Get the free ORDER FORM TAX INVOICE - be-contentmanagementcomb

Show details

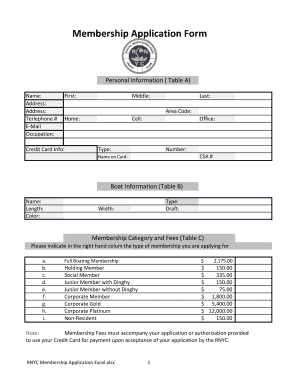

INDIVIDUAL ISSUE ORDER FORM / TAX INVOICE ABN87091432567 PricesforprintissuesfromRuralSocietyISSN10371656. Pleasenotethatsomeissuesaremoreexpensiveastheyareonlyavailableasadoubleissue. Institutional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign order form tax invoice

Edit your order form tax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your order form tax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit order form tax invoice online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit order form tax invoice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out order form tax invoice

How to fill out an order form tax invoice:

01

Start by filling in the necessary contact information at the top of the form. This typically includes your name or business name, address, phone number, and email address.

02

Enter the invoice number and the date on which the order was made. This information is usually pre-filled or assigned by the billing system.

03

Include the details of the products or services being ordered. This should include a description, quantity, unit price, and total cost for each item or service.

04

If applicable, add any discounts, taxes, or additional charges to the invoice. Specify the reason and amount for each of these adjustments.

05

Calculate the total amount due by summing up the individual costs, taxes, and additional charges. Make sure this is clearly stated on the invoice.

06

Provide the payment terms and methods accepted. Specify the due date for payment and any late payment penalties or discounts that apply.

07

Include your business or company details, such as your tax identification number and invoice issuer information.

08

Review the completed order form tax invoice to ensure all information is accurate and legible. If any corrections are needed, make them before sending or providing the invoice to the customer.

Who needs an order form tax invoice?

01

Any individual or business that sells products or services and wants to maintain an organized record of their transactions can benefit from using an order form tax invoice.

02

Retailers, wholesalers, and manufacturers commonly use order form tax invoices to provide a detailed breakdown of the items ordered, quantities, and prices.

03

Service providers, such as consultants, contractors, and freelancers, can also benefit from using order form tax invoices to bill their clients accurately and efficiently.

04

Both small and large businesses, whether online or offline, can utilize order form tax invoices to maintain a systematic record of their sales and facilitate smooth financial operations.

05

Individuals who sell items or services on a regular basis, whether as a side business or through online platforms, may also find order form tax invoices helpful for maintaining proper financial records and completing tax filings accurately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify order form tax invoice without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like order form tax invoice, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out order form tax invoice on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your order form tax invoice, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete order form tax invoice on an Android device?

Use the pdfFiller app for Android to finish your order form tax invoice. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is order form tax invoice?

The order form tax invoice is a document used to request payment for goods or services provided by a seller.

Who is required to file order form tax invoice?

Businesses or individuals who have provided goods or services and are registered for taxes are required to file order form tax invoices.

How to fill out order form tax invoice?

To fill out an order form tax invoice, the seller needs to include information such as their name, address, tax registration number, details of the goods or services provided, and the total amount due.

What is the purpose of order form tax invoice?

The purpose of the order form tax invoice is to provide a formal request for payment and to assist in tracking tax obligations for both the seller and the buyer.

What information must be reported on order form tax invoice?

The order form tax invoice must include details such as the seller's name, address, tax registration number, date of issue, description of goods or services, quantity, unit price, total amount due, and applicable tax rates.

Fill out your order form tax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Order Form Tax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.