Get the free Charitable Gift Annuity Issuer Annual Report Form - TN.gov - tn

Show details

STATE OF TENNESSEE DEPARTMENT OF COMMERCE AND INSURANCE CHARITABLE GIFT ANNUITY ISSUER ANNUAL REPORT INSTRUCTIONS AND FORM ALL ANNUAL REPORTS SHOULD BE MAILED TO THE FOLLOWING ADDRESS: Joe Walker

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gift annuity issuer

Edit your charitable gift annuity issuer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable gift annuity issuer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable gift annuity issuer online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable gift annuity issuer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up a charitable annuity?

First, you make a donation to a single charity. Then, the gift is set aside in a reserve account and invested. Based on your age(s) at the time of the gift, you receive a fixed monthly or quarterly payout (typically supported by the investment account) for the rest of your life.

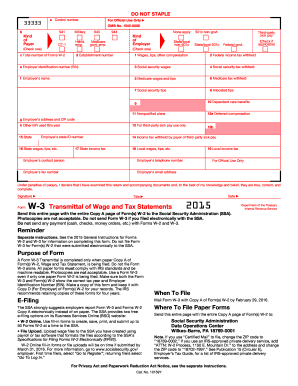

How do I report a charitable gift annuity?

The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

Is a charitable gift annuity a capital gain?

If you fund the gift annuity with appreciated securities or real estate owned more than one year, part of the payments will be taxed as ordinary income, part as capital gain, and part may be tax-free. In most instances, the payments will eventually be taxed as ordinary income.

Can you make a charity the beneficiary of an annuity?

Annuities are also an option for those looking to leave a charitable legacy. A charitable gift annuity is a type of annuity that provides its owner with income during retirement while also gifting funds to a designated charity after the owner passes. In other words, the charity becomes a beneficiary.

Who is the beneficiary of a charitable gift annuity?

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. In exchange, the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies.

Is the income from a charitable gift annuity taxable?

Tax-Free Income The payments you receive from a charitable gift annuity are tax-free and can help supplement your retirement income. Additionally, the donation itself is tax-deductible. Charitable gift annuities can be an excellent way to support a cause you care about while also receiving financial benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find charitable gift annuity issuer?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific charitable gift annuity issuer and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the charitable gift annuity issuer in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your charitable gift annuity issuer in seconds.

How do I fill out the charitable gift annuity issuer form on my smartphone?

Use the pdfFiller mobile app to fill out and sign charitable gift annuity issuer on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is charitable gift annuity issuer?

A charitable gift annuity issuer is an organization that issues charitable gift annuities to donors.

Who is required to file charitable gift annuity issuer?

Charitable gift annuity issuers are required to file if they meet certain criteria set by the relevant tax authorities. Generally, non-profit organizations that issue charitable gift annuities may be required to file.

How to fill out charitable gift annuity issuer?

The process of filling out the charitable gift annuity issuer form may vary depending on the specific requirements of the tax authorities. Generally, the form requires the organization to provide details about their operations, financials, and the information related to the charitable gift annuities issued.

What is the purpose of charitable gift annuity issuer?

The purpose of a charitable gift annuity issuer is to provide donors with a way to make a charitable contribution while also receiving a financial benefit. The issuer manages the funds and payments related to the charitable gift annuity to ensure they are distributed according to the terms of the agreement.

What information must be reported on charitable gift annuity issuer?

The information that must be reported on the charitable gift annuity issuer form may include the organization's financials, details about the annuity agreements, and any other relevant information required by the tax authorities.

Fill out your charitable gift annuity issuer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gift Annuity Issuer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.