing?

Common errors include mismatched information, missing signatures, or incorrect formatting. Double-check all entries before submission to minimize the risk of delays and ensure smooth processing of your otr cfo.

Are there any specific privacy or data security measures I should take when filing my otr cfo?

Yes, when filing your otr cfo electronically, ensure that you use secure internet connections and reputable software. Protect your personal information by avoiding public Wi-Fi and using encryption tools if needed.

What should I do if I receive a notice regarding my submitted otr cfo?

If you receive a notice or audit communication related to your otr cfo, review the document carefully to understand the issue. Prepare any requested documentation and consider consulting with a tax professional for assistance in responding appropriately.

See what our users say