LA R-1029 2020 free printable template

Show details

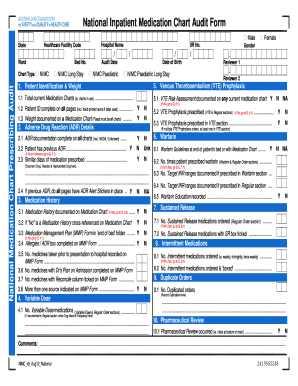

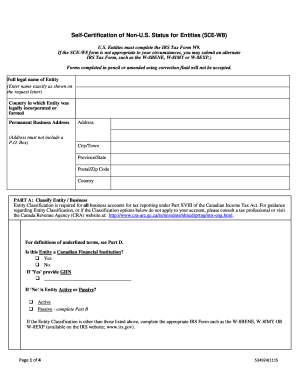

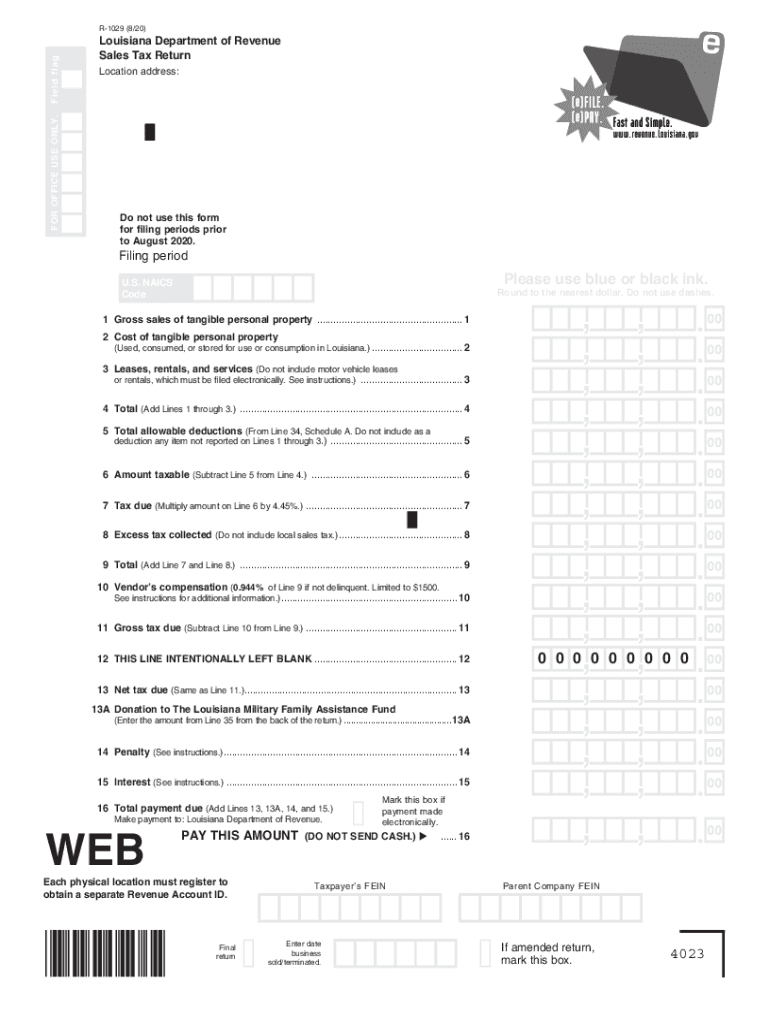

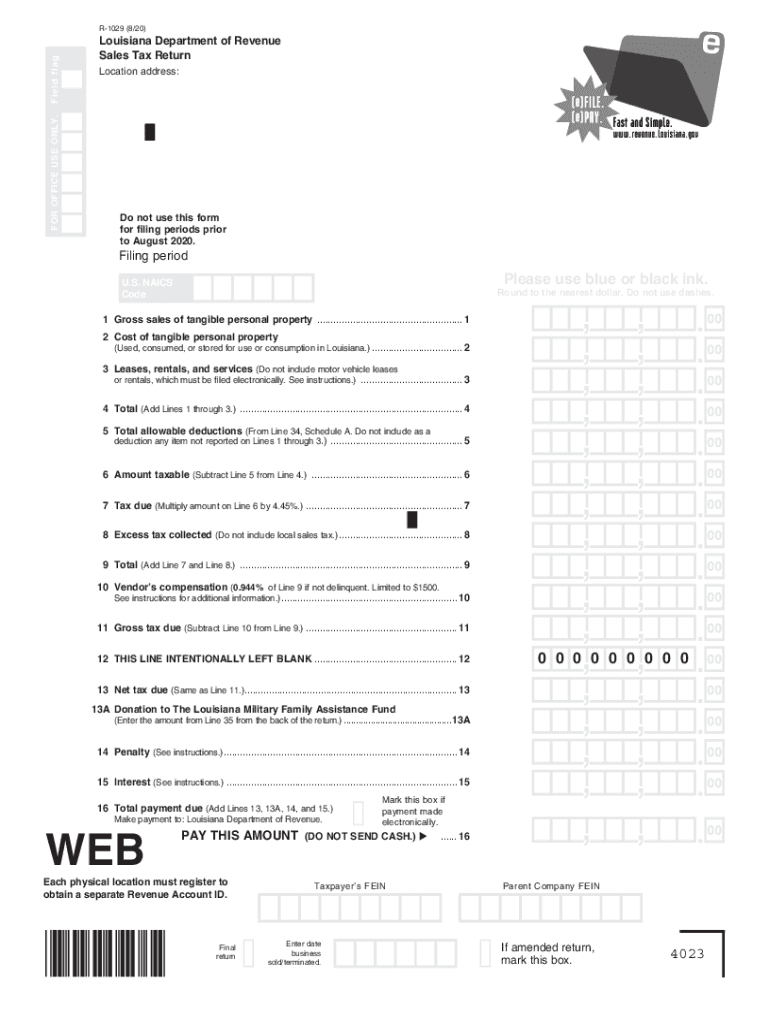

FOR OFFICE USE ONLY. F ield flag R-1029 7/18 Louisiana Department of Revenue Sales Tax Return Location address Address City State ZIP Account Number Name 1 Name 2 Do not use this form for filing periods prior to July 2018. mmyy Please use blue or black ink. U*S* NAICS Code Round to the nearest dollar. Do not use dashes. 1 Gross sales of tangible personal property. 1 2 Cost of tangible personal property Used consumed or stored for use or consumption in Louisiana*. 2 3 Leases rentals and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA R-1029

Edit your LA R-1029 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA R-1029 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA R-1029 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit LA R-1029. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1029 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA R-1029

How to fill out LA R-1029

01

Start by downloading the LA R-1029 form from the official website.

02

Fill in the top section with your personal information, including your name, address, and contact details.

03

In the next section, provide the relevant financial information as requested on the form.

04

Carefully read the instructions for each section to ensure you provide accurate information.

05

Review the completed form for any errors or missing information.

06

Sign and date the form at the designated area.

07

Submit the completed LA R-1029 form to the appropriate agency or department as instructed.

Who needs LA R-1029?

01

Individuals who are applying for state benefits or assistance programs in Louisiana.

02

Residents who need to report their income and financial situation for tax purposes.

03

Anyone who is required to provide financial information for eligibility verification.

Fill

form

: Try Risk Free

People Also Ask about

How far can a state go back to collect taxes?

State tax rules can vary by state. Most IRS audits must occur within three years, but six states give themselves four years. Louisiana gives itself three and a half years. Statutes of limitation can restart with your state if the IRS adjusts your federal return or if you file an amended return.

How long does Louisiana have to collect back taxes?

Tax claims. The state has three years from December 31 of the year in which taxes are due in which to assess the tax, a limitation period set out in the 1974 Louisiana Constitution.

What happens if you don't pay Louisiana state taxes?

The delinquent filing penalty is five percent of the tax due for each 30-day period that the failure to file continues, not to exceed 25 percent of the total tax.

What is exempt from sales tax in Louisiana?

Those services are the furnishing of sleeping rooms by hotels; the sale of admissions to places of amusement and to athletic and recreational events, and the furnishing of privileges of access to amusement, entertainment, athletic, or recreational facilities; the furnishing of storage or parking privileges by auto

Is selling personal items considered income?

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

What is the statute of limitations on sales tax in Louisiana?

Louisiana Revised Statute 47:1580 defines the statute of limitations for sales tax assessment as 3 years from the return due date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send LA R-1029 to be eSigned by others?

Once your LA R-1029 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out LA R-1029 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign LA R-1029 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit LA R-1029 on an iOS device?

Create, modify, and share LA R-1029 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is LA R-1029?

LA R-1029 is a reporting form used in Louisiana for the purpose of tax compliance and to report certain financial information.

Who is required to file LA R-1029?

Individuals and businesses that meet specific criteria set forth by Louisiana tax regulations are required to file LA R-1029.

How to fill out LA R-1029?

To fill out LA R-1029, individuals and businesses must provide accurate financial data as outlined in the form instructions, ensuring that all required fields are completed.

What is the purpose of LA R-1029?

The purpose of LA R-1029 is to ensure compliance with Louisiana tax laws by collecting necessary financial information from taxpayers.

What information must be reported on LA R-1029?

The information that must be reported on LA R-1029 includes income, deductions, credits, and other financial details relevant to the taxpayer's obligations.

Fill out your LA R-1029 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA R-1029 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.