Get the free fha max mortgage worksheet

Show details

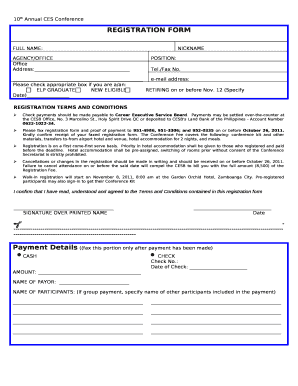

FHA Maximum Mortgage Calculation Worksheet Streamline With Appraisal Borrower Name s CMS Loan FHA Case Step 1 Calculate Maximum Base Mortgage based on LTV Limitation 1 a. Appraised Value 1 b. Original FHA Loan Amount Base MIP Step 2 2 a* Unpaid Principal Balance may include up to 60 days interest for the current month but may not include late charges escrow shortages delinquent interest and processing type fees 2 b. Allowable Borrower-Paid Closing Costs excluding discount points 2 c*...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha maximum mortgage worksheet form

Edit your fha max mortgage worksheet streamline form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha streamline worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha max mortgage worksheet online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fha max mortgage worksheet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha max mortgage worksheet

How to fill out FHA maximum mortgage calculation:

01

Gather necessary information: To fill out the FHA maximum mortgage calculation, you will need specific information about the property and the borrower. This includes the property's appraised value, the borrower's income and debts, and any down payment amount.

02

Calculate the maximum mortgage amount: Using the gathered information, you can now calculate the maximum mortgage amount. This involves determining the loan-to-value ratio (LTV) and applying it to the property's appraised value. The LTV is the percentage of the property's value that can be financed with an FHA loan.

03

Consider other factors: While the maximum mortgage calculation provides an estimate, it's important to also consider other factors. These include the borrower's credit history, employment stability, and any additional costs such as mortgage insurance premiums.

Who needs FHA maximum mortgage calculation:

01

First-time homebuyers: FHA loans are often popular among first-time homebuyers who may have limited funds for a down payment or a lower credit score. They can use the FHA maximum mortgage calculation to determine how much they can afford to borrow.

02

Homeowners refinancing: Homeowners who currently have an FHA loan and are considering refinancing can benefit from understanding the maximum mortgage calculation. It helps them assess if refinancing will provide them with any financial advantages.

03

Prospective homebuyers: Those planning to purchase a home and looking for financing options can use the FHA maximum mortgage calculation to evaluate whether an FHA loan suits their needs. It provides them with a clearer understanding of their borrowing capacity.

In conclusion, anyone considering an FHA loan or seeking to understand the maximum mortgage amount they can obtain can benefit from filling out the FHA maximum mortgage calculation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fha max mortgage worksheet?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific fha max mortgage worksheet and other forms. Find the template you want and tweak it with powerful editing tools.

How can I fill out fha max mortgage worksheet on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your fha max mortgage worksheet, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out fha max mortgage worksheet on an Android device?

Use the pdfFiller mobile app and complete your fha max mortgage worksheet and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is fha maximum mortgage calculation?

FHA maximum mortgage calculation is the process of determining the highest amount that can be borrowed under the Federal Housing Administration loan program.

Who is required to file fha maximum mortgage calculation?

Lenders and borrowers participating in the FHA loan program are required to calculate the maximum mortgage amount.

How to fill out fha maximum mortgage calculation?

To fill out the FHA maximum mortgage calculation, borrowers and lenders need to input specific financial information into the FHA loan calculator.

What is the purpose of fha maximum mortgage calculation?

The purpose of fha maximum mortgage calculation is to ensure that borrowers do not borrow more than they can afford under the FHA loan program.

What information must be reported on fha maximum mortgage calculation?

The fha maximum mortgage calculation requires information such as the borrower's income, debts, and credit score to determine the maximum loan amount.

Fill out your fha max mortgage worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Max Mortgage Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.