Get the free NEW JERSEY CORPORATION BUSINESS TAX 301 - state nj

Show details

This form is used to claim the Urban Enterprise Zone Investment Tax Credit for qualified businesses in New Jersey that have made investments in Urban Enterprise Zones.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey corporation business

Edit your new jersey corporation business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey corporation business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

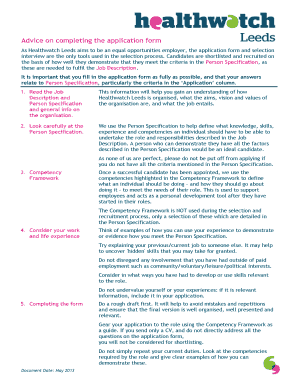

Editing new jersey corporation business online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit new jersey corporation business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey corporation business

How to fill out NEW JERSEY CORPORATION BUSINESS TAX 301

01

Obtain the NEW JERSEY CORPORATION BUSINESS TAX 301 form from the New Jersey Division of Taxation website.

02

Fill in the entity's name and identification number in the appropriate sections.

03

Provide the corporation's principal business address.

04

Indicate the type of business activity and the date of incorporation.

05

Report the total income and any applicable deductions on the form.

06

Complete the necessary schedules and calculations based on your business's financials.

07

Review the completed form for accuracy.

08

Sign and date the form in the designated section.

09

Submit the form electronically or mail it to the New Jersey Division of Taxation by the due date.

Who needs NEW JERSEY CORPORATION BUSINESS TAX 301?

01

All corporations that conduct business in New Jersey must file the NEW JERSEY CORPORATION BUSINESS TAX 301.

02

Corporations that have income sourced to New Jersey or are classified as New Jersey corporations.

03

Businesses that meet the annual gross receipts thresholds set by the state.

Fill

form

: Try Risk Free

People Also Ask about

How much is income tax on $70,000 a year in New Jersey?

If you make $70,000 a year living in the region of New Jersey, United States of America, you will be taxed $15,328. That means that your net pay will be $54,672 per year, or $4,556 per month. Your average tax rate is 21.9% and your marginal tax rate is 33.8%.

What is the self employed tax rate in New Jersey?

New Jersey's self-employed tax rate is 15.3%. This number combines a 12.4% Social Security tax on earnings of up to $147,000 and a 2.9% Medicare tax on all your earnings as an independent contractor.

How much tax does a business pay in NJ?

What Is the New Jersey Corporate Tax Rate? Corporation's Entire Net income (ETI)Tax Rate $50,000 or less 6.5% Over $50,000 and up to $100,000 7.5% Over $100,000 9.0% Mar 13, 2025

What is the corporate business tax in New Jersey?

In 2023, New Jersey's corporate business tax rate ranges from 6.5% to 9% of a corporation's business income.

How is an LLC taxed in New Jersey?

By default, a New Jersey LLC is taxed by the Internal Revenue Service (IRS) based on the number of Members the LLC has. Then the New Jersey Division of Taxation honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship.

How is an LLC taxed in New Jersey?

By default, a New Jersey LLC is taxed by the Internal Revenue Service (IRS) based on the number of Members the LLC has. Then the New Jersey Division of Taxation honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship.

What is the corporate business tax surcharge in New Jersey?

The Corporate Transit Fee of 2.5% is levied on businesses with annual taxable net income allocated to New Jersey greater than $10 million for the 2024–2028 privilege periods. ingly, these businesses will be subject to an 11.5% tax as opposed to the standard CBT rate of 9%.

What is the sales tax in New Jersey for small business?

New Jersey assesses a 6.625% Sales Tax on sales of most tangible personal property, specified digital products, and certain services unless specifically exempt under New Jersey law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW JERSEY CORPORATION BUSINESS TAX 301?

NEW JERSEY CORPORATION BUSINESS TAX 301 is a tax form used by corporations to report their business income and calculate the tax owed to the state of New Jersey. It is a crucial part of the state’s corporate taxation system.

Who is required to file NEW JERSEY CORPORATION BUSINESS TAX 301?

Any corporation doing business, or having a nexus in New Jersey, is required to file the NEW JERSEY CORPORATION BUSINESS TAX 301. This includes domestic corporations as well as foreign corporations that have established business operations in the state.

How to fill out NEW JERSEY CORPORATION BUSINESS TAX 301?

To fill out the NEW JERSEY CORPORATION BUSINESS TAX 301, corporations must provide detailed financial information, including gross income, deductions, and computing the net taxable income. The form must be completed accurately following the provided instructions and submitted by the due date.

What is the purpose of NEW JERSEY CORPORATION BUSINESS TAX 301?

The purpose of NEW JERSEY CORPORATION BUSINESS TAX 301 is to assess the tax liabilities of corporations operating in the state. It helps the New Jersey Division of Taxation to collect revenue necessary for funding state services and infrastructure.

What information must be reported on NEW JERSEY CORPORATION BUSINESS TAX 301?

The NEW JERSEY CORPORATION BUSINESS TAX 301 requires corporations to report income details such as total revenue, cost of goods sold, business expenses, and other deductions. It also necessitates the disclosure of any tax credits claimed and the overall tax due.

Fill out your new jersey corporation business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Corporation Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.