LA R-1029 2011 free printable template

Show details

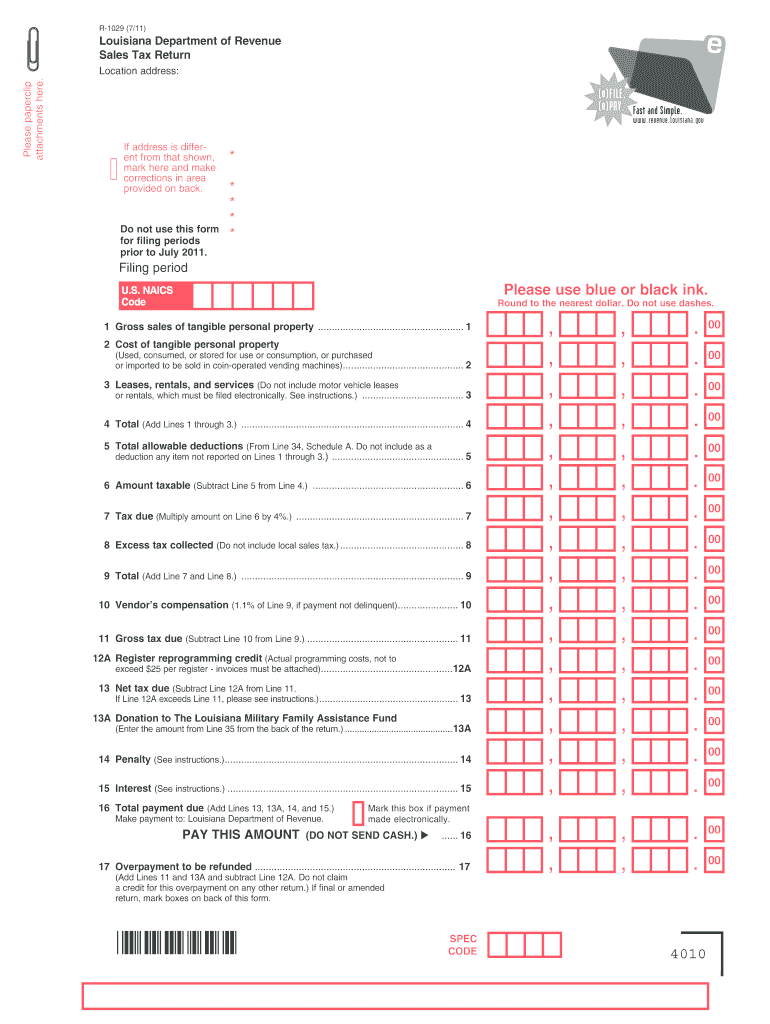

R-1029 (7/11)

Louisiana Department of Revenue

Sales Tax Return

Please paperclip

attachments here.

Location address:

Address

City

State

If address is different from that shown,

mark here and make

corrections

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign louisiana form 4010 2011

Edit your louisiana form 4010 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisiana form 4010 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing louisiana form 4010 2011 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit louisiana form 4010 2011. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1029 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out louisiana form 4010 2011

How to fill out LA R-1029

01

Obtain the LA R-1029 form from the appropriate government website or office.

02

Fill in your personal information such as name, address, and contact details in the designated fields.

03

Provide information regarding your income sources and amounts as required by the form.

04

Attach any necessary supporting documents that verify your income and other relevant information.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form at the designated location.

07

Submit the completed form to the appropriate authority by the deadline.

Who needs LA R-1029?

01

Individuals or families applying for financial assistance or benefits in Louisiana.

02

Residents who need to certify their income for eligibility in specific programs.

03

Applicants for housing assistance or other state-sponsored programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between form 540 and 540NR?

Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2021. If you and your spouse/RDP were California residents during the entire tax year 2021, use Forms 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return.

What is a 540 tax form?

2021 Form 540 California Resident Income Tax Return.

What is a form 540 used for?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Where can I get Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

How do I get Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

How do I file Louisiana sales tax?

To file and pay your Louisiana sales tax you have some options: File online at the Louisiana Taxpayer Access Point: You can remit your payment through their online system. Pay by credit card. AutoFile – Let TaxJar file your sales tax for you.

Does Louisiana have a state income tax form?

Resident Individual Income Tax Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540, reporting all of their income.

Do you use the same form for state and federal taxes?

While residents of all states use the same forms to file their federal income tax returns, state income tax forms differ from state to state. As a result, you'll need to use the appropriate forms to file your state income tax return.

Does Louisiana have a state tax form?

Resident Individual Income Tax Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana.

How does sales tax work in Louisiana?

Louisiana's total sales and use tax rate is 4 percent. This rate is comprised of 2 percent tax levied by Re- vised Statute 47:302, 1 percent tax levied by Revised Statute 47:321, . 97 percent tax levied by Revised Statute 47:331, and . 03 percent levied by the Tourism Promotion District.

What is a 540 for taxes?

What is Form 540? Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Where can I get Louisiana tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Can you file Louisiana state taxes online?

Welcome to Online Filing and Payments You have arrived at Louisiana File and Pay Online, your gateway to filing and paying your state taxes electronically. Louisiana File Online is a fast, easy to use, absolutely free public service from the Louisiana Department of Revenue.

Who must file form 540?

If you have a tax liability for 2021 or owe any of the following taxes for 2021, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Do I need to file a Louisiana state tax return?

ing to the Louisiana Instructions for Form IT40i, if you are a Louisiana resident and are required to file a Federal income tax return, you must file a Louisiana income tax return reporting all income earned for that tax year.

Do I need a state tax ID in Louisiana?

You're legally required to have one if your business hires employees in Louisiana, if you're selling taxable goods and services in the state, or if you sell products that qualify for special excise taxes, like alcohol, gasoline, or tobacco.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in louisiana form 4010 2011 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your louisiana form 4010 2011, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit louisiana form 4010 2011 on an iOS device?

Create, modify, and share louisiana form 4010 2011 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete louisiana form 4010 2011 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your louisiana form 4010 2011 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is LA R-1029?

LA R-1029 is a tax form used in Louisiana for reporting certain financial activities related to the state's tax obligations.

Who is required to file LA R-1029?

Individuals and businesses in Louisiana that meet specific financial thresholds or engage in qualifying activities are required to file LA R-1029.

How to fill out LA R-1029?

To fill out LA R-1029, you should gather all required financial information, follow the instructions provided with the form, and complete each section truthfully and accurately before submitting it to the appropriate state agency.

What is the purpose of LA R-1029?

The purpose of LA R-1029 is to facilitate the reporting of financial information to ensure compliance with Louisiana tax laws and regulations.

What information must be reported on LA R-1029?

LA R-1029 requires reporting of financial income, expenses, deductions, and any other relevant details that contribute to the state tax calculations.

Fill out your louisiana form 4010 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisiana Form 4010 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.